Monero Price Prediction: New All-Time High Coming?

Where will this privacy-oriented cryptocurrency go next? Find out in this Monero price prediction. We'll be taking a detailed look at possible movements starting from 2022 all the way to 2030. And while you're here, we'll also look at its past performance and factors driving its price.

What Is Monero (XMR)?

Monero (XMR) is an open-source cryptocurrency created in 2014 that focuses on privacy and being untraceable. Advocates say that Monero is what Bitcoin noobs think they bought: fungible, digital, sound money.

Whether you agree with the statement or not, the project does indeed focus on providing value with no money-hungry underlying cause. Monero's developers didn't even keep any stake for themselves when they launched it. But for transparency's sake, they did bank on contributions and community support to make sure they could roll out upgrades and developments.

Basic Technical Info

Below are the main technical concepts that you need to know about Monero:

- Proof of Work: Monero uses the RandomX algorithm that is optimised for general-purpose CPUs. This way, Monero community members eliminated the use of mining-specific hardware and made mining more accessible for an average person.

- Blocks: It takes around 2 minutes to create a new block with no limit to the number of blocks that can be created. However, there is a policy of dynamic scalability ensured by a block reward penalty and a dynamic block size.

- Emission curve: Monero is divided into two fundamental emissions: the main curve and the tail curve. The latter kicks in after around 18 million coins are mined. The rewards for the tail emission will translate to <1% inflation, decreasing over time.

- Main privacy-enhancing technologies: Developers and contributors ensure the privacy promises of the stealth crypto coin through these technologies: RingCT, Stealth Addresses, Ring Signatures, Transactions over Tor/I2P and Dandelion++.

Monero vs Bitcoin

It's important to clarify how Monero differs from Bitcoin. For a BTC transaction to happen, the sender needs to know the recipient's public address. This reveals some information to the sender, such as how many coins there are on this wallet. In addition to that, all transactions are openly available on the public ledger.

Monero uses Random Addresses for anonymous routing. That way, senders don't need to know the recipient's account info or see their holdings. The coins are routed through one-time addresses that are created randomly, and no one can tell that a particular sender made a transaction with a particular recipient.

There is an option to allow others to view your account. All it takes is to share their view key. It's useful for an audit, and what's even better, the key doesn't grant withdrawal rights.

5 Factors That Affect Monero's Value

It goes without saying the socio-economic conditions, regulatory changes and the price of Bitcoin all have an effect. But if we strictly focus on what drives the price of Monero, there are a few other things worth mentioning.

1. Bulletproofs+

The existing non-interactive zero-knowledge proof protocol Bulletproofs will be replaced by Bulletproofs+. This will be the basis of a new algorithm to protect Monero users called Triptych.

Bulletproofs+ is currently going through its second third-party audit. Why is that necessary? The immediate goal is to mitigate existing vulnerabilities in the code. Once it's done, Monero transactions will be lighter, faster and more secure.

The new initiative is an improvement from the various forms of ring signatures that make node synchronisation bloated and slower. Obviously, if all works out, Monero has a higher chance of widespread adoption and interest from traditional finance.

2. Monero's ERC-20 Token

An Ethereum-based version of Monero called Wrapped Monero (WXMR) was launched in 2021. The counterpart is minted on a 1:1 basis.

It's an ERC-20 token that can be traded and utilised on the Ethereum network. What's more, WXMR makes Monero available within the DeFi sector for the first time, one of the biggest crypto trends. Experts say it's unlocking a host of exciting possibilities.

Overall, this is very good news: WXMR is entering the world's leading smart contract network for trading, lending, staking, yield farming and other DeFi services.

3. Inclusion as a Payment Option

The Monero community is striving to enter mainstream spaces. There was even an interesting case when members created a proposal to add XMR as a payment option on Tesla's website and gathered $150,000 as part of it. The proposal followed Elon Musk's announcement that Tesla Motors had started to accept BTC.

Community members expressed their concern that BTC transactions let the other party know a user's entire wallet balance.

Historically, every time crypto gains recognition from major websites, the coin's trading volume and value go up. If Monero gets added as a payment on other similarly popular platforms, it will certainly be reflected in Monero's price prediction.

4. Funding and Community

Monero utilises a community crowdfunding system. All development projects are supported by the community, so the network's prosperity essentially relies on donations. If Monero acquires positive attention and gathers more advocates, its funding will go up. Subsequently, this creates more opportunities for improvement.

Anyone in the community can make new proposals or fund existing ones. Funding is held in escrow and released once milestones are achieved. So, a big driving factor for XMR is how strong the network's support is.

5. The Dark Web

Bitcoin is still the dark web's 'favourite' cryptocurrency, but privacy-focused cryptocurrencies like Monero are in high demand. Even though it's a questionable method of promotion, it still exists. The last time Monero was adopted as a payment method by a darknet market, it saw a huge spike in value.

If another underground market goes in the same direction, there will be more people wanting to acquire currency they can trade in.

Monero (XMR): Historical Performance

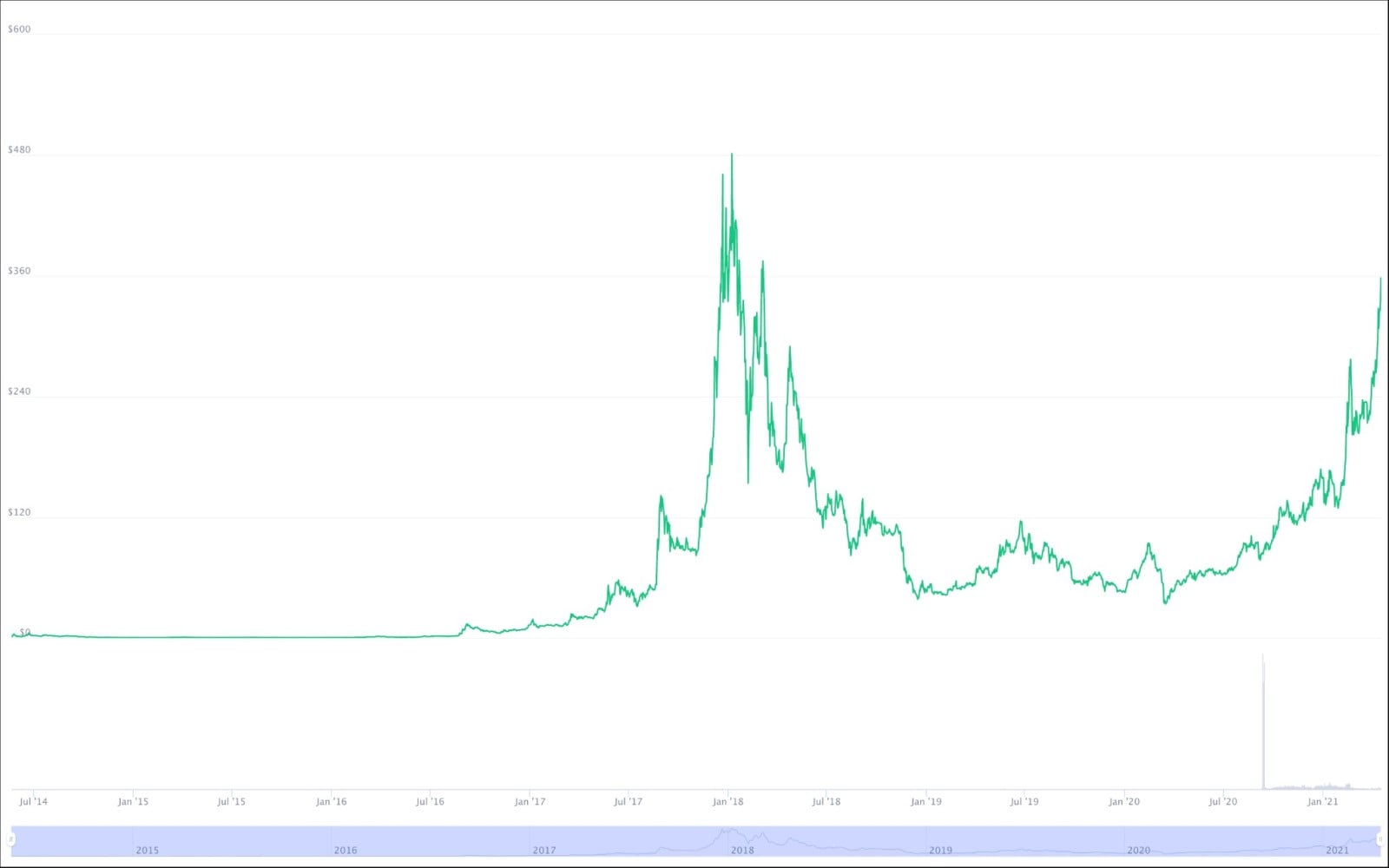

Let's not jump into Monero's price prediction just yet. To understand the full context, we first need to cover the most notable events in the project's history and how they correlated to its price:

- April 2014: The coin launched on Bitcointalk and was renamed from Bitmonero to Monero, with its price fluctuating between $1-$3 at the time.

- September 2014: It recovered from a spam attack, moving its price to $0.30-$0.40.

- March 2016: Monero's network was upgraded, pushing the price to $1.10-$1.60.

- December 2017: Multi-signatures were introduced, resulting in skyrocketing prices from $272 to $472 (it's all-time high).

- March 2018: The new Lithium Luna was released, which helped the price to recover after a correction, going from $229 to $349.

- April-December 2018: The price experienced a gradual but consistent drop from $279 to $39 after the cryptocurrency bubble crash.

- October 2018: Bulletproofs was implemented to reduce transaction sizes.

- January 2019-June 2019: Following a number of upgrade releases, the price experienced an upward trend movement from $50 to $116.

- February 2020: The price saw a small peak of $84 after the website Getmonero was translated into 19 languages.

- March-December 2020: A surprising but exciting rise took the price from around $40 to $165.

- January-April 2021: The price saw a frenzied rise from $130 to $350 that we'll talk about in more detail in the next section.

Monero's Price Today

Monero has been trading bullishly since the start of the year with no significant corrections. The period from 1 January to February was relatively uneventful, seeing only an approximately 10% change in price. Then, a big spike took Monero's price from $152 to $257 in a matter of a few weeks.

The period between 21 February and 28 March was another relatively stagnant period but with a slight drop from $257 down to $224. From late March to mid-April, the price went up by almost 30%. By mid-April 2021, Monero's trading volume managed to surpass $1 billion. This put the coin in some of the most favourable conditions it has ever been in.

The second part of the year has been progressing in a lower price range, albeit with some notable price spikes: $338.69 (24 August), $316.48 (6 September), $295.78 (7 October), $292.22 (26 October), $286.39 (11 November). By the very end of the year, Monero traded at around $215. As for Monero's early 2022 performance, it experienced a massive dip in value ($144.48) and is now recovering ($180.43).

And with all the basics covered, here's the Monero forecast.

Short-Term Monero (XRP) Price Prediction - 2022

The first Monero price prediction for today comes from TradingBeasts. As you'll see, most forecasts in this article don't promise huge price surges. The coin might even go into a mild downtrend, steadily losing value month after month.

|

Month |

Minimum Price ($) |

Maximum Price ($) |

Average Price ($) |

Change |

|

March 2022 |

153.243 |

225.358 |

180.286 |

-1.87 % |

|

April 2022 |

152.970 |

224.956 |

179.965 |

-2.05 % |

|

May 2022 |

152.462 |

224.209 |

179.367 |

-2.37 % |

|

June 2022 |

151.664 |

223.035 |

178.428 |

-2.89 % |

|

July 2022 |

150.600 |

221.470 |

177.176 |

-3.57 % |

|

August 2022 |

149.167 |

219.364 |

175.491 |

-4.48 % |

|

September 2022 |

147.358 |

216.702 |

173.362 |

-5.64 % |

|

October 2022 |

145.200 |

213.530 |

170.824 |

-7.02 % |

|

November 2022 |

142.491 |

209.546 |

167.637 |

-8.76 % |

|

December 2022 |

139.334 |

204.903 |

163.922 |

-10.78 % |

But if we step away from this conservative view on Monero's future, we might see a bigger potential in one exciting development. Since its inception, Monero has struggled to implement atomic swaps, but it's rumoured that atomic swaps between BTC and XMR will be released very soon.

Developers might finally resolve the unique problem in the protocol design that stemmed from Monero's privacy features. As a result, this change will build a bridge between the two blockchains and increase the user base for both.

The beauty of the Monero protocol is that it's still quite new and can be easily optimised. It's also quite flexible in its architecture. Implementation in other wallets or decentralised exchanges will not only be simple but also drive the price up.

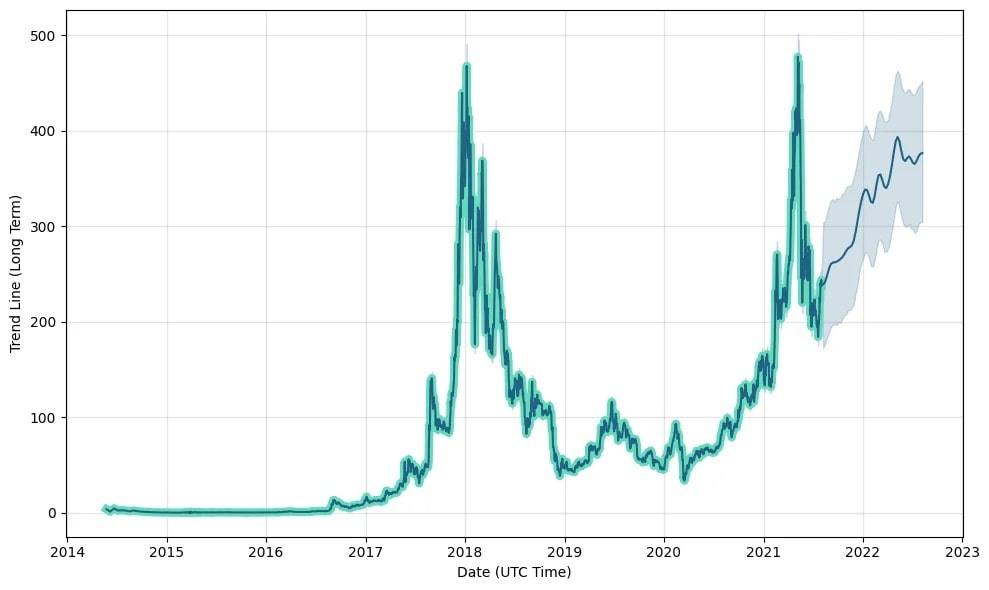

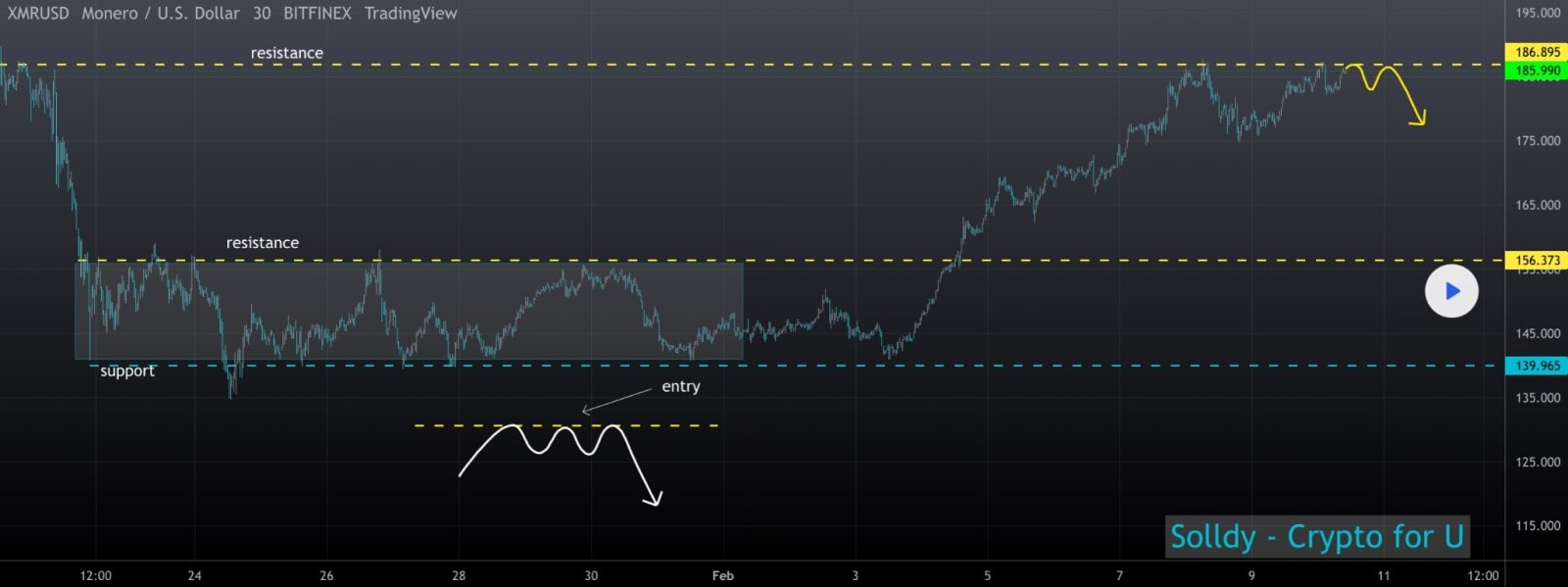

Take a look at the Monero prediction chart for a general idea of where the asset might go.

The table below is a shortened version of the PricePrediction.Net forecast for 2022. Compared to the 2021 figures, there's an increase in average price. Throughout the year, XMR might go from around $198.69 in January up to $251.71 by December.

|

Month |

Minimum Price ($) |

Average Price ($) |

Maximum Price ($) |

|

March 2022 |

189.59 |

198.69 |

206.05 |

|

April 2022 |

195.55 |

204.65 |

215.99 |

|

May 2022 |

201.69 |

210.79 |

226.22 |

|

June 2022 |

205.90 |

215.00 |

234.65 |

|

July 2022 |

212.02 |

219.30 |

243.25 |

|

August 2022 |

220.79 |

228.07 |

254.22 |

|

September 2022 |

225.36 |

232.63 |

263.34 |

|

October 2022 |

234.66 |

241.94 |

274.97 |

|

November 2022 |

239.50 |

246.78 |

284.65 |

|

December 2022 |

244.44 |

251.71 |

294.52 |

Monero Price Forecast for 2023-2025

Long Forecast shared their Monero price prediction for 2023. This time, we see bigger fluctuations not only over the year but also within certain months. May might be one of the most interesting periods, where long-term investors might be tempted to panic-sell.

|

Month |

Open ($) |

Low-High ($) |

Close ($) |

Mo,% |

Total,% |

|

January 2023 |

162 |

162-201 |

188 |

16.0% |

28.8% |

|

February 2023 |

188 |

188-224 |

209 |

11.2% |

43.2% |

|

March 2023 |

209 |

209-259 |

242 |

15.8% |

65.8% |

|

April 2023 |

242 |

196-242 |

211 |

-12.8% |

44.5% |

|

May 2023 |

211 |

211-262 |

245 |

16.1% |

67.8% |

|

June 2023 |

245 |

233-268 |

250 |

2.0% |

71.2% |

|

July 2022 |

250 |

250-310 |

290 |

16.0% |

98.6% |

|

August 2023 |

290 |

287-331 |

309 |

6.6% |

112% |

|

September 2023 |

309 |

309-378 |

353 |

14.2% |

142% |

|

October 2023 |

353 |

353-438 |

409 |

15.9% |

180% |

|

November 2023 |

409 |

374-430 |

402 |

-1.7% |

175% |

|

December 2023 |

402 |

391-449 |

420 |

4.5% |

188% |

The 2025 forecast is taken from PricePrediction.Net. It predicts a good deal of upward movement, from $591.44 to $842.52.

|

Month |

Minimum Price ($) |

Average Price ($) |

Maximum Price ($) |

|

January 2025 |

535.11 |

591.44 |

608.33 |

|

February 2025 |

580.73 |

603.26 |

631.99 |

|

March 2025 |

599.23 |

627.39 |

656.12 |

|

April 2025 |

611.78 |

639.94 |

681.22 |

|

May 2025 |

630.98 |

659.14 |

713.21 |

|

June 2025 |

650.75 |

678.91 |

739.58 |

|

July 2025 |

677.91 |

706.07 |

766.74 |

|

August 2025 |

711.78 |

734.31 |

802.04 |

|

September 2025 |

741.16 |

763.69 |

838.76 |

|

October 2025 |

771.70 |

794.23 |

876.94 |

|

November 2025 |

803.47 |

826.00 |

916.65 |

|

December 2025 |

814.36 |

842.52 |

949.69 |

Bear in mind that these are not the highest figures circulating online. The table above is just one example that doesn't necessarily show off the asset's full potential. At the same time, it's not giving traders false hope.

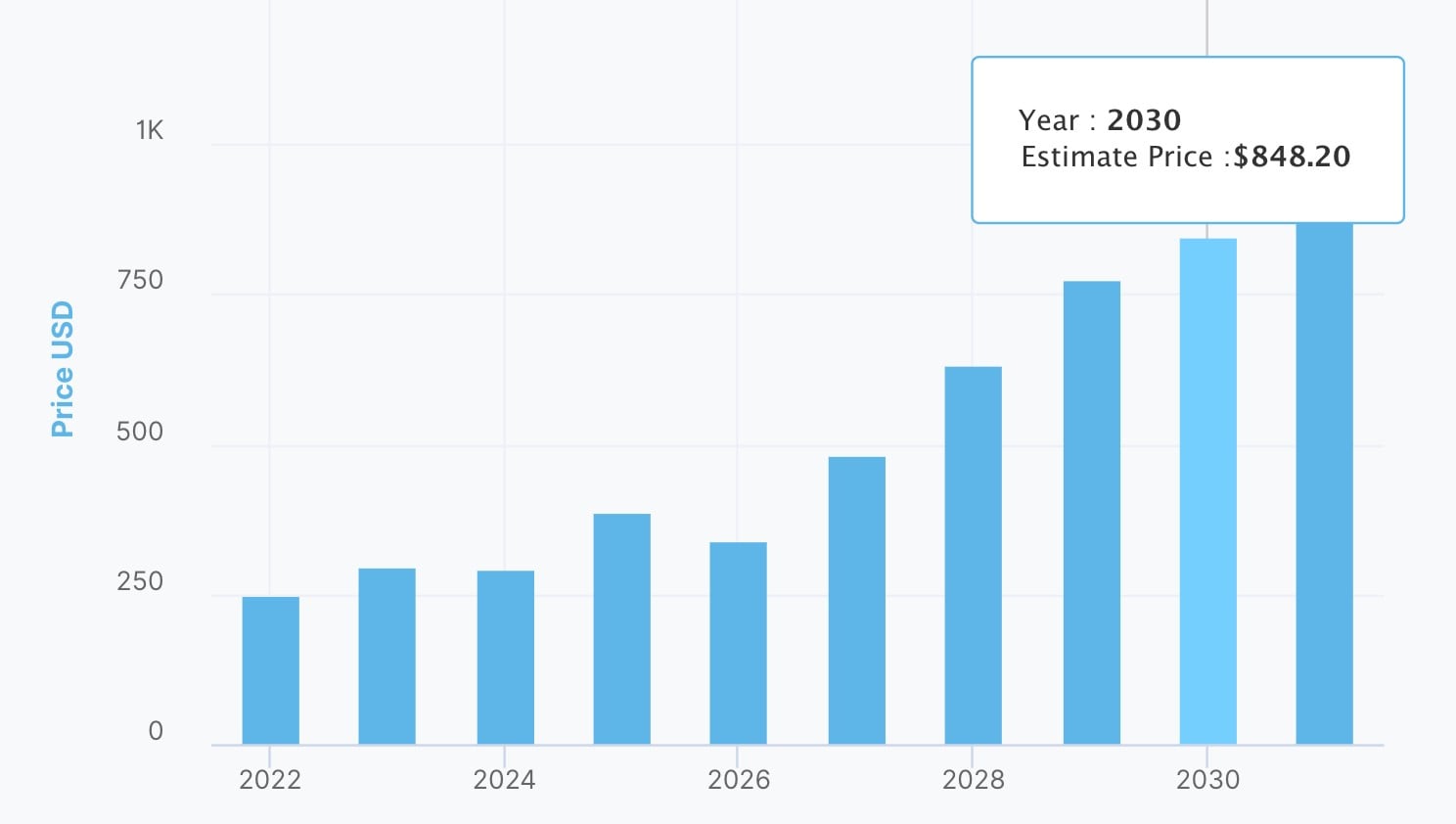

Long-Term Monero Price Prediction - 2030

The graph below pieces together all the predictions we've covered so far. It shows Monero's general direction from 2022 to 2030 and beyond.

The final Monero forecast comes from PricePrediction.Net and puts the asset at an impressive mark above $5,000. But remember that looking so far ahead into the future may not give accurate results. The long-term predictions suggest rather than tell what may be.

|

Year |

Minimum Price ($) |

Average Price ($) |

Maximum Price ($) |

|

2030 |

5,003.31 |

5,147.80 |

5,936.56 |

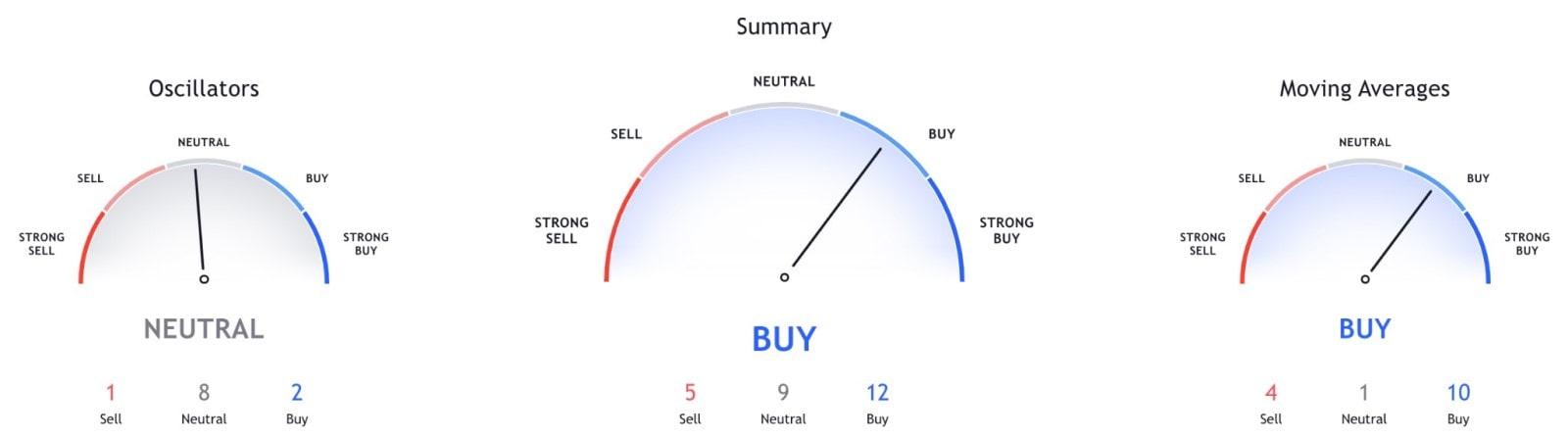

Technical Analysis of Monero

The first thing in technical analysis is to look at larger timeframes and gauge the bigger picture. In previous sections, we already analysed the trajectory that Monero is following.

Then, you should incorporate technical indicators given their quantitative nature. Below are the summary and ratings from the most popular technical indicators: Moving Averages, Oscillators and Pivots.

Oscillators:

- Relative Strength Index (14) - 54.22 - Neutral

- Stochastic %K (14, 3, 3) - 33.04 - Neutral

- Average Directional Index (14) - 24.58 - Neutral

- Awesome Oscillator - 0.99 - Neutral

- Momentum (10) - (−5.21) - Buy

- MACD Level (12, 26) - 1.91 - Sell

Moving Averages:

- Exponential Moving Average (50) - 173.67 - Buy

- Simple Moving Average (50) - 172.42 - Buy

- Exponential Moving Average (100) - 169.89 - Buy

- Simple Moving Average (100) - 159.88 - Buy

- Exponential Moving Average (200) - 175.67 - Buy

- Simple Moving Average (200) - 175.74 - Buy

Now, let's take a final look at the Monero chart. We can tell that Monero is working its way up to catch up with its previous all-time high.

Traders and Advisors on Monero's Future

Not many people are vocal about their Monero price predictions, which is a shame. Our quest has led us to several prominent online figures whose views on XMR's future we'll share here.

Crypto advisor Bernd Schmid thinks that Monero's strength is that XMR miners will always be rewarded by the network itself rather than by the transactions. He also strongly believes that Monero could become a cash replacement thanks to its excellent protocol.

Motley Fool contributor Chris MacDonald compares Monero to Bitcoin. Although the coin prices are nowhere near each other, he views Monero as the next iteration of Bitcoin.

Crypto rating and news portal Weiss Research rates Monero as B-, its technology and adoption as C+ and market performance as B-.

Is Monero Better for Investing or Trading?

Monero's circulating supply is smaller than BTC's, potentially giving it better investment prospects. If you also take into account the attractiveness of full anonymity for users, there are very good reasons to look into investing in Monero.

With that said, long-term investments are not sure bets. The market could crash for various reasons, and projects could go bust. If that's something that concerns you, there are other ways to take advantage of blockchain technology besides investing directly in cryptocurrencies.

One solid option is to buy crypto CFDs. With CFD trading, you're not solely reliant on the rising trend. You can also trade on volatility, with interchanging upward and downward movements. On top of that, you can use leverage and deposit a small percentage of the trade's total value.

If you're not sure about the whole process, try a demo account on Libertex. Crypto trading beginners can gain experience and knowledge, while professionals can test out new strategies or a new market risk-free.

If you want to go over the main points about Monero predictions, take note of the following questions.

FAQ

Is Monero a Good Investment in 2022?

Some say that Monero won't reach, let alone break above, the $500 mark. But even with the most conservative forecasts, the crypto asset is expected to appreciate, especially when BTC-XMR atomic swaps come into effect.

Is Monero Worth Buying?

Yes, technical and fundamental analysis, investor sentiment and upcoming projects give us reason to believe that Monero's will go up. The question is, by how much. Please remember that every investment carries a degree of risk.

What Will Monero Be Worth in 2025?

The Monero forecast by PricePrediction.Net puts Monero around$500-$800by 2025. There are even more optimistic opinions projecting it to be way in the thousands.

What Will Monero Be Worth in 2030?

Based on the Monero price prediction provided by Coin Price Forecast, XMR might surpass $5,000 by 2030. If you think that the outlook is far-fetched, let us remind you that the asset has recently more than doubled in price in just a few months.

Can Monero Overtake Bitcoin?

Looking at the market capitalisation difference alone, there's no way Monero will surpass Bitcoin in the near future. And while anything can happen in the crypto world, BTC's leading position is fairly secure. However, that doesn't mean Monero won't make it big.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.