Many businesses are reacting to the COVID-19 pandemic by encouraging their employees to work from home. Tech companies including Apple, Microsoft and Amazon are leading the charge. So it’s no surprise that professional collaboration software such as Slack Technologies Inc. is seeing an increased interest. One would expect Slack shares to be on the up, but that’s not what’s happening. Not yet, at any rate.

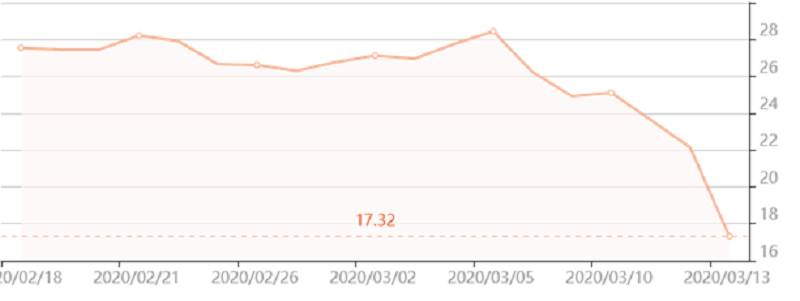

Slack shares at the time of writing

Slack (WORK) shares initially appeared to absorb most of the shock from the stock market’s coronavirus panic, but that was short-lived. Following a company report on Thursday that losses had more than doubled in the fourth quarter, shares in Slack slumped down 20%. Furthermore, the company forecast first-quarter revenue of $185 million to $188 million, around $50 million below what some analysts were expecting. An increased number of users isn’t translating into money.

Slack’s economic model is slow to gain

Slack was a natural beacon of optimism in the stock market because of the assumption that workers consigned to home office would rely more on the instant-messaging software for professionals to stay in touch with co-workers. That’s certainly the case, as executives said that demand was increasing, especially in countries where COVID-19 is spreading.

“The headline is there’s just a massive outpouring of interest on the customer side and it’s really all over the place,” co-founder and Chief Executive Stewart Butterfield told analysts. “There’s existing customers who are accelerating some of their plans. A lot of it is changing.”

But more users doesn’t mean more revenue, mainly due to Slack’s freemium business model. The base product is free, and although the free version comes with some limitations, its enough for many individuals. The idea is that adoption by employees encourages corporations to purchase the paid version with all the perks and advantages for larger organisations.

Because of the long conversion time, Slack’s payoff may come later down the line than investors would like. But it could still be a wise long-term investment. Slack Chief Financial Officer Allan Shim admitted as much, saying that the service was “definitely seeing a lot more usage, but in terms of where that’s going to be showing the results, I think that’s going to take some time to play out.”

Keep an eye on productivity services

The corporate customers that Slack relies on for revenue could still be reluctant to spend, just like every other business sector in the wake of the disruption caused by the pandemic. Other software firms that offer useful tools for remote work such as Zoom Video Communications Inc. as weathering the storm relatively well, but suffer similar short-term uncertainty, using the same price model as Slack.

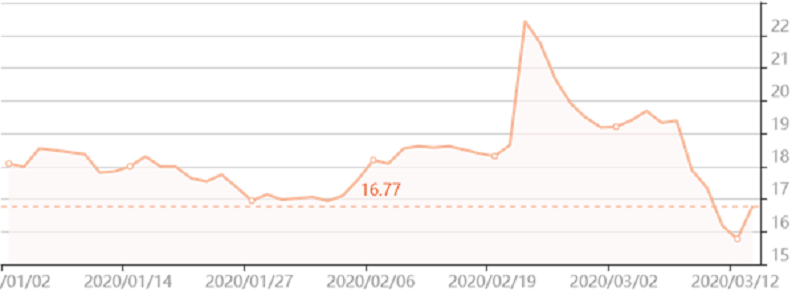

Google shares at the time of writing

Alphabet’s Google, on the other hand, is doing well after the company announced free access to advanced Hangout Meet video-conferencing capabilities that allow up to 250 participants at once. Dropbox and Docusign are also beating expectations, even as the broader stock market selloff turns the screws.

Dropbox shares at the time of writing

Libertex: your best bet for the future

As traders plans their next moves in a volatile market where anything can happen, Libertex remains the most effective way to profit from the innovative tech sector. Available on your smartphone or the web, Libertex is a trading platform offers stocks in Slack, Dropbox, Google, Facebook, Apple, Twitter and other top tech companies. That’s in addition to 240 other financial instruments including fuel, precious metals, foreign currencies and cryptocurrencies. Even if you yourself are taking precautions and staying at home, the stock market is always at your fingertips.

Our award-winning platform allows Libertex clients trade with zero spreads and favorable leverage (up to 1:30 for Retail Clients and up to 1:600 for Professional Clients), whenever and wherever you want. Thanks to trading signals from our in-house finance experts and regular news updates, Libertex clients can keep up with the fast-paced financial market. If you’re ready to take advantage of the latest opportunities in the stock market, register with Libertex and start trading now!