The Hammer Candlestick Pattern: Build Your Reliable Signal

Hammer Candlestick: What It Is and How to Catch Its Signals

A hammer is a bullish reversal pattern that consists of only one candlestick. The candlestick is easily identified because it has a small body and a long lower shadow that exceeds the body by at least double. High and opening/closing prices are almost the same, which is why the candlestick either doesn't have an upper shadow or has an upper shadow that is too small.

The candlestick can be any colour. But if it's bullish, the signal is much stronger because the colour shows that not only bears were weak and unable to keep the price low, but bulls were so strong that they were able to push the price above its opening level.

A hammer is a bullish reversal pattern that consists of only one candlestick. It signals a price may reverse after an extended downward movement.

The hammer allows traders to understand where supply and demand are placed. To remember what signals the candlestick provides, just look at its form. A long lower shadow signals that bears tried to push the price down and didn't succeed in keeping it at a new low. As a result, the price moved up at the end of trading, so bulls gained momentum. It's a sign of a trend reversal.

There are two conditions that can affect the strength of a hammer's signal:

- The provided signal is more reliable if the candlestick occurs after a long downtrend. It means that bears are losing their force and can control the market anymore. The length of the downtrend will depend on the period of the chart you trade on.

- The upward signal is more solid if a candlestick that follows a hammer closes above its opening price.

When talking about the hammer pattern, we should also mention the inverted hammer. It's also a pattern that consists of only one candlestick that also has a small body and a shadow that is double the length of the body. However, the shadow is above the body, not below it. The colour doesn't affect the signal of the inverted hammer. Still, if it's bullish, the signal is more reliable.

An inverted hammer is the mirror opposite of the hammer pattern. Still, it provides the same signal as the standard one: a trend reversal.

The inverted hammer provides the same signal as the standard one: a trend reversal. However, the inverted hammer is a less reliable pattern and always needs additional confirmation.

Hammer Candlestick Pattern: Find It in Forex

The hammer candlestick often occurs on price charts, so you won't have difficulties looking for it on any asset's chart.

Look at the chart of the EUR/USD pair's daily chart. There are two examples on one chart that confirm the hammer pattern is one of the most frequent candlestick patterns.

Benefits and Limitations of the Hammer Candlestick Pattern

Any pattern and indicator have advantages and disadvantages. Knowing them, you limit the risks of losing trades.

|

Benefits |

Limitations |

|

Frequency. Hammers occur frequently, so you can easily practice finding them on the price chart. |

No assurance. The hammer signals an upside movement. However, a trader can't be fully sure the bullish trend will occur even after a confirmation candlestick. It can be a short-term price rise. |

|

Easily recognisable. You can recognise a hammer pattern without problems. It always has a long lower shadow and a small body. The upper shadow either doesn't exist or is too small. |

No Take Profit level. Although the pattern is used to open a trade in the opposite direction to the previous (bearish) trend, the pattern doesn't indicate what reward you will get. You need other patterns and indicators that will provide a Take Profit level. |

|

Exit the market. Hammers signal when you should exit the market. A hammer is always formed at the end of a downtrend. When seeing a hammer candlestick, a seller can close their trade. |

Confusing. The hammer candlestick resembles a hanging man candlestick and even a shooting star. |

|

Wait for a reversal. The hammer candlestick is a perfect pattern that predicts a trend reversal. |

Confirmation. As with any other signal, the hammer alerts should be confirmed by other indicators. Otherwise, there is a high risk of fake signals. Another tricky point is that until a buyer waits for the formation of the confirmation candlestick, they miss a good entry point. Entering the market after the second candlestick provides a higher risk/reward ratio, where the risk can exceed the ratio dramatically. |

Find the Hammer Candlestick Pattern

In this section, we consider how to identify the hammer pattern on the price chart.

Step 1: Find a Strong Downtrend

Both the hammer and inverted hammer occur at the end of the downtrend. It's vital the downtrend is strong and lasts for a long time. If the hammer pattern appears after several candlesticks moving down, the risk of a false signal increases.

Step 2. Identify the Length of Shadows

The candlestick should have a long lower wick (two times bigger than the body) and a small upper wick or the lack of one. If the candlestick has a long upper shadow, it's not a hammer; more likely, it's a doji candlestick. The opposite rule applies to the inverted hammer.

Step 3. Look at Highs and Lows

The hammer's signal is considered stronger if the hammer is closed below the previous candlestick. Still, if it's closed within the early candlestick, the signal is also workable. However, the hammer doesn't work if a new high is set when the candlestick finishes forming. Also, the hammer pattern fails if the following candlestick sets a new low.

Hammer vs Other Candlesticks

The look of the hammer candlestick is not unique. There are some candles that look similar. That's why it's crucial to distinguish them.

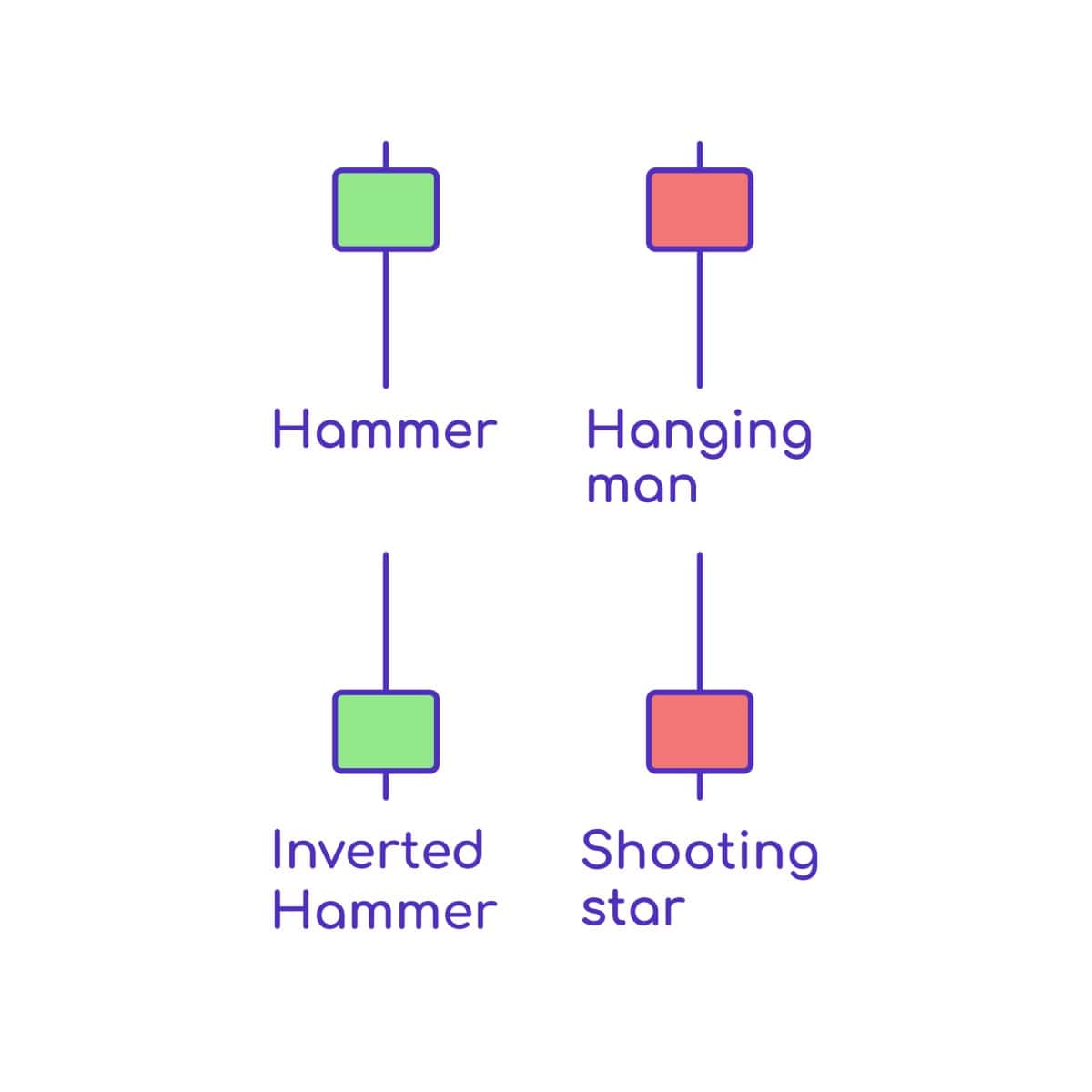

The hammer resembles the hanging man candlestick, while the inverted hammer looks similar to the shooting star.

Hammer and Hanging Man Candlesticks

The hammer and hanging man candlesticks look similar but form in different circumstances. The hammer pattern is a signal of a reversal upward. It forms at the end of the downtrend and shows that, although bears pulled the price down, they couldn't maintain control, and the price closed up.

The hanging man forms when the market is going to move down. It shows that the price is ready to decline after a strong uptrend as the candlestick has a long lower shadow that depicts the force of bears.

Inverted Hammer and Shooting Star Candlesticks

As both candlesticks are the mirror opposite of the hammer and hanging man candlesticks, and, therefore, they also look similar.

However, the inverted hammer is formed at the end of the downtrend, while the shooting star occurs after a strong uptrend.

Hammer Candlestick: Catching Its Signals

The key signal of the hammer candlestick is a price reversal. Still, you can use the hammer pattern for different trading phases.

The Take Profit Level

The main signal provided by the hammer is a trend reversal. The candlestick shows that bears have lost their strength, and bulls are ready to control the market. Thus, the candlestick can be used as a good point to exit the market and take profit if you hold a short trade as soon as the hammer is formed.

Entry Point

An entry point can also be identified by using the hammer pattern. Although the candlestick won't provide an accurate level, you can open a long trade after the hammer signal is confirmed. Below, you'll find information on how to confirm the hammer's signals.

Stop Loss

The hammer candlestick can be used to define a Stop Loss level. After the market turns up, you can open a long position. However, it's vital to set a Stop Loss level any time you trade. Draw a support level through the hammer and previous candlesticks. This level can be set as a Stop Loss.

We'd like to remind you that this way of identifying a Stop Loss level can be risky as the risk may exceed reward dramatically.

The Best Hammer Candlestick Strategy

There is no one best strategy, but we do have one for you that will open up another way of using the pattern.

- Step 1. Find a strong downtrend.

- Step 2. Look for the hammer candlestick.

- Step 3. Place Fibonacci retracements from the beginning of the downtrend to the low of the hammer.

- Step 4. Open a long position after you get a confirmation of the upward movement. To do this, you can apply the RSI or Stochastic Oscillator.

- Step 5. Place the Take Profit at the previous Fibonacci retracement level. If you're confident that the market will keep rising, you can trail your Take Profit to the next Fibonacci level.

In the example below, we used the Stochastic Oscillator. The oscillator first crossed the oversold area from the bottom up. Then, the price and oscillator formed a bullish divergence, signalling a price increase.

In our example, Take Profit levels are placed at 1.1174 and 1.1219.

Tips for Traders: Key Points About the Hammer Candlestick Pattern

Always confirm the signal. This rule applies to all patterns and indicators as no trading tool would provide a 100% signal. You will find the most reliable signal by following these rules:

- Apply technical indicators, for instance, the RSI or Stochastic Oscillator, to define oversold areas.

- The hammer signal is stronger if it's formed near the support level.

As such, you can draw a support level and apply pivot points or Fibonacci retracements.

Here are a few other useful guidelines:

- The colour doesn't matter. Even if the hammer is a bullish pattern, its colour doesn't matter. However, if the candlestick is green (bullish), the signal is stronger.

- The hammer and inverted hammer are both bullish reversal patterns. Still, the inverted hammer provides a weaker signal.

- The size matters. Remember that the lower shadow of the hammer candlestick and the upper shadow of the inverted hammer should at least double the body in size.

Conclusion

To conclude, the hammer is a bullish reversal single candlestick pattern that signals a potential upward movement after a strong downtrend. This pattern is simple and occurs so often that you can practice looking for on different timeframes and for different assets almost every day.

However, before trading the pattern, you need to practise. Create a Libertex demo account to train before entering the real market. It covers all the securities and indicators that are available for a real account.

It's time to summarise. Check out the answers to the most frequently asked questions.

FAQ

Is a Hammer Bullish or Bearish?

A hammer is a bullish pattern that predicts an upward movement after a downtrend.

Is a Red Hammer Bullish?

Although it sounds strange, the red hammer is a bullish pattern. The hammer pattern is bullish in general, and the colour doesn't matter. Still, if the candlestick is green (bullish), the signal is stronger.

What Does a Bullish Hammer Mean?

A bullish hammer means that the market is supposed to move up after it forms.

Why Is an Inverted Hammer Bullish?

Hammer and inverted hammer candlesticks are both bullish patterns. Their colour and type don't affect their signals.

What Is Inverted Hammer Bullish Reversal?

An inverted hammer bullish reversal is a signal that is given by the inverted hammer. It shows the price will move up after the downward movement.

What Does a Bullish Hammer Look Like?

A bullish hammer has a short body and a long lower shadow that is at least twice the size of the body. The upper shadow may be small or missing.

What Is an Inverted Hammer Candlestick?

An inverted hammer candlestick is a kind of hammer candlestick that provides the same signal as the hammer, but it looks like the mirror opposite of the hammer.

How Do You Trade a Hammer Candlestick?

A hammer candlestick signals an upward movement after a downtrend. So, you can either close the sell position or wait for a confirmation of the upward movement to open a buying one.

What Is the Difference Between a Hammer and an Inverted Hammer?

The only difference is what the candlesticks look like. The hammer has a long lower shadow, while the inverted hammer has a long upper shadow.

What Is the Difference Between an Inverted Hammer and a Shooting Star?

The inverted hammer candlestick is formed at the end of a downtrend, and the shooting star occurs at the end of an uptrend.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.