Chainlink Price Prediction: Is It on Track for a Bull Rally?

In this article, you'll see the Chainlink crypto price prediction for the short term, covering 2023 and 2024. But beyond that, you'll also see what's in store for LINK in the distant future: 2025, 2030 and even 2050. To avoid fixating on the Chainlink price history alone, we'll be looking at fundamentals and factors affecting the coin's value.

What Is Chainlink (LINK)?

Chainlink is a decentralised oracle network built on Ethereum. It connects off-chain data sources, such as APIs, real world data feeds and bank payments to on-chain smart contracts.

For example, a payment will only be released if a certain amount of Ether is deposited into a smart contract by a certain date. Otherwise, it'll be returned to the sender. Since smart contracts exist on a blockchain, they're immutable (can't be changed) and verifiable (able to be checked by everyone).

The Chainlink network launched in 2017, with the first version appearing in June and Chainlink's white paper from Steve Ellis and Sergey Nazarov coming in September of that year.

In late March 2021, the crypto asset's market cap was steadily moving towards $11.5 billion, with 350 million tokens currently circulating. The LINK token has many purposes, but its main function is to compensate Chainlink node operators and allow staking to incentivise good behaviour.

How Does Chainlink Work?

The following process facilitates the communication between blockchain-based smart contracts it services and external data sources:

- Oracle Selection: A user defines several parameters that make up the service level agreement (SLA). After submitting the SLA and depositing LINK in an Order-Matching contract, oracles are selected based on the requirements.

- Data Reporting: The off-chain oracles connect with external data sources to execute the agreement and report on-chain, utilising the Chainlink service.

- Result Aggregation: The oracles validate the data and reveal their results to the main contract and return it to what's known as an aggregation contract. This contract also calculates the weighted answer and returns it to the user (a smart contract).

What Can Drive Chainlink's Price Higher?

Before we delve into the Chainlink crypto prediction, we need to identify the factors that have the most profound effect on LINK's price. Aside from the obvious ones, like conditions on the entire cryptocurrency market, economic news and government regulations, we've been able to identify the following ones.

Chainlink's Oracle Services

Smart contracts are only as smart as the oracles that feed external information into them. If there's malicious code or bad data, the smart contract will produce an incorrect and unpredictable outcome. It's the single biggest problem of smart contracts that Chainlink solves.

The extended functionality of Chainlink's oracle services establishes the project firmly in the blockchain space. Notably, it's the ability to act as the bridge for interactions of several blockchains.

For this, Chainlink even received a shout-out from the tech giant Google. The announcement that they were integrating Chainlink's middleware with BigQuery resulted in a giant price spike for Chainlink. Just the mention of usefulness and real-world application managed to affect the price so significantly.

Upcoming Chainlink Projects

Last year showed that Chainlink is serious about accelerating smart contract adoption. It's been integrated into more than 300 projects, most of which are in DeFi and blockchain, followed by data providers and nodes. Moreover, Chainlink continues to appeal to more and more developers.

Every integration has further bolstered Chainlink's market cap, and it's probably going to continue. The more projects get added to the network, the more the coin rises in value, especially if the projects grow and scale.

Here are a few examples of Chainlink's recent big integrations:

- Bloom Credits' verifiable credential data became accessible to DeFi applications through Chainlink oracles. This secured valuable identity data, such as credit history & accreditation, sourced from regular credit bureaus.

- Tezos and Chainlink agreed to let two of Tezos' teams access Chainlink's oracle network. This allowed Tezos' devs to leverage the network's power and securely access off-chain resources.

- Agoric, a decentralised platform for JavaScript development associated with Chainlink's technology, started integrating smart contracts. The collaboration allowed quicker and more effective product development without creating custom data feeds for DeFi dApps.

- There was an interesting partnership in the form of a hackathon with the State of Colorado to develop a lottery game with a $1 billion revenue goal. This was the first-ever game development hackathon.

Speculative Interest

LINK's price surges are often reliant on the ascent of DeFi and rising interest around it. If the market has taught us anything, it's that a strong uptick in interest by institutional investors drives the price up. Crypto platforms that cater to the needs of institutional investors also play a role.

Generally, as with other cryptocurrencies, LINK's value will remain volatile and fluctuate based on news, rumours and online chatter among traders and miners. The anticipation of traditional, centralised finance slowly shifting to DeFi certainty sparks significant speculative interest around projects like Chainlink.

How Chainlink's (LINK) Price Developed in the Past

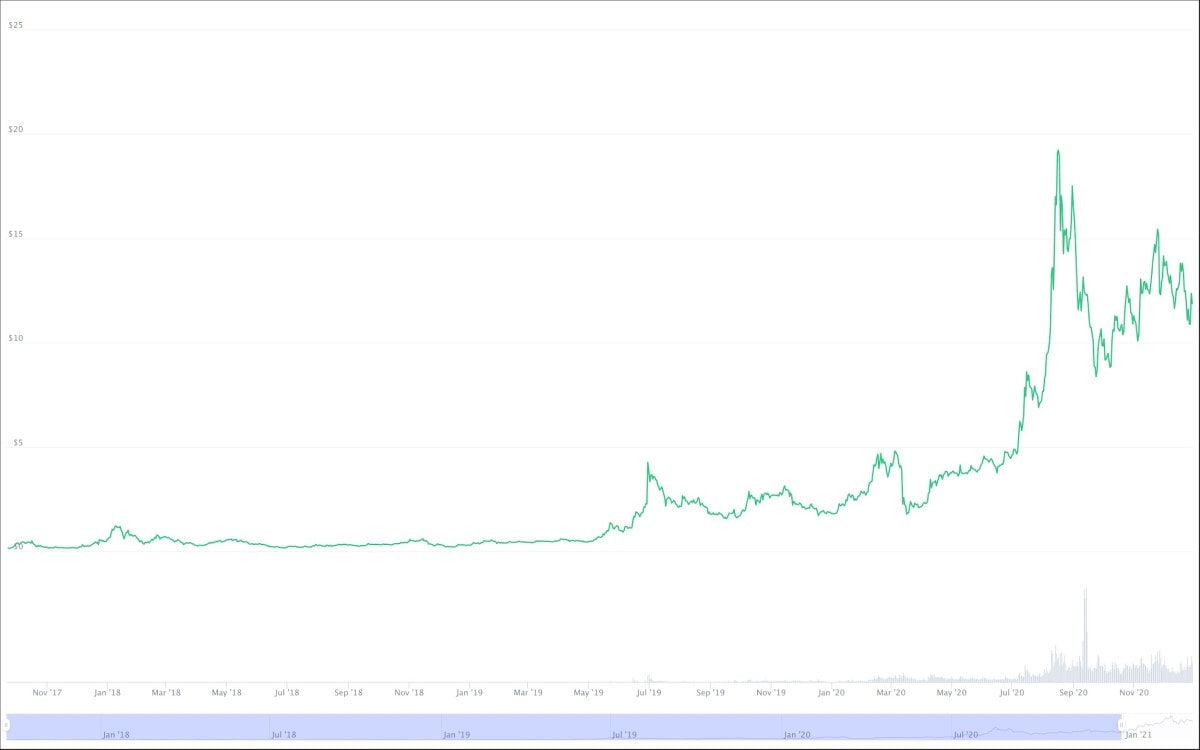

The dynamics of Chainlink's price and its volatility can be assessed through the notable events in this project's history:

- September 2017: LINK's ICO raised 114,285 ETH, or $32 million. The tokens were privately sold for $0.09 and sold publicly for $0.11.

- June 2018: After the first all-time high price of $1.51, LINK corrected in a bearish run over the next 171 days, settling at $0.16.

- Early June 2019: Google announced Chainlink as its Official Cloud Partner. Also, Chainlink unveiled the Trusted Compute Framework, for which they linked up with Intel, Hyperledger and the Enterprise Ethereum Alliance. As a result, the price jumped by more than 100%.

- Late June 2019: LINK was listed on Coinbase and saw a surge to $4.30 (compared to $1 on 1 June).

- March 2020: The start of the pandemic put LINK just below the $2 mark, which was a similar pattern among all cryptocurrencies at the time.

- August 2020: Chainlink was crushing it, reaching $19.09 on 16 August. LINK's per cent supply in smart contracts has reached an all-time high of 52.448%. However, this was followed by a several-month-long consolidation period.

- End of 2020: Chainlink saw a new integration of its decentralised oracle technology almost every day. The bullish sentiment continued.

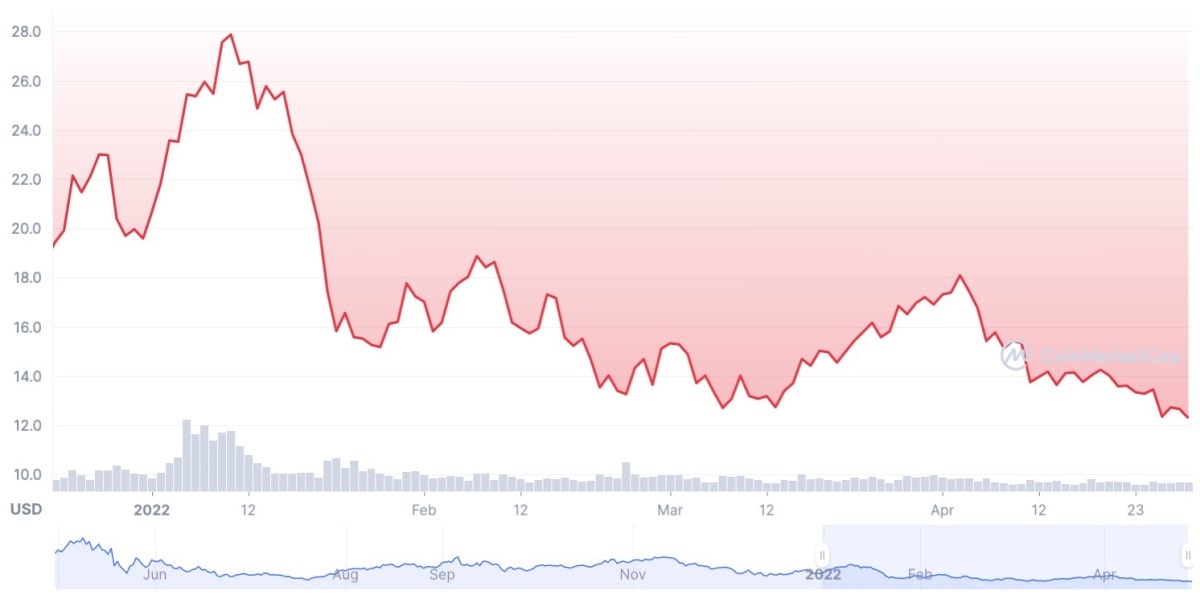

- Beginning of 2022: Chainlink started the year at around $25, then its price dropped down to around $16 in the middle of February and continued fluctuating at this level until the beginning of April.

- May 2022: Chainlink cost significantly less, dropping to $7 in the middle of May and then was traded flat until the end of the year.

How Has Chainlink Performed in 2021-2022?

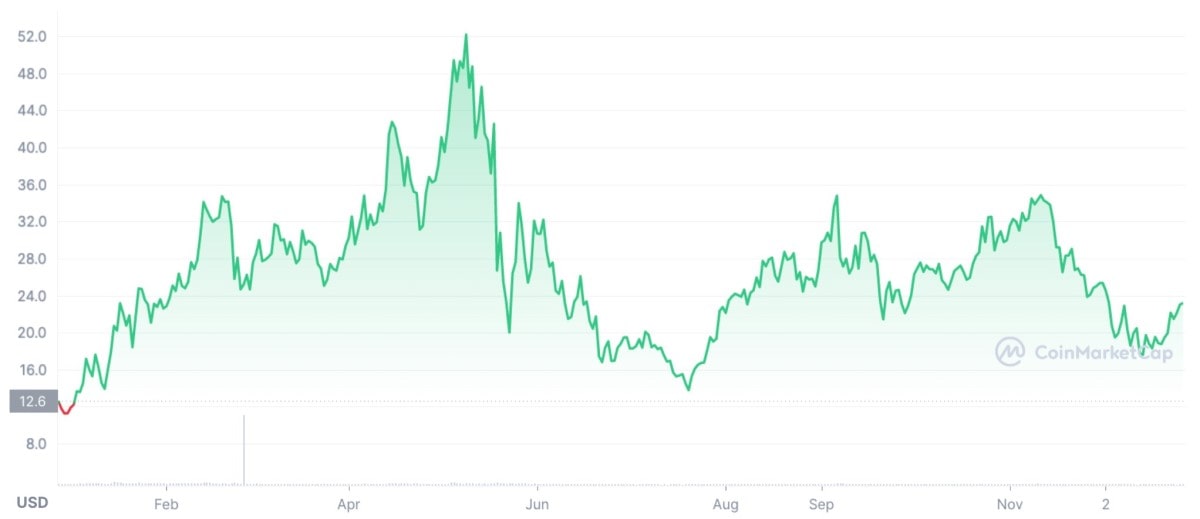

Here's the quickest recap of 2021: Chainlink started the year at $11.55 (1 January) and climbed to $27.54 (16 March). The highest price point for the year was $46.47 on 9 May. Unfortunately, that was followed by a significant decline to $13.87 by 20 July. By the end of the year, the price was sitting around $23.

There have been a lot of exciting announcements from the Chainlink team:

- The zero-collateral lending protocol Trust Token expands its integration.

- Konomi money market will use Chainlink oracles to secure its cross-chain loans.

- Sport Monks data provider will launch their own Chainlink node for supplying sports data.

- Ether cards will integrate Chainlink VRF as a core part of its #NFT gamification and monetisation platform.

- An elastic finance aggregator will integrate Chainlink price feeds.

This is just a small snippet of news surrounding the project. As it has been the last several months, with every new announcement, Chainlink has become more and more established in modern-day finance.

Unfortunately, all the upcoming announcements are yet to have an effect on the price. In March 2022, the price chart was red. The downtrend started at the start of the year and moved the price to a humble $13.34 mark. In April, LINK's price fell even lower to around $12 at the end of the month.

In May, the Chainlink token significantly dropped in value to around $7 by the end of the month and continued fluctuating flat without surpassing the level of $10.

Short-Term LINK Price Prediction for 2023

For a better understanding of the price dynamics, we'll cover a few sources.

Our first 2023 forecast comes from Digital Coin Price with both minimum and maximum prices. By mid-year, Chainlink's price is predicted to reach the maximum price value of $15.32 and stay at approximately the same level by the end of it. Overall, there isn't much expected growth. But there might be fluctuations that short-term traders will be able to take advantage of.

|

Month |

Minimum Trading Price |

Average Trading Price |

Maximum Trading Price |

|

Mar 2023 |

$6.17 |

$11.86 |

$15.88 |

|

Apr 2023 |

$6.46 |

$13.54 |

$15.48 |

|

May 2023 |

$6.49 |

$8.19 |

$15.46 |

|

Jun 2023 |

$6.24 |

$10.24 |

$15.66 |

|

Jul 2023 |

$6.18 |

$9.86 |

$15.56 |

|

Aug 2023 |

$5.96 |

$7.63 |

$15.52 |

|

Sep 2023 |

$5.98 |

$14.91 |

$15.94 |

|

Oct 2023 |

$6.07 |

$13.96 |

$15.55 |

|

Nov 2023 |

$6.37 |

$14.94 |

$15.29 |

|

Dec 2023 |

$5.97 |

$7.17 |

$15.90 |

Long Forecast shares a more pessimistic Chainlink price prediction. LINK may continue the year in the $6-$8 price range. There will be no significant price changes and a slightly bearish trend in the latter half of the year.

|

Month |

Open ($) |

Low-High ($) |

Close ($) |

Monthly Change |

Total Change |

|

Mar |

7.24 |

6.31-8.16 |

7.37 |

1.8% |

6.0% |

|

Apr |

7.37 |

7.37-9.15 |

8.55 |

16.0% |

23.0% |

|

May |

8.55 |

6.68-8.55 |

7.18 |

-16.0% |

3.3% |

|

Jun |

7.18 |

6.50-7.48 |

6.99 |

-2.6% |

0.6% |

|

Jul |

6.99 |

6.73-7.75 |

7.24 |

3.6% |

4.2% |

|

Aug |

7.24 |

7.24-8.86 |

8.28 |

14.4% |

19.1% |

|

Sep |

8.28 |

6.66-8.28 |

7.16 |

-13.5% |

3.0% |

|

Oct |

7.16 |

7.16-8.89 |

8.31 |

16.1% |

19.6% |

|

Nov |

8.31 |

6.49-8.31 |

6.98 |

-16.0% |

0.4% |

|

Dec |

6.98 |

5.45-6.98 |

5.86 |

-16.0% |

-15.7% |

Chainlink Price Forecast for 2024

Let's move to the longer-term Chainlink price prediction. The tables below came from Digital Coin Price and paint a really positive future for the coin. Since the previous forecasts also ended on an optimistic note, it's only natural that the growth will continue to persist.

Here are the approximate figures for 2024.

|

Month |

Minimum Prices |

Average Prices |

Maximum Prices |

|

Jan 2024 |

$15.65 |

$15.94 |

$16.61 |

|

Feb 2024 |

$15.35 |

$16.97 |

$17.35 |

|

Mar 2024 |

$15.50 |

$17.92 |

$18.72 |

|

Apr 2024 |

$15.52 |

$16.61 |

$17.05 |

|

May 2024 |

$15.61 |

$18.35 |

$18.74 |

|

Jun 2024 |

$15.37 |

$16.20 |

$17.08 |

|

Jul 2024 |

$15.41 |

$15.66 |

$16.05 |

|

Aug 2024 |

$15.52 |

$15.98 |

$16.29 |

|

Sep 2024 |

$15.61 |

$15.81 |

$17.88 |

|

Oct 2024 |

$15.46 |

$17.47 |

$17.65 |

|

Nov 2024 |

$15.38 |

$15.75 |

$17.76 |

|

Dec 2024 |

$15.52 |

$17.09 |

$17.81 |

Chainlink Price Prediction for 2025

The 2025 prediction shows general upside movement (although with a few big dips), backed by historical patterns and fundamental factors. Digital Coin Price provides the following chainlink price prediction model.

|

Month |

Minimum Value |

Average Value |

Maximum Value |

|

Jan 2025 |

$21.37 |

$21.72 |

$24.09 |

|

Feb 2025 |

$21.44 |

$23.30 |

$24.52 |

|

Mar 2025 |

$21.45 |

$22.85 |

$23.56 |

|

Apr 2025 |

$21.30 |

$23.35 |

$24.02 |

|

May 2025 |

$21.39 |

$21.99 |

$23.74 |

|

Jun 2025 |

$21.29 |

$21.83 |

$22.41 |

|

Jul 2025 |

$21.35 |

$24.37 |

$24.67 |

|

Aug 2025 |

$21.42 |

$22.62 |

$24.42 |

|

Sep 2025 |

$21.36 |

$21.56 |

$23.02 |

|

Oct 2025 |

$21.24 |

$23.20 |

$25.93 |

|

Nov 2025 |

$21.51 |

$24.13 |

$26.40 |

|

Dec 2025 |

$21.28 |

$21.86 |

$23.04 |

Chainlink Price Forecast for 2030

Below is the Chainlink price prediction for 2025-2030. The forecast is prepared and published by Coin Price Forecast. Just like the previous predictions, the figures are based on historical data.

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End |

|

2025 |

$11.62 |

$12.44 |

+69% |

|

2026 |

$13.17 |

$14.27 |

+94% |

|

2027 |

$15.70 |

$17.11 |

+133% |

|

2028 |

$18.51 |

$19.90 |

+171% |

|

2029 |

$21.28 |

$21.39 |

+191% |

|

2030 |

$22.67 |

$23.95 |

+226% |

Based on all forecasts above, it's quite clear that Chainlink is here to stay. Its presence is very likely to be at the centre of the blockchain revolution. The 'Internet of value' is expected to gain massive traction in the next five to seven years. In the meantime, LINK might experience endless appreciation.

Below there is also a more detailed Chainlink forecast for 2030 provided by Digital Coin Price.

|

Month |

Minimum Price |

Average Price |

Maximum Price |

|

Jan 2030 |

$71.05 |

$73.63 |

$74.86 |

|

Feb 2030 |

$70.95 |

$73.73 |

$74.02 |

|

Mar 2030 |

$71.11 |

$71.52 |

$72.88 |

|

Apr 2030 |

$70.88 |

$73.02 |

$75.41 |

|

May 2030 |

$70.98 |

$71.71 |

$73.05 |

|

Jun 2030 |

$71.05 |

$71.22 |

$74.77 |

|

Jul 2030 |

$71.20 |

$73.28 |

$76.02 |

|

Aug 2030 |

$71.23 |

$72.46 |

$73.32 |

|

Sep 2030 |

$71.06 |

$71.33 |

$72.98 |

|

Oct 2030 |

$70.93 |

$71.68 |

$74.93 |

|

Nov 2030 |

$70.92 |

$71.89 |

$72.05 |

|

Dec 2030 |

$71.10 |

$71.73 |

$75.31 |

What Will Happen with Chainlink in 2040-2050?

The Chainlink long term price prediction for 2040-2050 is a thankless task. It's unclear what the monetary structure will be reformed to. Not to mention, there's uncertainty in terms of what will be the exchange factor for digital currencies.

Other cryptocurrencies may be facing the extra risks of all their token supplies being mined. But this isn't a problem for LINK as it's an ERC-20 token with a total supply limit of 1 billion tokens. So, the token supply is not going to be as important as for BTC.

The future price of Chainlink so far depends on how its related applications mature. Its market value will reflect the blockchain's utility at the time, just as it always does. If the project maintains its relevance in the industry, it'll surely be worth a hundred times more than it is now.

Since Chainlink is so different from Bitcoin in terms of its application, it's not a competitor to the BTC mania. But it always helps to keep track of BTC because if it goes upwards, the market tends to move accordingly.

How to Conduct Chainlink Technical Analysis

First, we'll give you the steps involved in technical analysis. And then, we'll show you the current technicals for LINK and expert analysis to guide your trading.

Below are the tools you'll need to conduct technical analysis on your own.

- Trend lines: the current price direction to determine long-term and short-term trends.

- Support and resistance levels: the level at which there is a considerable amount of traders willing to buy the coin (support), the area where many sellers believe that the price cannot go above (resistance).

- Technical indicators: pattern-based signals produced by the price, trading volume, and/or open interest, one of the most important tools of technical analysis.

- Trading volume: A representation of the number of trades that have occurred within a given time period.

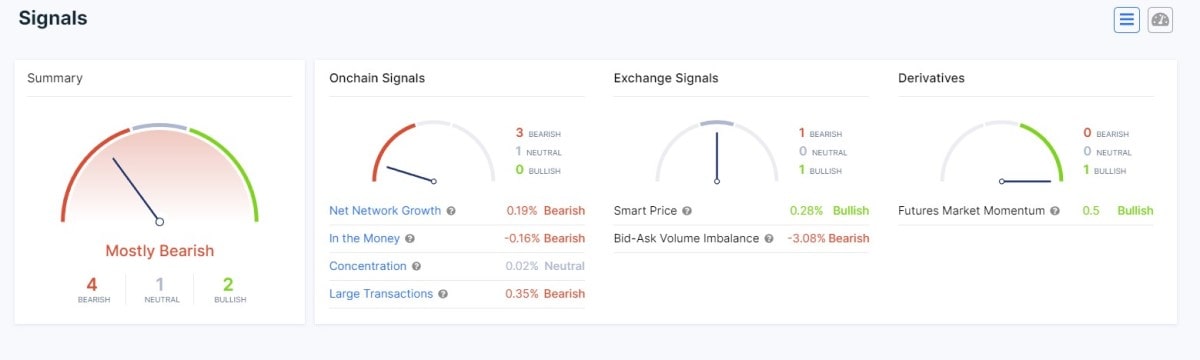

Right now, Link is looking to hold its support before coming up into the ascending channel. If the daily close moves above the current support, it might climb back up. But if it closes below the support level, we might see a bit of a drop.

Calculations for trading with the current Chainlink price of $7.33 would be:

- Support Level (S3): $6.73

- Support Level (S2): $6.93

- Support Level (S1): $7.16

- Resistance Level (R1): $7.53

- Resistance Level (R2): $7.93

- Resistance Level (R3): $8.10

Below are the ratings for the price chart and the summary for LINK/USD based on the most popular technical analysis indicators.

Below you can find LINK price predictions by the most common technical indicators:

|

Name |

Value |

Action |

|

RSI (14) |

48.38 |

NEUTRAL |

|

Stoch RSI (14) |

48.58 |

NEUTRAL |

|

Stochastic Fast (14) |

42.30 |

NEUTRAL |

|

Commodity Channel Index (20) |

66.67 |

NEUTRAL |

|

Average Directional Index (14) |

24.13 |

NEUTRAL |

|

Awesome Oscillator (5, 34) |

-0.08 |

NEUTRAL |

|

Momentum (10) |

0.19 |

NEUTRAL |

|

MACD (12, 26) |

-0.03 |

NEUTRAL |

|

Williams Percent Range (14) |

-57.70 |

NEUTRAL |

|

Ultimate Oscillator (7, 14, 28) |

51.90 |

NEUTRAL |

|

VWMA (10) |

6.97 |

BUY |

|

Hull Moving Average (9) |

6.84 |

BUY |

|

Ichimoku Cloud B/L (9, 26, 52, 26) |

7.12 |

NEUTRAL |

Experts on Chainlink's Future Price

Every Chainlink price prediction from experts shows a slightly different attitude toward the coin's future. However, we can confidently say that most opinions are optimistic, and here are a couple of examples.

Cryptocurrency analyst and content creator, CEO & Founder of Eightglobal Michaël Van de Poppe is very hopeful about Chainlink despite the dull market. "Recently, we've actually seen strength on the DeFi section, and multiple DeFi protocols have been breaking out left and right, showing strength, through which continuation seems very likely. If DeFi is going to wake up nicely, Chainlink is most likely going to follow through."

A content creator by the nickname @IllusiveTrades noted that his analysis and prediction from February hold up. The support seems to be at $13, showing no signs of an upcoming breakout.

According to Joseph Raczynski, a technologist and futurist at Thomson Reuters who participated as a panellist for Finder, Chainlink (LINK) has a promising future. He predicts that by 2025, the coin will have a value of $100 and that it will be worth $500 by 2030.

Is It Better to Trade or Invest in Chainlink?

On the one hand, Chainlink is a good long-term investment to keep in your wallet for years. This technology is blockchain agnostic and interoperable. In other words, the infrastructure is compatible with "all leading public and private blockchain environments." As a result, mainstream adoption (if not from individual users, then from new and existing products/services) will be followed by LINK's appreciation in the future.

However, many investors are fearful about putting their funds into an asset for a long time. The crypto markets can lead to tremendous wealth and make you lose it all. The decline of an altcoin like LINK is even more heightened. But there is definitely speculative potential.

If you're interested in trading LINK, there's a great opportunity to maximise the results: CFDs. You get the chance to speculate on the price without owning the digital asset while also leveraging your positions.

The best way to get into CFD trading is through a Libertex demo account. Why? You'll get to explore the trading platform and user interface, learn cryptocurrency trading and technical analysis, understand market dynamics and a lot more. Sign up today for free!

If you have any questions left, this section is for you.

FAQ

Should You Invest in Chainlink in 2023?

Almost any Chainlink price prediction will leave you hopeful for its future. If you invest in 2023, don't expect to make bank in the same year. But if you wait a few years, your investment may potentially pay off. It's crucial to note that, before making any trading decisions, it's recommended to conduct your own research and seek professional investment advice.

Can You Predict Chainlink's Price?

Yes and no. On the one hand, you can gauge the fundamentals and hypothesise about the success of future projects. You can also conduct technical analysis or seek a report from experts. On the other hand, it's important to understand the shortcomings of any prediction and the inaccuracies it may involve.

Will Chainlink Reach $100?

Judging from the Chainlink price prediction for 2025-2030 given above, the coin is unlikely to reach the $100 mark.

Is Now a Good Time to Buy Chainlink?

According to different experts, Chainlink has a promising future, and thus, it could be an attractive investment choice. However, it's essential to conduct thorough research and analysis and consult with a licensed financial advisor before making any investment decisions.

Does Chainlink Have a Future?

In theory, smart contract technologies combined with Chainlink can change the business at its core and rebuild our financial infrastructure from the ground up. This is a big statement, but technology is moving ahead at a rapid speed from what it seems.

Will Chainlink Keep Rising?

In the short term, we may see a bit of a drop. However, in a few years, the project is expected to climb back up and reach new heights as DeFi and oracle services grow.

Is Chainlink a Good Investment?

Chainlink is one of the most prominent cryptocurrencies. A few reasons why it can be a good investment are that it has the right technology behind it, enough resources for further development and an excellent community.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.