How to Invest in Facebook Stock

Overview: The History of Facebook

Most people only know that Mark Zuckerberg developed Facebook, but the truth is he wasn't alone. Facebook was founded by Mark Zuckerberg, Eduardo Saverin, Chris Hughes, Andrew McCollum and Dustin Moskovitz in their dorm at Harvard University back in 2004.

The team first developed Facebook for Harvard students only. But after some time, it was expanded into more areas until the website was opened in 2006 to anyone with a valid email address who was at least 13 years old. In 2012, Facebook raised about $15 billion in an Initial Public Offering (IPO), which valued Facebook at about $100 billion. In just three years, it had reached more than a hundred million users. Today, Facebook now has almost 3 billion active users.

Facebook, Inc. develops products that allow users to connect and share using tablets, mobile devices and computers. In addition to its main social media network, Facebook, the company has also acquired Instagram and WhatsApp and developed and launched Oculus and Messenger.

Why Invest in FacebookStock?

There are many reasons why investing in Facebook stock may be a good idea, including:

- Active users

- Sales growth

- Profitability and pricing power

- Stock valuation and performance

Active Users

Facebook has over 260 million active users in the US and Canada alone. The age of users is mostly above 18. Even if US and Canadian users are the smallest per cent of the total users of the social media company, each user still generates excellent revenue. Additionally, even though US and Canadian users make up only about 10% of total users, they generate revenue that's three times more than the revenue of Europe. Overall, the monthly active users of the platform increased to 2.8 billion last year.

Sales Growth

Facebook's revenue reached $84.2 billion in 2021, and net profit increased to almost $41 billion. The majority of Facebook's revenue is from ads on its platform. In 2021, the company's advertising sales hit $25.4 billion. Of that, $732 million came from streams on the platform, which involve the company's Oculus VR hardware and other minor business lines.

Profitability and Pricing Power

Among the various big social media platforms, Facebook's gross margin and operating margin are far better off. The gross margin includes direct costs from the business, and the operating margin includes R&D and salaries. Pinterest Inc. and Snap Inc. have negative operating margins since they're focused on rapid growth. They also lack gross margins. On the other hand, Facebook is at its critical mass phase in terms of users, so its gross margin is more consistent, and that's a good thing for the investor community.

Stock Valuation and Performance

When using old-school valuation metrics, Facebook isn't overvalued. Accordingly, its price-to-earnings ratio is at 21.54, according to Nasdaq. Its predicted P/E ratio for next year's earnings is 21.71, while the forward P/E for S&P 500 Index is at 21.56, and the Nasdaq Composite Index is 24.77.

Compared to these two, Facebook's P/E is normal relative to the broader market and is below similar platforms. This is reasonable since Facebook's growth has led many investors to grant a premium valuation above less dynamic stocks in other sectors.

How Much Does Facebook Stock Cost?

Facebook stock reached a market cap of $839.285 billion in late January 2022, which puts it among the top 5 most valuable companies in the S&P 500 index, alongside Apple, Amazon, Google and Microsoft. On 28 January, the stock cost $301.71.

Fundamental Analysis of Facebook's Stock

Based on ChartMill, Facebook has an overall fundamental rating of 8 out of 10 compared to another 383 networks in industries such as data processing, computer programming and other computer-related services. The fundamental analysis of Facebook stock involves:

Profitability

Facebook scored 4.5 out of 5 in profitability for these reasons:

- It has a 23.77% Return of Assets, which is one of the best returns in the industry, where the average is -2.42%.

- Its profit margin is at 35.88%, which is also significantly better than the industry average of -4.38%.

- It has a Return on Equity of 30.22%, which is still better than the average of 13.29%.

Valuation

In terms of valuation, Facebook garnered a 1.5 out of 5. This is because:

- Facebook is valued lower than the industry average P/E ratio of 21.54.

- The forward P/E ratio of FB is at 20.65, which shows that it's expensive.

- Its price-book ratio is in line with the industry's average book ratio of 6.29.

Growth

Scoring 4 out of 5, Facebook has:

- 65.41% growth in its Earnings per Share and is growing at an average of 34.17% each year.

- 42.23% growth in its Revenue for the past year.

- The EPS growth will decrease for the next five years.

- Comparing the growth rate of the revenue, the next few years will have a lower growth compared to the past years.

Health

Facebook has a great health rating (4 out of 5) because of the following reasons:

- With its current ratio at 4.23, Facebook isn't having any trouble paying its short-term obligations. It's better than the industry average of 1.98.

- It has an Altman-Z score of 16.55, implying that Facebook is not near bankruptcy.

- The Debt to Equity ratio belongs to the industry averages.

Dividend payouts

This is the only 0 out of 5 rating of Facebook since Facebook doesn't offer dividends.

What Affects The Price of Facebook?

Since the price of Facebook stock fluctuates, there are some factors or things investors or traders usually look for. These factors can affect the price and include:

Active Users

Even though there are now billions of Facebook users, Munster predicted that it would reach a saturation point. According to this prediction, there will come a time when the number of new active users will decrease and stop, and the users will spend less time on the company's platforms.

Ad Revenue

Facebook is very reliant on ad revenue. In 2017, Facebook's ad revenue reached 98%, according to Statista.com. But the cost of advertising on the platform has increased to 219%, which means that some ad users get great results, but most don't. This shows that the company lacks revenue diversification. Relying on only one source of revenue is risky.

Competition

There are many rival platforms that continue to rise in the industry, and Facebook can't buy all of them like how they bought Instagram for $1 billion. As competition increases, some active users may turn away from Facebook or use it less.

Market Risks

This factor will probably have the biggest effect on all stocks. When the stock market experiences a crash or a crisis, there isn't much any company can do. For instance, during the dot-com crisis, Nasdaq lost over 75% of its value. Furthermore, it's hard to predict when another crisis may come.

Regulatory Risks

This factor can also affect the stock's price since social media is viewed as an unregulated market. These risks include the misuse of Facebook, like what happened in 2016, when the data of about a million Facebook users fell to the hands of foreign political operators after Facebook allowed Cambridge Analytica's political data firm to acquire the data. Instances like this may result in fewer users, leading to less ad revenue.

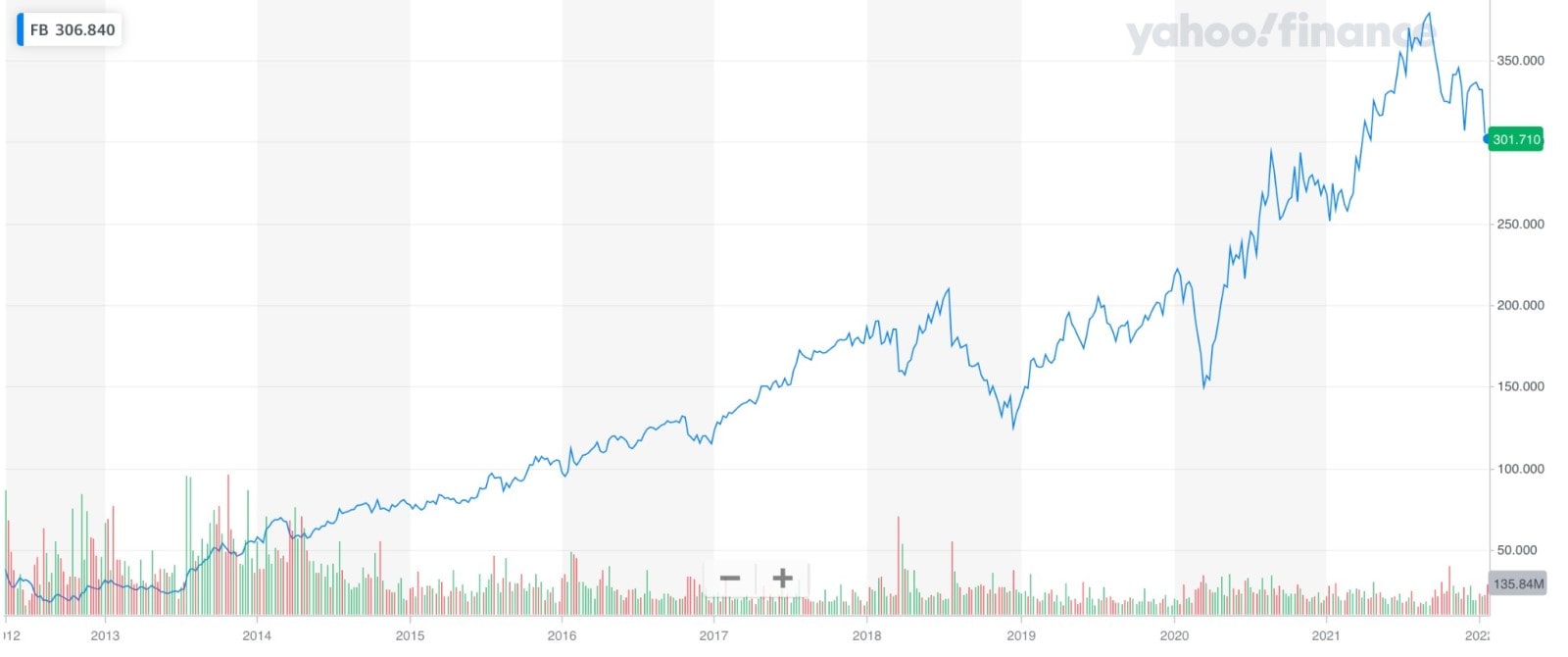

Facebook Stock's Historical Performance

In 2012, Facebook experienced three significant events:

- It was the first social network to reach over a billion users.

- With its Initial Public Offering, or IPO, Facebook raised up to $16 billion.

- The price of each IPO share reached $38, putting the company's valuation at $104 billion.

In the same year, the company acquired Instagram and WhatsApp after two years. In 2019, Facebook was considered one of the most popular social networks, resulting in a relatively high stock price.

Trading during the first year wasn't good for Facebook. The stock lost at least 50% of its first valuation and needed over a year to get it back to more than $100 billion. From $250 billion in 2015, it crossed $500 billion in 2017 and continued to rise.

How Is Facebook After the Coronavirus?

Despite COVID-19, Facebook is doing relatively well. Although many industries and companies were left devastated after the coronavirus, Facebook still had a relatively good year. As mentioned, its revenue grew by 22% and reached $86 billion. Its active users per month also increased to 2.8 billion.

Because of worldwide lockdowns, people are spending more time at home — and many are filling this extra time by scrolling through social media platforms like Facebook.

Businesses recognise that more people than ever are active on Facebook and are accounting for this in their marketing strategies. Companies are placing advertisements on Facebook to reach the widest possible target audience. As such, Facebook is raking in ad revenue, so one could even say that it benefitted from the pandemic.

Facebook 2021 Results

Facebook stock has been consistently high-performing over the years. According to Macrotrends, on 28 January 2022, Facebook stock experienced:

- A 52-week high stock price of $384.33, which is more than 27.4% of the current share price.

- A 52-week low stock price amounting to $253.50, which is about 16% less compared to the current share price.

- An average Facebook stock price of $325.32 for the last 52 weeks.

The all-time high closing price was 382.18 on 7 September 2021.

What to Expect in the Future

Based on Wall Street analysts, the consensus target price for Facebook stock is about $460 and implies some possible upside of over 50%. If Facebook performs well, it might join Apple in the group of corporations that have crossed the $1 billion market cap mark multiple times.

TechnicalAnalysis of Facebook Stock

There are two main ways to analyse the potential of Facebook stock: through fundamental analysis and technical analysis. Fundamental analysis of Facebook stock has been discussed in this guide, and it focuses on the intrinsic value of the stock. However, with technical analysis, investors use the stock's statistics.

Technical analysis focuses on analysing trends and patterns in the current and future price fluctuations of the stock. Here are some more general indicators you might want to look at:

- Momentum and volume indicators

- Moving averages

- Oscillators

- Resistance and support levels

Pros and Cons of Facebook Stock

To determine whether Facebook stock is right for your portfolio, make sure to review the pros and cons of purchasing it.

|

Pros |

Cons |

|

|

How to Invest and Trade FacebookStock

When you buy Facebook stock, there are two major strategies: investing in it or trading it. When you invest, you buy the stock and wait for it to reach a significant amount or a certain period of time and sell it. It's a long-term strategy. But when you trade stock, you buy it and sell it again when the market conditions are great. This is a short-term strategy.

Investing in Facebook Stock

Investing starts with buying. Remember that Facebook trades on Nasdaq and is part of the S&P 500 index. And as mentioned, investing is a long-term strategy, so it's a better approach for people who have money to spare and for people who prefer keeping stocks as assets. Here are the steps you need to follow to invest:

- Decide how much you would like to invest.

- Choose and join a broker.

- Deposit your funds.

- Place an order to buy stock.

TradingFacebook Stock

Aside from investing, you can also trade Facebook shares using a contract for difference (CFD) or spread bets. Using these two, your results will depend on the full value of your position.

Technically, the steps you need to follow are the same as when you invest in Facebook stock. You choose your broker or platform, open an account, deposit your funds, and buy your stock. The only difference is when trading, you have an additional step, which is to sell or trade what you bought after a short period of time.

Specifically, when you trade CFDs, you're watching and observing if the price will go up or go down. And based on your prediction, you can go long or go short. If you expect the price to go up, you can go long. But if you expect it to go down, you can go short. And remember that with CFDs, you're exchanging the difference between the opening and closing difference of your position.

On the other hand, when you spread bet, you're betting based on the point on its share price movement. So, if you predicted correctly, it will result in a profit, and if you're wrong, you'll experience a loss.

Conclusion

There are various ways you can make use of Facebook stock. If you prefer a long-term approach, you can just invest. But, trading CFDs is also a good way to participate in the market since you can potentially get profit in a shorter period of time. Please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital. The best way for anyone to decide is to practice so that they can try whichever without any risk. And to practice, opening a Libertex demo account is always the best choice.

FAQ

Should I Sell Facebook Stock?

Many traders and investors have been interested in Facebook stock over the years. And they either just invest in it or trade it. Both include selling the stock but differ in terms of the timeframe. If you want to sell Facebook stock after just some time, you should trade. But if you want to sell it when the 'right' time comes, you can just invest.

Does Facebook Stock Pay Dividends?

No, Facebook stock doesn't pay dividends. Although Facebook, Inc. is a successful and big company, it doesn't distribute any of its earnings. And so, the only opportunities you have with Facebook are investing in and trading its stocks.

Is Facebook Publicly Traded?

Yes, it's publicly traded. Facebook stock is traded on the Nasdaq under the ticker FB. It also filed an initial public offering (IPO), which shows that Facebook is publicly traded.

How Many Shares Does Facebook Have?

There are currently over 2.37 billion Facebook shares.

Why Is Facebook Stock Down?

There are many things that could affect the fluctuation of Facebook stock. The biggest factor is the number of active users. If the number of users who use Facebook decreases, the company's revenue will decrease.

How to Buy Facebook Stock?

Buying Facebook stock is a straightforward process. First, you have to decide which broker or platform to join. Create an account and deposit your decided funds for the purchase. Place your order and pay.

Why Buy Facebook Stock?

Facebook stock is consistent in various aspects and has the possibility to grow further in the future. Buying Facebook stock can be successful if you choose an appropriate strategy. Also, Facebook is also a popular social media network; hence it is unlikely to fall or go bankrupt anytime soon.

How to Buy Facebook Stock Without a Broker

Although the most common way of buying Facebook stock is with a broker, you can also buy it without one. You can do this through the Direct Stock Purchase Plan (DSPP), where you'll be helped by a transfer agent. The company will allow you to purchase shares through this directly.

Is Facebook Stock a Good Buy?

Facebook is a big thing now, and according to stock market analysts, yes, it's a good buy. Also, it has more than 2 billion shares, which proves that it's a good buy for many people.

How Much Is One Share of Facebook Stock?

As of 28 January 2022, one Facebook share was worth over $301.71. It's good to remember that the price fluctuates, so you shouldn't expect a fixed price even within one day. Pay attention to the closing price.

When Will Facebook Stock Split?

Over the years, there hasn't been any stock split history. Although there are plans for splits, there's still no final date for the split.

How Do I Invest in Facebook Stock?

Investing in Facebook stock can be done in a few steps. First, find a broker. Then deposit your funds. Decide on how much you want to invest and place an order once you decide. You can sell your share after a certain amount of time or when it hits a high price.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.