It's now official: we're no longer dealing with a correction but a bona fide crash on the crypto market. Bitcoin is down around 43% from its November all-time high, while Ethereum is doing even worse after posting close to a 45% decline over the same period. And the damage elsewhere in the cryptosphere is far greater than among the legacy players, with recent high-flyers Cardano and Solana losing almost 60% of their value in a matter of weeks.

But what are the causes of this carnage, and when, if ever, will we see a resurgence in digital currencies? Are we looking at one of the most unique opportunities to buy the dip, or is this just the tip of the iceberg? Before we can get into all that, we first asked a team of analysts from Libertex, a leading online CFD broker that has recently launched an attractive zero commission proposition on crypto CFDs, to analyse the admittedly scant longitudinal data available in order to understand how this fledgling asset class tends to behave.

Dancing to the Bit of the same drum

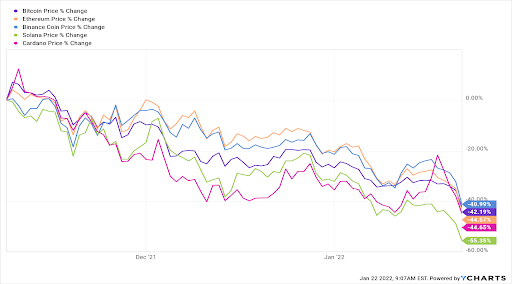

Whatever the altcoin champions will have you believe, it's largely Bitcoin that sets the trends in the cryptocurrencies space. When the original coin skyrockets, the rest of the market rides its coattails to the moon. And when it crashes, the others tend to fall even harder. Just take a look at these recent charts and see for yourself:

Naturally, this isn't the first time such a pattern has been observed. Similar behaviour can be seen during the last major correction of summer 2021:

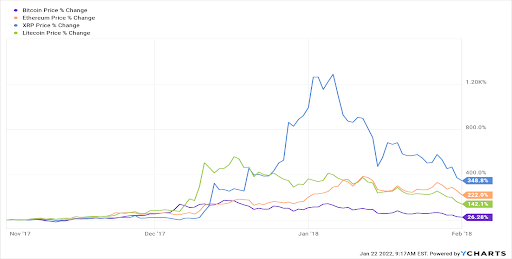

Once Bitcoin starts to make a significant move, the rest of the established coins tend to follow. Of course, there are always exceptions, such as when new breakthrough projects like Solana and Cardano are released, but for the bulk of the market, the trend holds true.

We can even see a comparable trajectory as far back as in the initial crypto bubble of 2017/2018 (albeit slightly less homogenous):

At the bottom of the mine

It's all well and good using BTC as a leading indicator, but the question remains: how bad can the crypto situation get before prices recover? Well, the data would suggest that we are at or very close to the bottom.

Now, everyone knows the stories of countless investors that have been burnt trying to call the bottom. Even though some brokers are trying to help them stay afloat by providing them with ideal trading conditions, Libertex seems to be the only one at the moment providing some truly phenomenal trading conditions that have not been previously observed in the market by completely slashing commission, swap and exchange fees to zero on all crypto CFDs available on its platform. And while the markets might indeed remain erratic longer than you can stay solvent, with finite commodities like Bitcoin, intrinsic value is much more predictable.

To establish the fair value of Bitcoin, we first need to look at the mining market. Remember the Chinese ban on crypto mining introduced around June of last year? The ensuing drop in calculation difficulty did cause prices to bomb in the short term, hitting bottom in late July. But then something interesting happened: BTC (and the rest of the digital currency space) began rising rapidly as new players entered the mining game and started driving difficulty back up.

Keep holding on

Fast forward to today: mining difficulty is at an all-time high and showing no signs of budging. Hot on the tails of their competitors in the developing world, Western miners are buying up the latest ASICs in a bid to maximise their output and dominate the mining market.

In fact, Marathon Digital recently took out a $100 million loan to buy a fleet of the latest S19 XP machines, which boast an incredible capacity of 140 Th/s. After all that investment, the low profitability engendered by high difficulty and low prices has to be weighing on Marathon's management. With an intrinsic cost of mining 1 BTC of approximately $34,000 (at current electricity prices), any drop below this level will surely see miners begin hoarding coins in anticipation of higher prices.

This action is then likely to be mirrored by whales and ordinary HODLers since unnecessarily selling at these levels makes little financial sense. In the end, the laws of supply and demand dictate that this mass hoarding should lead in and of itself to rising Bitcoin prices.

Technically right

Fundamentals might tell us what ought to happen, but if we want even the slightest hint as to when, we need to look at the graphs. With that in mind, let's have a gander at the recent chart below and see what clues we can find:

We are currently at a strong support of $35,000, with an even stronger level below that at $30,000 (the very same July 2021 lows referred to above). What's more, the daily RSI (20%) indicates that BTC is hugely oversold, thus predicting a pullback to the upside over the medium term.

Nonetheless, there is still every chance we could see a protracted period of consolidation, much like earlier in the month, as the price dropped impulsively from $48,000 to $40,000. On that occasion, BTC was rejected multiple times at the 100-day MA before eventually capitulating and dropping further to current levels. This time, however, we expect the eventual movement to be to the upside as opposed to a further bearish leg down.

Buyer beware

Given all of the above, the case that the bottom is either here or at the very least close is highly compelling. After all, how long can prices really remain at or below the actual cost of production? All the conventional wisdom would say it's only a matter of time before a bullish correction comes, which makes current levels an incredible buying option. But deciding to invest is only one part of the equation, where you buy can be equally as important to your eventual gains as when you pull the trigger.

Say you manage to time the perfect bottom of the market and decide to purchase $1000 worth of Bitcoin. The exchange fees, commission and swaps charged by many brokers could end up reducing your investment to as little as $950. It might not seem like much at first, but if BTC then rises 10 times in value, that's $500 you're missing out on!

That’s why it's crucial to choose a broker who charges minimum fees, such as Libertex, whose clients don't have to pay exchange fees, commission or swaps on cryptocurrency CFDs. Just the spread and nothing more. Obviously, this can translate to huge savings when users complete multiple transactions, high volume trades or hold positions overnight. It only takes a few seconds to register with Libertex and discover a wide range of crypto CFDs with zero commission, swaps or exchange fees on one of the most popular platforms.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading CFDs with this provider. Tight spreads apply. Please check our spreads in the platform. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Cryptocurrency instruments are not available to retail clients in the UK.

Available for retail clients on the Libertex Trading Platform.