Everything You Want to Know About Social Trading

What Are the Basics of Social Trading?

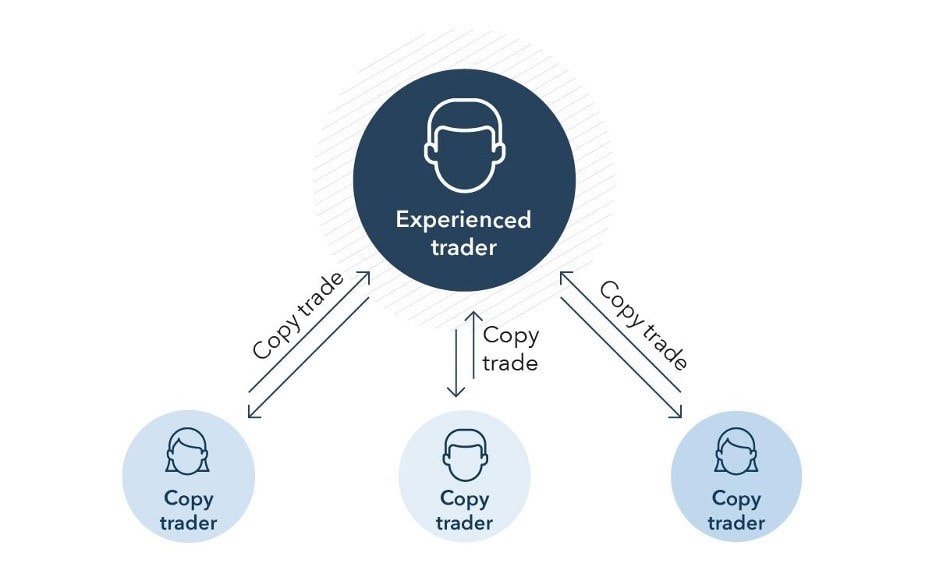

Social trading is a trading method where investors can observe their peers or expert trading behaviour. The technique allows beginners with little to no prior knowledge to learn trading strategies using copy trading or to follow a mirror trader.

What Is Copy Trading And Why Do Traders Use It?

The actual method varies depending on the platform used, but the basic principle remains the same:

- Trade according to the scheme of your chosen trader.

- Copy their trades in a percentage-based manner.

Most sites do not allow you to invest any more than 20% of your portfolio with a single trader, which is a great policy to prevent you from losing too much if said trader hits a bad streak.

There have been a few studies done on this tactic to measure how successful people are when using copy trading. Results show that those who invest in carefully chosen traders based on previous statistics and portfolio experience up to 10% more success than people who choose traders based on personal preference or trade manually.

Copy trading is a great method that enables beginner traders since it allows you to dip into trading using the experience other traders have.

How Are Copy and Social Trading Different From Each Other?

Social and copy trading share the same basis but differ in many ways. Copy trading is a part of social trading but not vice versa. In fact, copy trading is a very strict type of social trading where your trading account is bound to another trader's account. Their trade and decisions are reflected in your trading account. Their profits and losses are shared with you, and your trading account changes in the same way theirs does.

Your trading account automatically changes depending on the trader you follow, and you do not have the choice to make any trades or changes. The only change you're entitled to is to stop following the trader. In its simplest form, copy trading means your trading account mirrors each move the other trader makes – hence the name!

Social trading differs because not all types of social trading allow someone else to manage your trades. Instead, you can use information from other traders you follow to base your investing decisions on, meaning the ultimate decision is yours.

How Do You Use Social Trading?

Social trading is quite similar to social networking that you probably already use, but the information you come across is more deliberate and directly useful. You will still come across trading topics, but the platform is lively and easy to be part of. You are quickly connected to traders on the network and can trade in collaborations with them or use readily provided information to improve your trading strategies.

If you come across a trader whose advice you appreciate, you can follow them. Following them gives you access to their moves, comments, and updates, allowing you to learn from them in real time. If they make a trade you are unfamiliar with; you can easily ask them to explain the process and how their idea will play out.

Other than commenting on their profiles, you can also privately message traders when you want to learn more about different strategies. Once you are more skilled, you can help fellow traders on the same platform.

Why Is Social Trading So Popular?

The method's popularity stems from the unique access new traders have. Social trading platforms cut down on the time spent searching the internet for trading information by giving you access to expert traders you can interact with.

Getting access to their techniques also means you do not have to spend money on tutorials. These platforms allow you to earn while you're still learning which strategies work, and in time, you can build a community of investors that you trust.

What’s an Example of Social Trading?

The above terms may be difficult to conceive without being an active part of the process, so let's look at an example:

Let's say there was a domestic market crash in Brazil around the time you wanted to get some exposure to the Brazilian real. This is the first time you are attempting to understand local economics, banking policies, and politics with the aim of coming to an informed investment decision. You turn to a trading platform and look for traders who are talking about trading with Brazilian real and either follow, get in touch with them, or both. You use this opportunity to learn market sentiment. This is what social trading is all about.

Let's say you want to begin trading sooner rather than later. Instead of following traders to watch their strategies, you choose to copy trade with a trader whose methods work for your local market.

How Do You Copy Trade?

Copy trading connects part of your portfolio (usually up to 20%) with a trader's portfolio. As soon as you do, their opened trades get copied to your trading account, and their future actions are automatically copied onto your trading account. Most times, your trading account does not contain the same amount as the traders, so the trades are made as percentages of each other instead of actual amounts.

For example, let's say you invested $100 in your trader, which happens to be 10% of their portfolio. If they then invest $200 somewhere else, you will make the same trade but with only 10% of that amount, which comes to $20.

The method can be intimidating, but once you understand the patterns, it can be a very successful approach to trading. Since you're not actively trading, you can focus on learning while making some money. Each time they make a good decision, you benefit from it in knowledge and in funds. Just be sure to choose a reputable trader.

You Can Copy The Traders Experience

Copying a world-leading trader may be the best way to learn as a beginner. The process is the same as above, but the people on the platform are different. Since you may not have a lot of prior trading knowledge, you are investing in people who make good decisions instead of stocks.

Traders are experts in reading the market's implied volatility (VIX) and saving their commodities from a bearish market. They may not have as much time to reply to questions you have, so you'll need to pay attention to how they trade and why it was a good choice. They also make the kinds of investments that require constant attention (as they are usually high risk, high reward).

What's great about the technique is you're in the middle of the action without having to study technical analysis or fundamentals. If you're quick to learn and good at reading profiles, it's a method that might work for you.

What Are Some Social Trading Types?

- Copy trading is the most used social trading on Forex's Meta Trader 4 (MT4) platform, but it's not the only one:

- ● Tips/signals: the easiest way to find information or strategies is to find tips across the platform. The advice is usually free-floating instead of targeted to a specific audience, but still helpful.

- ● Profiles and forums: Forums allow traders of all experience levels to share information or to get to know one another. Good platforms can provide full profiles with details on other traders' styles.

- Bots: most platforms allow you to use customisable trading bots, so you do not need to monitor trades at all times. You can use autochartist to monitor trends in Forex.

What Are the Pros and Cons of Social Trading?

Now that we've covered the various terms, let's talk about some advantages and limits to social trading.

Potential benefits of social trading:

- Earn while you learn. It is possible to make money by following or copying others and increase your capital quickly.

- Awareness of market sentiment. You can see market movements both as a newbie and also through the eyes of an expert. You get to immerse yourself in the market and quickly get information not accessible elsewhere.

- Take your time back. By creating quick access to experts, you save time on combing the internet for these tips and can spend your time doing something else.

- Diversify your portfolio. Getting access to different traders (and investing in traders rather than stock).

Drawbacks of social trading:

- Little to no agency. If you rely on social trading, you are relying on other people's experience and skills to make trading decisions and then cross your fingers to hope it was a good decision. If you copy trade, you have no say in where the trades are made even if you know they might be bad trades which is a large drawback of social trading.

- Constant monitoring. As with most techniques, you need to constantly monitor the market to know what is happening. This is true even if you're copy trading, as it's a good idea to know what the traders you entrust with a part of your portfolio are actually doing.

Social Trading: Fundamental and Technical Analysis

Technical analysis refers to the process of analysing data to allow you to make good predictions about an asset's future price movements. The method is based on the asset's past movements that show hints of how it will do in the future. That also means you need to know what you're looking at for the information to be useful to you. You'll need to be able to read and interpret charts and patterns and move from there.

Fundamental analysis goes deeper than looking at previous past movements. The analyst's aim is to determine the actual intrinsic value of the commodity. Any factor that can provide a specific inducement to the asset and its price is taken into consideration: the company's revenue,CFD*, NFA, profits, etc. Their idea is that the general price of an item does not always reflect the intrinsic value.

Each of these techniques takes some time to learn and then more time to dive into each commodity before engaging in a trade. So why are we talking about this? You need to understand these methods in order to understand how the traders make decisions, especially if you are using someone else's advice instead of copying their trades. Knowing how fundamental and technical analysis differs from one another will also help you evaluate different traders. Whichever analytical method you choose to adopt, learning about the pros and cons of each is a good idea.

*Please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital.

Managing Risk While Social Trading

Risk management is an important factor to consider while trading. In most cases, your money management is closely tied to risk management and leads to successful trades. Risk management is a set of rules that you set to help you determine whether a situation is risky or not. Good risk management is the root of responsible trading.

- Understanding risk: Studying short-term and long trends can help you evaluate what is low or high risk. The mood of financial markets can definitely change at any moment, but studying previous trends can help you gauge how the price changes at least within the next few hours.

- Mitigate risk: Diversifying your portfolio means you invest in different fields and trades. Each new trade improves your chance of success but also prevents you from losing too much if one of your fields hits a bad streak.

In Conclusion

Sharing information on platforms and learning from experts is just the beginning of social trading. Now that you've read this article, you are almost ready to put this knowledge to the test. You can test your skills using a Libertex demo account to try different techniques before you begin live trading. A Libertex demo account allows you to try the statistics without risk.

FAQ

How Do You Copy Trade in Social Trading?

When you copy trade, you link your trading account with a trader's account that you found on a social trading platform. Once you are bound to them, their actions are reflected on your trading account. Their wins and profits are yours, as are their losses. Most platforms allow you to trade only up to 20% of your portfolio, so you do not lose all of your assets if the market is bearish leaning.

What Does Copy Trading Mean?

As the name suggests, copy trading allows you to copy each movement made by another trader. This occurs after you connect part of your portfolio to theirs. This link allows your trading account to make the same financial moves as the other social trader, mimicking their trades, wins, and losses.

What Is the Best Social Trading Platform?

Traders use various platforms, depending on their trading style and frequency of trades, so the easiest way to determine the best one for you personally is to test it. Make sure the platform allows you to create a demo account, which means you can practice trading without the risk. This is perfect for enabling beginner traders or even experienced ones who want to try new techniques.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.