Dealing With Volatility: What Is the VIX Index?

So, what is the VIX index? Read on for detailed explanations.

What Is The VIX (Volatility Index) and How Does It Work?

It's also known as the Chicago Board Options Exchange VIX or the CBOEVolatility Index. The VIX is a real-time index that measures the amount of near-term volatility expected by investors from the S&P 500 (ticker: SPX) for the following 30 days. It's the first benchmark to quantify the volatility expectations of the market. With VIX, the speed of price changes in the market can be gauged as this volatility shows the fear and sentiment of traders and investors in the market.

The S&P 500 (SPX) represents the stock market itself or the market as a whole. On the other hand, VIX is referred to as implied volatility by many professionals in the market since it can track options where traders bet on future performances of various market indices. It's available on the exchange's website. The exchange also tracks the VXN or the volatility on the Nasdaq 100 Index and the VXD or the volatility on the sector-specific Dow Jones Industrial Average.

Real-World Example of the VIX Index

One fear among investors is the volatility value, which is always inversely connected to market movement, whether it falls or rises. Volatility measures the magnitude of price movements in a certain period. With a higher quantity of rapid changes, the higher volatility is, the less calm the market will be.

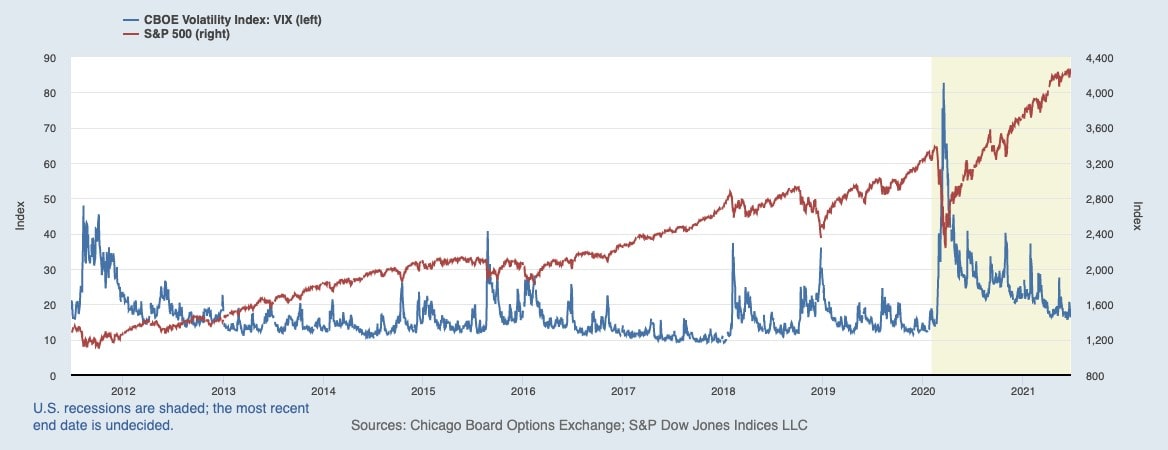

Below is a real-world example of the VIX and S&P 500 on a chart:

The red line in the statistically-based graph represents the S&P 500, while the blue line is the VIX index. In this real-world comparative example, which shows data from 2012 up to the present, you can see instances when the line for S&P 500 or the market spiked, which then resulted in VIX values dropping at the same time, as shown by the line on the chart.

Background: How Was the VIX Index Created?

The volatility index, or VIX, is famously known as the Chicago Board Options Exchange's volatility index. Before that, the origins and ideas about VIX and its creation started with the financial economics research of two partners, Dan Galai and Menachem Brenner. In 1989, they proposed the methodology for volatility indices, from indices about the stock market's volatility to interest rates, and even up to volatility of foreign exchange rate globally. They proposed that these be updated frequently.

In 1992, Bob Whaley was hired by CBOE. He calculated the volatility values using the proposed papers and provided computations for the initial VIX levels. The developed formulation provided a way to measure the market volatility from which future volatility might be expected. Currently, the VIX index value quotes the change in the S&P 500 index for the next 30 days.

VIX Formula: How Is The VIX Index Calculated?

VIX is computed from the live pricing of S&P 500 options, which include the standard CBOE SPX options that expire every third Friday of the month and the weekly CBOE SPX options, which expire every Friday. For a price or value to be considered for calculating the VIX index, the option must expire in 23 to 37 days.

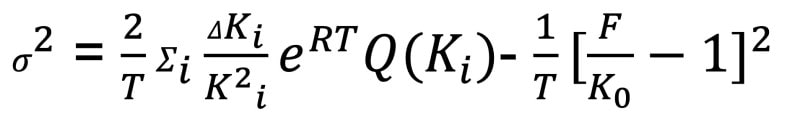

This is the formula provided by CBOE to calculate the VIX:

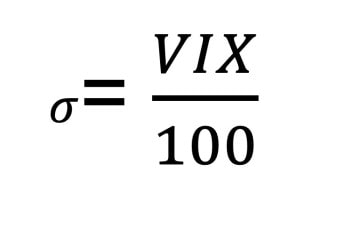

And

Where,

- T is the time to expiration

- F is the Forward index level derived from the index option prices

- K0 is the First strike below the forward index level (F)

- Ki is the Strike Price of the out-of-the-money option

- ΔKiis the interval between strike prices and is half the difference between the strikes

- R is the Risk-free interest rate to expiration

- Q(Ki) is the Midpoint of the bid-ask spread for option with strike

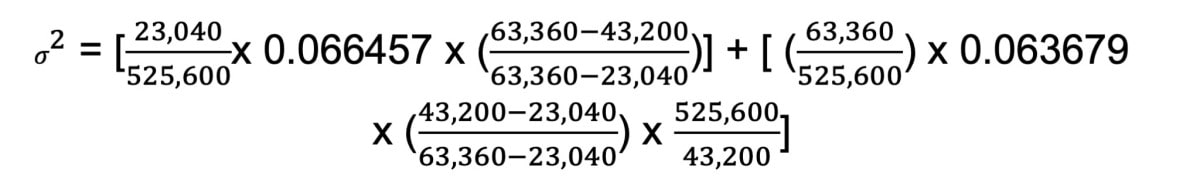

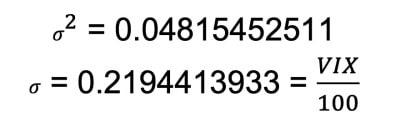

However, this formulation is too complex for people to use, especially for those who are not good at maths. To help you understand how the calculations work, let's use some specific values:

| VIX = 21.94 |

These values are included in the first square bracket:

- 525,600 is the number of minutes in a year, 365 days.

- Assuming that the VIX calculation time is 9:30 am and the time to expiration for a 17-day option, also expressed minutes, is equal to the number of minutes between 9:30 am today and 9:30 am on the settlement day. Excluding the time between midnight and 9:30 am of the two dates, the number of days to work with is 16 days. In minutes, this is equal to 16 days x 24 hours/day x 60 minutes/hr, 23,040.

- Using the same method to get the time to expiration for a 45-day option, it'll be 44 days x 24 hours/day x 60 minutes/hr, which is then equal to 63,360.

- The 0.066457 value in the equation represents an assumption of the volatility of the option.

- The last value, 43,200, is the number of minutes in 30 days since VIX uses a weighted average of options with a constant maturity of 30 days of expiry.

Moving on to the next bracket, it includes all the same values from before except that the flow of calculation is different and the volatility of the next term option to be used is assumed to be 0.063679.

Using these values, the calculation is made as follows:

- First, the number of minutes equal to the first term option, the 17-day option, is divided by the total number of minutes in a year.

- The value obtained from the first step will then be multiplied by the assumed volatility of the option.

- The number of minutes for the next term option, the 45-day option, will then be subtracted by the total number of minutes in 30 days. This value will be divided by the value obtained from subtracting the number of minutes of the first option from the number of minutes in the second option. The final value will then be multiplied by the value obtained from Step 2.

- Setting aside the final value from Steps 1 to 3, the focus now will be on the second option.

- Starting again by dividing the minutes equal to that option to the total minutes in a year, the obtained value is to be multiplied by new volatility, the volatility of the second option.

- Instead of subtracting the minutes for the first and second options, in this step, the number of minutes for the first option will be subtracted from the number of minutes for 30 days. The value from this will then be divided by the value obtained from subtracting the number of minutes of the first option from the number of minutes in the second option. The final value from this step will be multiplied by the obtained value from Step 5.

- The last part is the division of the number of minutes for 365 days by the number of minutes in 30 days. This value will be multiplied by the value obtained from the previous step, Step 6.

- The final value from Steps 1 to 3 will be added to the final value from Steps 5 to 7. The square root of the value obtained from this operation will be multiplied by 100 to get to the final value, the VIX.

The Correlation Between the VIX Index and the S&P 500 and More

From the previous sections, the correlation of the VIX index and the S&P 500 is clear: they move relative to each other. From the sample chart above, you can infer that they have a strong negative correlation with each other.

The stock market's drop results in an increase in the VIX index. This could even be observed during the 1990s, where the correlation between the changes of the two reached -77%. Even a decade after that, it continued to gain strength and reached -81%. The tight correlation of the two allows people to trade the VIX. And this relationship has been consistent through the years, only changing within the ranges of -70% to -90%.

What Happens If the VIX Index Goes Down?

Remember that the VIX index is used to predict the volatility on a market level, so it indicates essential details about the market through its movement. The stock market fluctuates and rises gradually, and because of their correlation, the VIX will also decline or fall gradually. This results in low levels of volatility and complacency. When VIX is low, investors and traders are complacent, and protection isn't a priority for them.

When the CBOE Volatility Index is low, the fluctuations are also low. Hence, volatility is low, too. When volatility is low, the value doesn't change dramatically. This suggests that it would be a good time to sell stocks.

What Happens If the VIX Index Goes Up?

The opposite happens when the VIX index goes up. This would mean that there's great or high volatility and fluctuation of prices ahead in the market. This usually happens when the S&P 500 drops since they have an inverse relationship with one another. Traders and investors tend to overreact when the market declines. That's why the VIX is also referred to as the fearbarometer of market participants.

When the VIX spikes when the market is under stress, it can be used as a signal that the market is oversold and that the market is more than likely to move higher. When the VIX rises, investors usually consider shifting their portfolios to assets that seem less risky, such as bonds.

Trading the VIX Index

The VIX-linked index is used by many for trading due to its very characteristics and correlation with the stock market. Traders and investors include VIX-basedinstruments in their choices for hedging, pure speculation and diversification. When they take positions on the VIX, it's possible for them to balance out their stock positions in their portfolio and hedge their exposure in the market.

There are five major steps for how you can trade the VIX:

- Research and understand the VIX index, i.e., how it works and how to calculate it.

- Understand VIX values.

- Decide if you'll spread bet or trade the CFDs.

- Choose if you'll go long or short on the VIX.

- Create a live account or practice through a demo account.

Step 1. Research and Understand the VIX Index

There are a lot of things you need to research and understand for this first step. You mustn't skip this step since it's an essential part of how you can trade VIX.

The VIX tracks the price of S&P 500 options and not the stock market itself. These options are contracts that obtain their prices from the Standard & Poor's 500 (S&P 500). Traders are given the right to trade the S&P 500 at a set price and before a set expiry date.

You may encounter a call option or a put option. The call option will allow you to buy the S&P 500 at a specific price, while a put option will allow you to sell the S&P 500 at a specific price. These prices are called strike prices.

In addition to options, you must know how the VIX is calculated. A detailed explanation of how you can calculate the VIX is given above. Although the formula involves complex mathematics, it's good to know how the future volatility of the S&P 500 is estimated or predicted.

Step 2. Understand VIX Index Values

We've previously explained the strong correlation between the VIX and the S&P 500. When one goes up, the other goes down. And when the VIX declines, the S&P 500 will likely be stable and cause no stress for traders and investors. However, it doesn't always mean that trading volatility is a market downturn since the probability of low volatility during a decline in the market is high.

Over the past years, if the VIX traded below 20, the market was stable. But when it reached 30 or higher, it meant volatility was high.

Step 3. Spread bet or Trade CFDs on the Volatility Index

You have two choices: To spread bet on the VIX or perform CFD trading on the VIX. Spread betting involves betting on the direction the volatility levels are heading in. The further the VIX moves in your predicted direction, the higher potential profit you may gain. As it moves away from that, you can possibly lose more. Additionally, your potential loss or gain will depend on the size of your bet at each point of movement.

CFD trading on the VIX, on the other hand, is equivalent to agreeing in an exchange-traded method. This is agreeing to exchange the difference between the prices from opening the position and closing it. The conditions of this method are similar to spread betting. The more the VIX moves in your predicted direction, the more potential profit you can get, and vice versa.

Step 4. Go Long or Short With the VIX Index

Opening a position on the VIX will give you two basic options: long or short. Don't forget that volatility traders don't care if the price of the S&P 500 will rise or fall since they can capitalise on either way. They're interested, instead, in whether or not the market is volatile. The position a trader takes depends on what the expected volatility level is.

Going Long

Going long on the VIX means that you believe that volatility will increase, and so, the VIX will, as well. This is a popular position for traders, especially during financial instability when the market is full of uncertainty and stress.

For example, if you predicted or expected that the S&P 500 is going to have a major and rapid decline after a political announcement, you're likely to take a long view of volatility. To do this, you just have to open a position you can use to buy the VIX. If there is indeed volatility and your prediction is right, you can gain potential profit. But, if there's none and you take a long position, you're likely to suffer potential losses.

Going Short

Taking a short position on the VIX means that a trader expects a rise in the value of the S&P 500. This is a popular idea, especially when interest rates are low, the economy is growing reasonably, and volatility across markets is low.

For example, S&P 500 constituents' share prices grow steadily from a combination of low volatility and high growth in the economy. You can choose to go short while expecting that the stock market will continue to rise as volatility remains low. If this happens, you can expect that the VIX will move lower, and you can get potential profit. However, shorting volatility is risky since you may encounter and suffer lots of potential losses if volatility spikes.

Step 5. Live Account or Demo Account When Trading the VIX Index

After all the previous steps, you can now try to trade the VIX index. You can do this by creating and opening your own live trading account. In this kind of account, you can choose the type of trading you prefer. However, remember that you can lose or gain money or funds with a live account. If you don't want to try to avoid losing funds, you can opt to practice trading the VIX in a demo account where you can generate personalised strategies.

Key Points About the Volatility Index

The VIX indicates various things in the markets. Even if it's simply a prediction of what volatility is expected in the market, it's important that you know how to apply it in practice. Here are some key points regarding the VIX:

- The VIX is a great and sound measure of risk in the market for equity traders. It can give them and short-term traders ideas and estimates about the possible movement of volatility in the market to use in their strategies. In addition to that, intraday traders can reduce their leverage or increase their stop losses when volatility is likely to spike.

- Long-term investors can also utilise the VIX as indicators even if they're not usually bothered by some short-term volatility. But they can also use the VIX to increase their hedges in the form of puts when the VIX is likely to show a rise in volatility.

- As mentioned, the VIX can also be used as an indicator in options. If there's a possibility of volatility rising, options tend to be more valuable, and buyers stand to potentially gain more. When the opposite happens, sellers have more potential to benefit.

- When trading on volatility, you can buy futures on the VIX index itself to benefit from it and not worry which direction the market will move in. You can do this instead of buying straddles or strangles since they cost too much when volatility is rising.

- Portfolio and mutual fund managers view the VIX as a valuable tool. When the VIX peaks, they can increase their high beta portfolio exposure and add on to low beta stocks if it bottoms out.

Conclusion

The VIX index is beneficial if used and applied correctly. By knowing about and understanding it, you can start practising how to trade the volatility index. The best way to do this is using a demo account from Libertex. With the Libertex demo account, you can experience trading the VIX in a simulated setting similar to trading in a live account without the risk.

FAQ

What Is the Volatility Index?

The Volatility Index or the VIX is an index from CBOE. It's used to measure and predict the level of volatility on the S&P 500 for the following 30 days. It's perceived by many as an indicator of when traders and investors can make bets about future market performances.

How Does the Volatility Index Work?

The Volatility Index has a negative correlation with the S&P 500. When the latter spikes up or moves higher, the VIX will decline. This will indicate that you can expect low volatility. And the opposite applies when the S&P 500 declines. Additionally, the VIX works based on a standard deviation formula and is a derivative from the theory developed even before the CBOE began to use it.

How to Invest in the VIX Volatility Index?

The best way to invest in the VIX is to trade. As with other assets, trading the VIX can lead to potential gains or losses. However, you can take advantage of it and possibly gain profit when used correctly.

What Does the VIX Index Tell Us?

The VIX is a real-time volatility index, and it quantifies the expected market volatility. However, this is forward-looking and only shows predictions of the volatility of the S&P 500 for the following 30 days. To put it simply, when its value rises, the S&P 500 is likely to decline, and vice versa.

What Does It Mean If the VIX Index Is Down?

It means that the S&P 500 is rising or moving higher gradually. This also means that the value of the VIX is declining. When it does, you can expect stability and low volatility on the S&P 500.

What Does It Mean If the VIX Index Is Up?

If the VIX is up, its value is increasing. An increased value means that there's increased volatility, and the S&P 500 is likely to be declining. This also shows fear among traders and investors since there's high volatility, and there may be rapid price swings.

How Do You Analyse the VIX Index?

Analysing the VIX index is simple and can be done by observing the index. If you see the VIX declining, volatility is low, and if it's rising, volatility is high. However, if you prefer using an advanced and complex method, you can try calculating the VIX.

Should I Buy When the Volatility Index Is High?

When the VIX is low, it may be a good idea to sell stocks. When the VIX is high, it might be a good choice to buy if you're bearish on stocks. However, remember that a high VIX value means that volatility is also high

Why Does the VIX Index Go Down When the Market Goes Up?

The correlation between the VIX and the S&P 500 or the market is clear as they move relative to one another. They're negatively correlated. That's why when the market spikes, the VIX declines. Also, when the market goes up, it increases gradually. Hence the price fluctuation isn't much, resulting in low volatility and the VIX going down.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.