How Liquidity Risk Affects Your Trades

What Are Liquidity and Liquidity Risk?

Liquidity stands for the ability of a company or an individual to convert something they own into cash immediately and at a desirable price. When talking about liquidity in trading, we understand that we don't own a specific asset. Instead, it's an opportunity to buy or sell an asset quickly and without losses.

Liquidity risk is the inability to buy or sell a security quickly and at a desirable price.

Liquidity risk is a situation in which there aren't enough buyers or sellers in the market who are prepared to buy or sell an asset at the price you want. Such an event leads to huge bid-ask spreads and high price fluctuations. The risk occurs because of market inefficiency or asset illiquidity.

Liquidity Risk: Types

There are two major types of liquidity risk:

- Market liquidity relates to an event when you can't buy or sell an asset at the price you want. As a result, you either have to wait for longer or buy/sell your asset at an undesired price.

- Funding liquidity means the lack of a company's ability to pay for its obligations. This happens due to a financial crisis or the company's ineffective administration, which leads to a reduction in funds.

Factors of Liquidity Risk

When you read the news or market analysis, you may hear something along the lines of "the market is suffering low liquidity." But why are some markets liquid while others aren't? Let's consider the factors that affect a security's liquidity.

- The number of market traders. This is the main factor that determines the liquidity in the market. The more traders who are willing to trade the asset you want to buy or sell, the more likely it is that your desired price will be fulfilled.

- Size and frequency of trades. Some assets are traded more frequently than others. For example, if we consider the forex market, the EUR/USD pair is more popular than the MXN/USD one.

- Time of trade completion. A liquid asset can be exchanged for cash immediately after an order is placed. However, if a trader is in a hurry to buy or sell an asset, the liquidity risk may increase. If the trader has time to wait until the desired price is met, the risk drops.

- Substitution. If a position is unique, liquidity risk increases. However, if it can be replaced with another asset, the risk level declines.

- Type of asset. Assets have a different degree of liquidity. For example, the stock market is more liquid than the real estate market.

How toMeasure Liquidity Risk: Liquidity Model

There are several models for measuring liquidity risk:

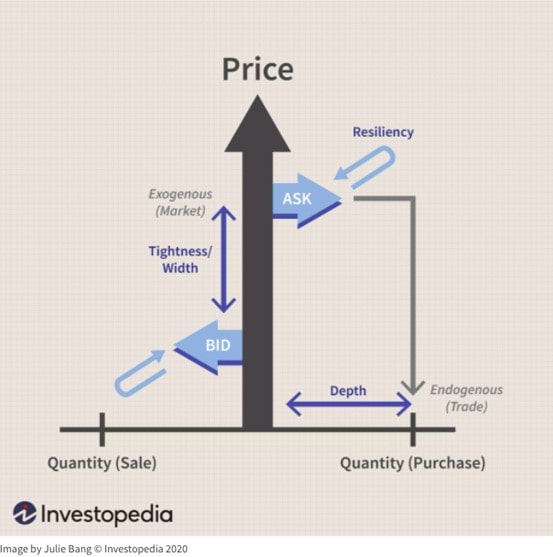

- The most used is the bid-ask spread, which we've already mentioned. If the range is narrow, the market will experience high liquidity. This represents the width.

- Position size represents the number of assets an investor holds. If we consider a giant company like Microsoft, one investor with several shares won't crash the market. However, if an institutional investor holds securities in a small market, any of his/her actions can lead to unexpected results. This represents the depth.

- Resiliency relates to a market's ability to rebound in case of incorrect prices. It measures liquidity in time.

The width of the bid-ask spread is the primary measure of liquidity risk.

Does Trading Volume Still Matter?

The volume indicator is a famous measure of market liquidity because it seems logical that high trading volume signals high market liquidity. However, a real-world example confirms that this isn't necessarily so.

On 6 May 2010, the flash crash happened when the SEC's sell algorithms included orders in the system faster than they were executed. As a result, trading volume surged while lots of orders went unfilled. That means that volume doesn't necessarily indicate that market liquidity is high, especially when volatility increases.

How to Use Liquidity in Trading

Liquidity is a crucial point of trading you should be aware of. Here are several points to consider.

Liquidity Degree

As we mentioned above, assets have a different degree of liquidity. To be confident that your trade will be fulfilled, choose highly traded securities. Traders prefer assets that guarantee stability. In the forex market, that would be currencies related to the most significant economies. If we consider the stock or bond market, choose blue-chip companies.

Liquidity and Economic Data

Market liquidity depends both on the asset you're trading and market events. Let's consider an example of liquidity risk. You want to sell Company X's stock at $15. However, while you're holding the position, its earnings report is released, showing the financial difficulties the company is in. As a result, the willingness to buy its shares declined along with its price. So, it's unlikely you'll be able to sell your shares in Company X at $15.

Liquidity Risk and Volatility Risk

It's essential to understand that these risks aren't correlated. In the previous example, we said that a negative earnings report led to an unexpected fall in the stock's value. However, the liquidity risk would occur only if the asset isn't widely traded in general. If we considered a blue-chip company, there would be enough traders to fill your position at the desired price.

Market Liquidity: Which Market to Choose

Let's consider the degree of liquidity for different financial markets, bearing in mind that there's no such thing as a market with the 'most liquidity' or the 'least liquidity'. All markets have assets that are more and less liquid than others.

Forex

In general, the forex market has high liquidity, but it has both high- and low-liquid currencies. All major currencies — EUR, USD, GBP, JPY, AUD, CHF and CAD — are highly liquid. They're related to stable economies and provide exciting trading opportunities because they're used in global trading operations.

If you want to trade Singapore dollars or Mexican pesos, you're more likely to run into liquidity risk. These currencies are risky assets and aren't used in world trading operations very often.

To avoid liquidity risks in forex, choose the currencies of the world's largest economies.

Stock Market

The stock market is one of the most popular places for financial operations, so it has high liquidity overall. However, as you know, there are both huge leading companies and those that have just entered the market. Traders will invest in the shares of companies that have been in the market for years and have proved their reliability. Blue-chip companies are also less affected by market fluctuations and economic releases than those recently created.

Cryptocurrencies

The cryptocurrency market is still one of the most volatile. It has always gone up against government restrictions worldwide. Many new cryptocurrencies have been launched, but most of them have disappeared because of low interest among investors.

If you want to trade in the cryptocurrency market without a liquidity risk, choose old cryptocurrencies, such as Bitcoin, Litecoin, Ethereum or Dash.

Commodity Market

The commodity market is not as liquid as its stock or forex counterpart. There are several assets you can trade with limited liquid risk: gold and oil. Gold is always used as a safe-haven asset that appreciates in times of economic instability. Its popularity dates back to the days of the gold standard.

The oil market is famous among traders who prefer to trade on high volatility. Previously, we mentioned that unexpected events lead to a vast difference between the bid and ask prices. However, because the oil market is famous among traders, unpredictable market fluctuations don't increase the bid-ask spread dramatically.

The Least Liquid Markets

There are markets that are always considered to be low-liquid ones.

Exotic Currencies

Currencies are divided into major and exotic ones. As we previously said, major currencies are the most liquid, while the exotic ones suffer the highest liquidity risk. First of all, this is because they're tied to unstable economies, which decreases the chances for trades. Secondly, many exotic currencies are issued by small countries that don't participate in global trade relations.

Small-Cap Stocks

Investors put their money in the shares of giant companies that are more likely to bring high rewards. Small-cap companies are less attractive for investors and traders because the potential profit is generally lower. As a result, there's a low demand for their shares.

Effective Liquidity Risk Management

It seems that the golden rule to liquidity risk management is easy: don't buy low-liquid assets. That said, low-liquid securities sometimes provide outstanding opportunities that may increase your profit. Let's consider several steps that will lower the possibility of liquidity risk.

Securities with low liquidity sometimes provide outstanding opportunities that may increase your profit.

- No long-term investments. If you still want to trade barely usable securities, don't buy them for an extended period. For example, if you want to trade MXN/USD pair because a crucial economic release is supposed to affect the direction of the exotic Mexican peso, choose a small timeframe.

- Think about risks in advance. There is no complete list of assets that are considered to be low-liquid or highly liquid. However, there is a primary concept: if an asset is tied to a stable economy, market or company, it's more likely to experience high liquidity. If a security relates to an unstable economy, young company or risky markets, it's more likely to attract fewer investors. You can also evaluate liquidity by checking the bid-ask spread.

- Monitor. Check the news and economic calendar before and during trading. Unexpected events may cause high volatility that will cost you profit in low liquid markets.

- Avoid low-liquid markets. If you're a newbie, don't enter low-liquid markets because you won't be able to deal with the stress and losses.

Conclusion

Liquidity risk is an essential point of successful trading. It represents your ability to buy or sell a security quickly and at the price you desire. The most prominent way to determine the level of risk is to evaluate the spread between the bid and ask prices. If it's enormous, the market is low-liquid, and you better avoid trading in it. Usually, exotic currencies and stocks of small young companies provide the highest risk.

If you'd like to test your skills trading low-liquid assets, you should start with a demo account. Libertex offers a fully-equipped demo account with a full range of securities with both high and low liquidity.

Check out the answers to the most frequently asked questions about liquidity risk.

FAQ

What Does Liquidity Mean in Trading?

Liquidity stands for the degree of your ability to buy or sell a particular asset quickly and at a desirable price.

Why Is Market Liquidity So Important?

Market liquidity determines how quickly and successfully your trade will execute. If you trade on a high-liquid market, you won't suffer difficulties even in times of high volatility. Low-liquid markets, however, may lead to significant losses, even in periods of stable circumstances.

How Is Liquidity Calculated?

The most efficient method to calculate liquidity is to measure the spread between the bid and ask prices. The higher the difference is, the lower liquidity is.

What Is Liquidity Risk?

It's the risk your trade won't be executed at desired conditions due to a lack of sufficient buyers or sellers in the market who are willing to buy/sell the asset. Such an event leads to huge bid-ask spreads and high price fluctuations. The risk occurs because of market inefficiency or asset illiquidity.

Why Is Liquidity Risk Important?

Liquidity risk predetermines the success of your trade. Imagine you want to sell the security at $15, but there are no buyers who want to purchase it at $15, only those who want to pay $10. You'll either have to lose money to get rid of the asset or wait a long time for someone to purchase it at $15 (and even then, it's not guaranteed to happen).

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.