Types of Orders: Perfect Entry and Limited Loss

Let's learn how they can help you trade in the market.

What Orders Are and Why Use Them

Simply stated, an order is an act of buying or selling a security. You know the phrase 'place an order,' which means to make an action with security in the market.

If you trade in the forex market, you do so via a broker. So, placing an order means giving special commands to your broker via a trading platform. You can either place an order right away or wait for better conditions. This is where different types of orders appear.

Placing an order means giving special commands to your broker via a trading platform.

However, the order doesn't only relate to the opening of a position. Through an order, you can exit the market or limit your losses if your trade moves in the opposite direction you expected. Let's consider each possible type of order.

Order Classifications

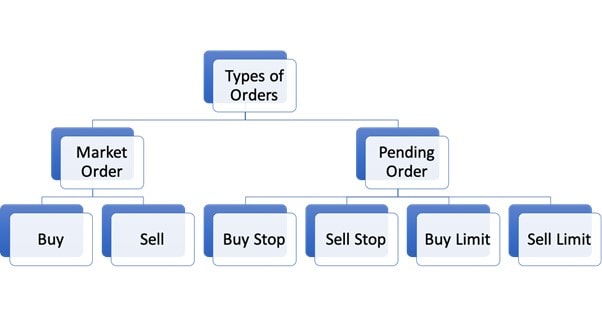

We'll start with the main order type classification. In the picture below, you see that there are two primary groups: market and pending orders.

Market Orders

A market order is the most frequent order type that you have already used if you tried to open a position. This type includes buy and sell commands. The market order occurs when you open a position at a current market price, whatever it is.

Market orders are immediate orders.

At the same time, if you've ever opened a trade, you saw that the price at which you opened it differed from the one at which you intended to open your trade. This happens because a broker takes a commission or so-called spread. So, if you're buying, the price at which your trade opens will be higher than the market price. If you're selling a security, your trade will be executed at a lower price.

Moreover, there's a risk that if you trade a highly volatile security, even a second between the moment when you place an order and the moment when a broker executes it may cost you more than you expect. Market orders are correlated with slippage. Slippage is the difference between the desired price and the price at which your trade was executed.

Why do traders use market orders? There is a risk of getting an unfavourable price when placing a market order, but traders use them if they want their positions to be executed as soon as possible. Usually, scalpers and day traders use market orders. They monitor the market throughout the day and pick the best entry points. The speed of the order's execution is a part of their successful strategy.

Pending Orders

The next type is pending orders. This type is the complete opposite of a market order:

- The first and primary difference is that the order isn't executed immediately when you place it. This allows you to choose the perfect moment in the future when the selected security should be bought or sold.

- The second difference is that the order is executed at an exact price. That means there's no difference between the price at which you place an order and at which the order is executed.

- The third difference is not so noticeable but is crucial for busy investors. Pending orders allow you to choose the perfect entry point in advance. As a result, you don't have to constantly monitor the market.

- The last difference is that the order is executed automatically as soon as the price touches the selected price point.

Pending orders allow you to choose the perfect moment in the future when the selected asset should be bought or sold.

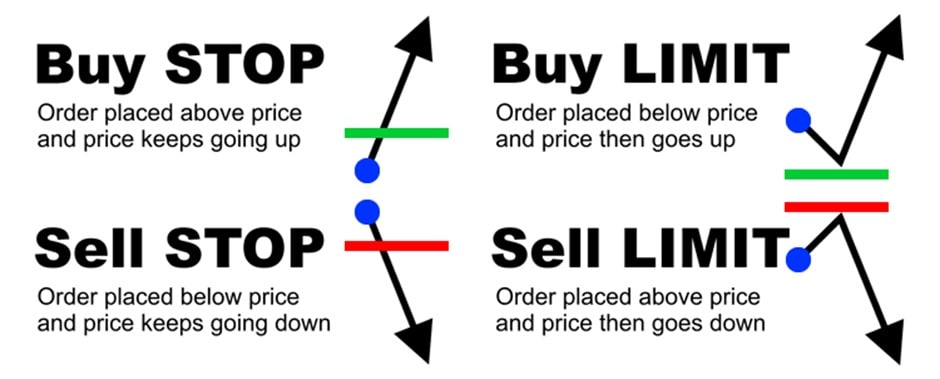

Pending orders are also used to buy and sell a security, but it's important to mention that there are four specific types. The picture below will help you understand the difference.

|

Type of Pending Order |

Explanation |

|

Buy Stop |

If you think the price will keep rising, you should place a buy stop order. The order is set above the current price. |

|

Sell Stop |

If you believe the downtrend will prevail, you should place a sell stop order. It's located below the current price. |

|

Buy Limit |

If, according to your forecast, the price should first decline and then rebound from a certain level and move up, place a buy limit order. The order will be located below the current price. |

|

Sell Limit |

If you see that the market is going to move up and then pull back to the downside, place a sell limit order. The order will be above the current price. |

A pending order is an excellent option if the current market conditions don't satisfy your trading strategy. Imagine you don't have time to sit in front of the monitor the whole day, but you believe that if the price matches several steps of your strategy, the perfect entry point will occur. Even if a pending order is not suitable for intraday traders, since they aim to play on fast market fluctuations, pending orders can become great assistance for longer-term trades.

Stop-Limit Order

A stop-limit order is another type you should be aware of. As you can understand from the name, it's similar to both limit and stop orders. When security comes to the stop price, a limit order is automatically triggered, and the asset is bought or sold at a target price.

A stop-limit order relates to both limit and stop orders.

If it sounds a little bit complicated, let's look at an example. Imagine you're buying Amazon stock. The current price is $2,900. However, you want to buy it only if the uptrend is strong. In this case, you set a stop-limit order to buy at the stop price of $3,000 and the limit price at $3,050. So, if the price breaks above $3000, the order becomes a limit order. As long as the price is below $3,050, the order can be executed. If the price moves above $3,050, the order won't be executed.

A disadvantage of the stop-limit order is that there is no guarantee it will be executed. So, why do traders use stop-limit orders? Stop-limit orders give control over trades. This type of order is mostly used to either limit losses or fix any profits that potentially arise.

Other Order Types

As mentioned above, there are other types of orders that aren't meant for opening a position. They are stop-loss and take-profit orders. Some traders forget about them when trading, but they're important concepts you should know about to limit losses and exit the market at the best point.

Take-Profit Orders

A take-profit order is at the level at which you would like to close your position. It's executed automatically as soon as the price reaches it. After that, your trade is closed. While market and pending orders are essential to place a position, a take-profit order isn't a must.

A take-profit order is at the level at which you would like to close your position.

Although a take-profit order can limit your potential profits, we recommend using it. Of course, if you plan to monitor your trade until it reaches a desirable point, you can avoid using a take-profit order. However, if there is a chance that you'll miss the moment when the trade turns against you, it's better to place it.

Stop-Loss Orders

Some traders also forget about stop-loss orders. A stop-loss order is at the level at which your trade is closed automatically if the price moves against your prediction. Stop-loss orders are even more critical than take-profit orders.

A stop-loss is at the level at which your trade is closed if the price moves against your prediction.

This type also has limitations. If you trade in a highly volatile market, a small stop-loss order can close your trade at an unfavourable price. After that, the market may turn around, and your prediction could be right. As such, if you don't fear highly volatile trades, you're better off placing either a significant stop-loss or not placing one at all.

How to Place Trading Orders: MT4 Guideline

No matter what kind of order you choose, it's placed in several simple steps.

Market Orders

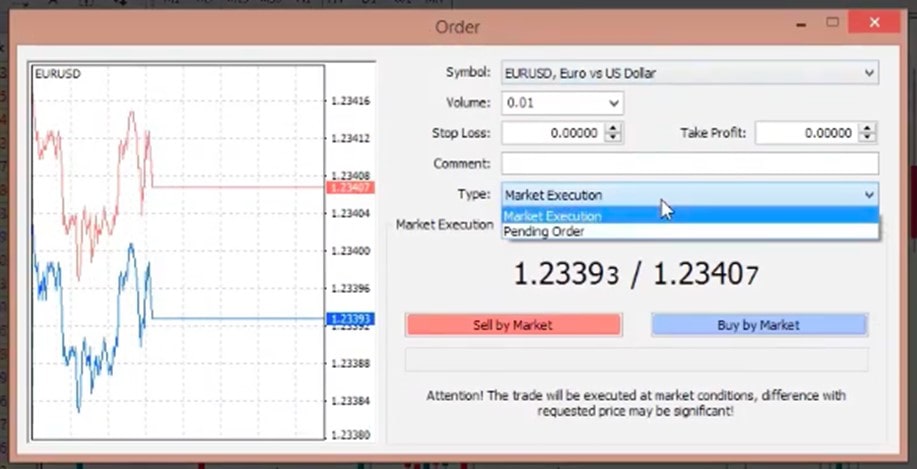

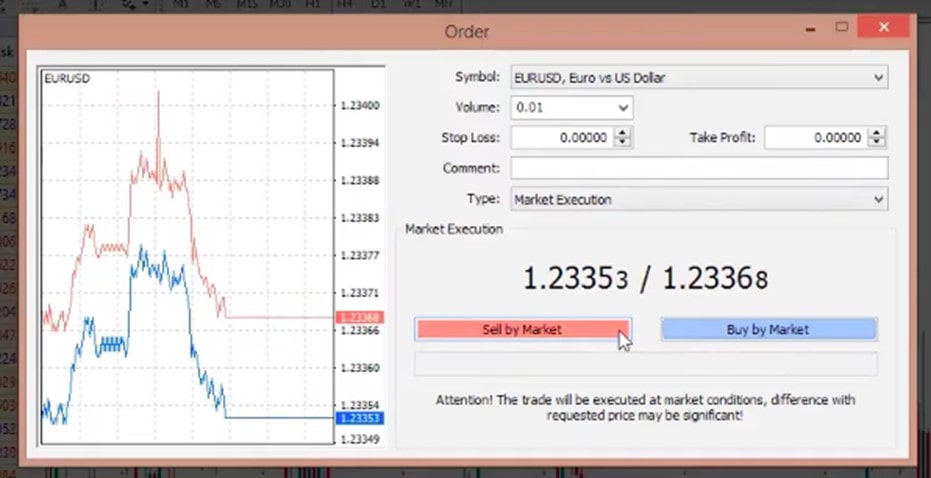

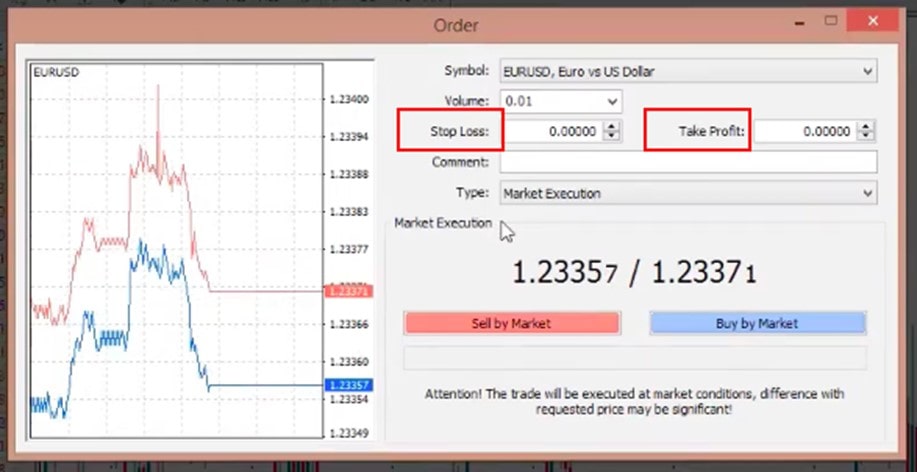

Step 1. Open the security you want to trade. In our example, we'll choose the EUR/USD pair. Click 'New Order.'

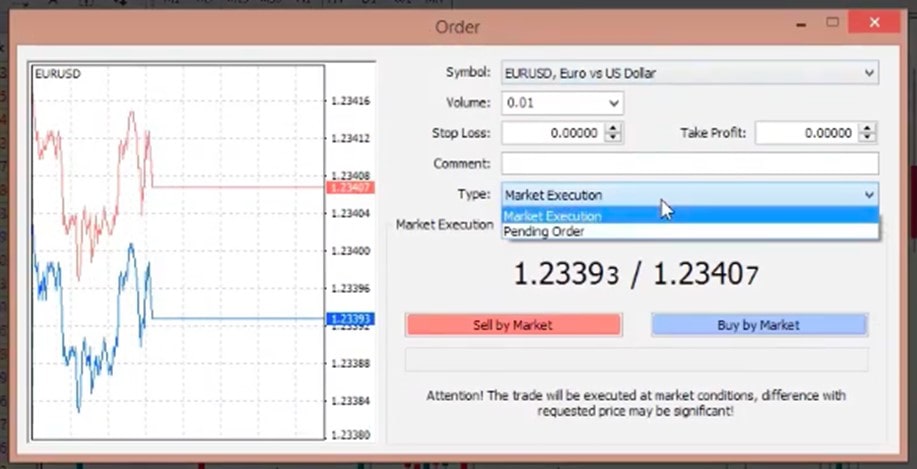

Step 2. Take a look at the 'Type' drop-down menu, where you'll find Market Execution and Pending Order.

Step 3. Market Execution order is set by default. To place a market order, just click buy or sell, and the order will be filled immediately.

Step 4. Here, you also see take-profit and stop-loss fields, where you can type the levels you have chosen.

Pending Order

The process is almost the same.

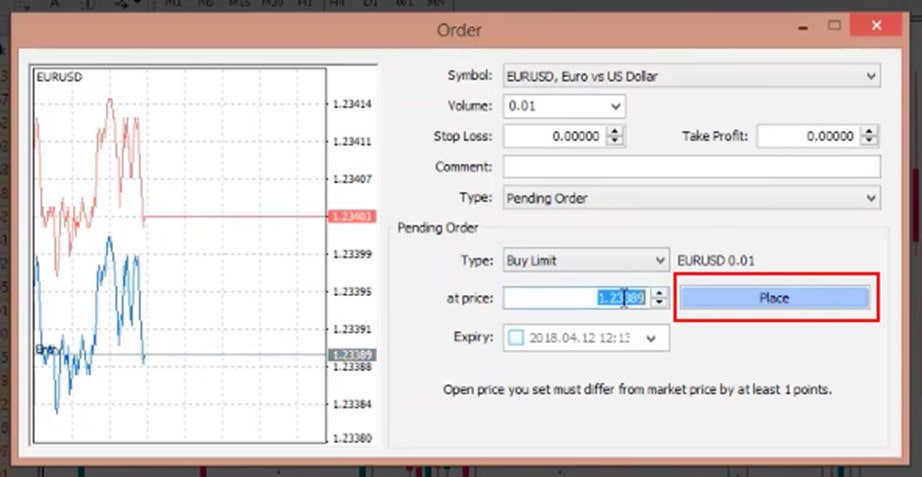

Step 1. Open the security you want to trade. For instance, the EUR/USD pair. Choose 'New Order.'

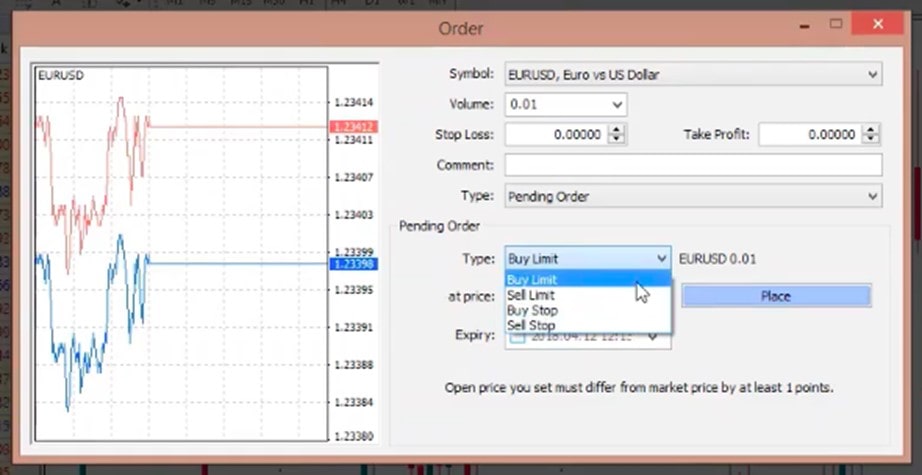

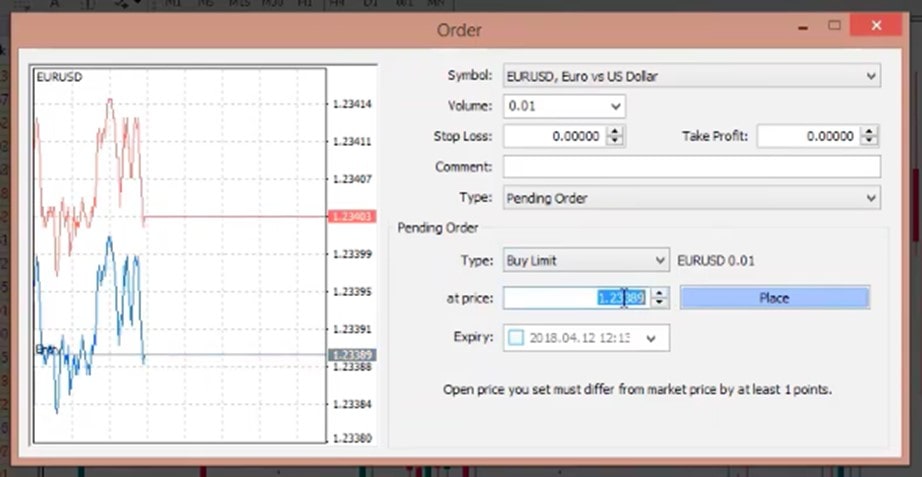

Step 2. In the 'Type' drop-down menu, select 'Pending Order'.

Step 3. A new 'Type' drop-down menu will appear. In this one, choose the type of pending order.

Step 4. Type the level at which you want the trade to be executed.

Step 5. Click 'Place.' The stop-loss and take-profit levels are also available here.

Conclusion

There are different types of orders you can use to enter or exit the market and limit your losses. Two major types are market and pending orders. If you want the trade to be executed immediately, choose market orders. If you see a better opportunity in the future, pick pending orders. You should also keep in mind the take-profit and stop-loss levels. A take-profit order will help you exit the market with profits, while a stop-loss order will limit your losses.

Please note that trading CFDs with leverage can be risky and may lead to you losing all of your invested capital.If you're still confused about what type of orders you should choose, you can practice trading in a free Libertex demo account. The demo account emulates real-market conditions so that you can understand what trading will be like. This way, you will improve your skills quickly.

Let's answer the most frequently asked questions.

FAQ

What Is a Trade Order?

A trade order is a command to a broker to execute the trade at a certain level.

Which Order Type Is the Best?

There is no 'best' type of order; it depends on your goals. If you need the trade to be triggered immediately, choose the market execution order. If you see a better option in the future, pick pending orders.

What Is the Difference Between Market Orders and Limit Orders?

A market order executes the trade immediately. A limit order is used to fill the trade only if the target level is reached.

What Is the Difference Between a Trade and an Order?

These terms are interconnected. If you want to place a trade, you need to choose one of the order types.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.