The Difference between CFD and Forex: What beginners should know

The term "forex" — also known as foreign currency trading, currency exchange or by its acronym "FX" — refers to foreign exchange or to transactions between currencies.

Today, forex is considered to be the most important exchange market in the world, with over $5 trillion traded every single day. The combined volumes of all the stock markets in the world do not even come close to this figure. That said, the CFD market is also quite extensive. The number of customers trading CFD products each month has reached 560,000 in the UK alone. So, it's worth taking a closer look at both markets.

Now, it seems that everyone has come across a currency exchange in one way or another, the obvious example being when people travel to another country and exchange their currency for the local one. But when it comes to trading, there are more nuances to take into consideration.

Background information

Let's start by establishing the basis of currency trading. The price of each currency varies depending on its demand in relation to other currencies. In other words: the more in demand a given currency is, the higher its price will be and vice versa. And when you access a decentralised currency marketplace, you can trade all the major world currencies. You will be alongside a wide range of different market actors, from the world's largest financial institutions dealing in big money transactions all the way to ordinary people converting a few dollars here and there. But they all have the same end goal — they either want to buy a currency and then sell it for more than they paid or else sell a currency and then buy it back for less money.

Switching over to CFDs, these are time-limited contracts that derive their value from the market performance of assets, which can be currency pairs or other assets (stocks, indices, commodities, cryptocurrencies, etc.). Since CFD trading is a popular form of derivatives trading, you don't buy the assets themselves, which is why we use the term "underlying asset". For example, in the case of a EUR/GBP CFD trade, you won't own these currencies. Instead, you only trade on the rise or fall in their price within a certain amount of time. Usually, the duration of a contract spans a relatively short period.

To join the ranks of those already trading on currency exchange or CFD markets, all you need is a computer, an internet connection, and a trading account to complete your transactions. Of course, you will also need to learn about CFD trading and practice.

How does forex trading work?

The aim of forex trading is to speculate on the changes in the value of one currency relative to another. You can do it by buying a currency and then selling it at a higher price, or by first selling it and then buying it back at a lower price.

To understand how this works in practice, you need to understand what exactly a currency pair is. Currencies are priced relative to other currencies. If you buy Euros (EUR), the price you pay will depend on whether you are exchanging US Dollars (USD), British Pounds (GBP) or another currency for those Euros.

A currency pair consists of a base currency and a counter or reference currency. The base currency is the first currency in the quote, and the counter currency is the second. The counter currency is the reference currency in which the base currency is being quoted.

Let's take an example of the EUR/USD being quoted at 1.1017-1.1019. In this example, the EURO is the base currency, and the USD is the reference currency. The Euro price is being quoted in USD. So, you would pay 1.1019 USD to buy 1 Euro. If you wanted to sell 1 Euro, you would receive 1.1017 USD.

For most pairs, the most liquid currency is usually quoted first. However, when the USD is paired with the British Pound, Euro, New Zealand Dollar, or Australian Dollar, the USD is quoted second.

If the base currency is a foreign currency, the quote is known as a direct quote. If the base currency is the domestic currency, the quote is known as an indirect quote.

Currency pairs are divided into three categories:

- The most widely traded currency pairs in the world are known as the majors. They include the EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, NZD/USD and USD/CAD. You will notice that these pairs all include the USD.

- Currency pairs that include two of the currencies listed above but not the USD are known as minor currency pairs. These pairs are also known as cross-currency pairs or crosses. Examples include EUR/GBP, AUD/JPY and GBP/CAD.

- Exotic currency pairs include one major currency and one other. The second currency is usually the currency of a developing nation like Turkey, Thailand or South Africa. However, exotic currencies also include those of quite developed nations like Singapore and Hong Kong.

An important aspect of forex trading is liquidity. If two countries have a healthy trading relationship, the currency pair with their two respective currencies should be very liquid. On the other hand, a currency pair that includes the currencies of two countries that don't have trading relationships may be illiquid.

The major and minor currency pairs are the most popular to trade due to high liquidity levels. These pairs can be traded on any time frame as the spread is narrow. Exotic pairs can be traded but require larger price movements to cover trading costs. This means you will need high levels of volatility or a longer time frame.

How does CFD trading work?

As mentioned, CFD trading allows you to speculate on the rises and falls of fast-moving financial markets (or instruments), such as stocks, indices, commodities, currencies, and other liquid assets. But we have not yet explained how the trades take place.

When you enter a CFD trade, you buy or sell a number of units for your chosen financial instrument, depending on the direction you believe the price will move in the future. If you think the price of the underlying asset will go up, you will enter a long trade. If you believe the price will fall, you will enter a short trade.For every point the price of the underlying asset moves in the expected direction, you gain multiples of the number of CFD units bought or sold previously. If the price moves in the opposite direction than expected, you will make a loss.

In the case of CFDs in currency pairs, a long position means you are buying the base currency, and you are effectively short of the reference currency. The price will rise if the base currency strengthens or if the counter currency weakens. You will profit if you close the position at a higher price (this is the best-case scenario, and it's not guaranteed).

If you open a short position, you are selling the base currency and buying the reference currency. The price will fall if the base currency weakens or if the counter currency strengthens. You can make a profit by closing the position at a lower price (but this isn't guaranteed, either).

It's also worth mentioning that CFDs are part of a group of derivative financial products which permit the use of leverage. However, traders should have some previous experience of using leverage before trying it with CFDs, as profits or losses could considerably exceed the amount invested.

Example of buying a CFD on a currency pair

You want to buy CFD units for EUR/GBP (0.8480/0.8490) worth €20,000, expecting the underlying instrument to go up. Let's assume the broker has a margin rate of 3.24% for EUR/GBP. So, you must deposit 3.24% of the total position value as position margin to open the trade. In this trade, your position margin will be: (3.24%*(20,000*0.8485)) = £549.82

If you guess the price movement correctly:

Let's say, over the next hour, the price rises by 50 points. In this case, you will make: £20,000*0.0050 = £100

If you guess the price movement incorrectly:

If the price falls by 50 points, you will lose £100.

Example of selling a CFD on a currency pair

In this scenario, you expect the value of EUR/USD (1.0680/1.0690) to fall, perhaps due to some kind of economic turmoil in Europe. So, you want to sell CFD units worth €20,000.

The calculations are similar, where the position margin is 3.24% of the total trade value: (3.32%*(20,000*1.0685)) = $709.48.

If the price drops by 50 points, you will make $100. If the price goes up by 50 points, you will lose $100. Please bear in mind that in all these examples, you may potentially lose more than you deposit.

Types of trading strategies for forex and CFDs

There are several approaches to analysing and trading currency pairs and currency pair CFDs:

- Fundamental analysis considers the difference between the economies of two countries and how that may affect the relative strength of each currency. This includes interest rates, money supply and trade balances.

- Technical analysis considers the price action of the pair. Price patterns, indicators and support and resistance levels are used to identify potential entry points.

- Traders also use news, market sentiment and algorithms.

- Scalping strategies make predictions for short-term price movements that may last seconds or minutes.

- Day traders use technical analysis to identify trades to hold minutes to hours. They close all positions at the end of the day.

- Swing traders hold positions for a few days in the hope of larger price swings.

- Position traders and trend flowers hold positions for as long as a few years. They follow major trends or trade price patterns.

Key terminology

Before we go on, let's focus on terms and concepts that you will need in both forex and forex CFD trading.

Lot sizes and how to calculate position size

One of the more confusing aspects of forex and forex CFD trading is calculating the size of a position. The size of a position, which is the size of its exposure to the market, depends on the traded price, the lot size, and the number of lots.

So, what is a lot? A lot is the standardised trade size for currencies. One lot is 100,000 units of the base currency. So, if you buy 1 lot of EUR/USD at 1.1019, you're buying 100,000 EUR, and you'll pay 110,190 USD.

You can also trade smaller lots:

- Mini lots are 10,000 units of the base currency

- Micro lots are 1,000 units of the base currency

- Nano lots are 100 units of the base currency

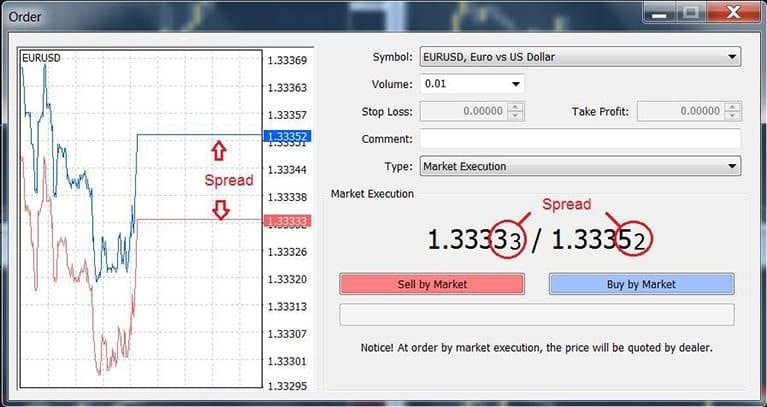

What does spread mean?

You have surely heard the word "spread" used endlessly in relation to the financial markets, but do you know its exact meaning?

Well, in most financial markets, you have three prices: the market price, the buy price and the sell price.

The word spread is used to refer to the difference between the supply (or sell) and demand (or buy) prices and is used for all assets and their derivatives.

In short, the spread is the difference between the sell price and the buy price.

In the chart margin, you can see the price for which you can buy the first currency and then compare it with the second currency.

Say the EUR/USD sell price is 1.300. If you want to buy €1, you should pay $1.30. Therefore, it would be advisable to make the purchase if you believe that the EUR will rise against the USD. In other words: you should buy only if you think you can sell your €1 for an amount greater than the $1.30 you paid for it.

If you wish to sell, the chart will show you the price at which you can sell the first currency for the second.

If the EUR/USD sell price stands at 1.300, you could sell €1 at that price. However, it is only advisable to sell if you think that the price of the EUR will fall against the US dollar. Because then you could buy the same euro for less than the $1.30 you paid when you opened the position.

What is a pip?

A pip — short for point in percentage — is a very small measure of change in a currency pair. It can be expressed either in terms of the quoted price or in terms of the underlying currency. A pip is a standardised unit and is the smallest amount by which a currency's quoted price can change.

If you see that the price of the EUR/USD pair has increased from 1.3600 to 1.3650, you can describe this as a rise of 50 pips. Therefore, if you bought at 1.36 and then you sell at 1.3650, your profit would be 50 pips. Of course, this is just meant to serve as an example.

The actual profit or loss you receive will depend on the amount of currency you have purchased. For instance, if you buy micro lots (1,000 units) and trade with an account denominated in US dollars, the pip value will be $0.1. Thus, if your profit/loss was 50 pips, this means you made/lost $5. In the event you bought mini lots (one unit of 10,000), the pip value will increase/drop to $1, making your profit/loss $50. Similarly, when you purchase a standard lot (100,000 units), the pip value rises/plummets to $10, which translates to a profit/loss of $500.

The same pip value will apply to all pairs where the US dollar appears in the second position. If it is listed as the first currency, though, the pip value will be different. To calculate this new pip value, you must divide the normal pip value by the current exchange rate. For example, if your currency pair is USD/CHF, you must divide $0.10 (micro lot value) by 0.9435 (the current exchange rate for CHF) to get $0.1060 (new pip value). If JPY is part of your pair, as in USD/JPY, you must follow the same steps and then multiply your result by 100 at the end.

What is leverage?

Leverage essentially means using something small to control something bigger. In the specific case of currency trading, it means having a small amount of capital in your account that you use to control a larger amount elsewhere in the market.

For instance, if you are offered leverage of 1:100, it means that you can trade with 100 times more money than the amount of your initial deposit. That means if you want to invest in 100,000 EUR/USD, you now only need €1,000. However, these kinds of trades come with much higher risk. Let's suppose you're using leverage of 1:100: your losses could then be multiplied by a factor of 100. So only go for it if you are completely sure.

Pros and cons of using leverage

- +Increases potential profit

The first and probably the most important benefit of trading with leverage is that it offers the potential to earn more if the market moves in your favour.

- -Increases potential losses

In the same vein, the results of the trade will be increased if you lose, too. So, you might potentially lose much more than you initially deposit.

- +Increases capital efficiency

Look at it this way: if it takes two days to generate £100 with unleveraged positions, leverage will take a much shorter period of time to reach the same result. This means your capital can be reinvested more (only if you have winning trades).

- -Increases your account risk exposure

Leveraged positions aren't limited to the amount of your trade and the balance of your trading account. So, your broker can lock your trading balance until you cover the stipulated margin requirement.

- +Mitigates low volatility

Another key advantage of leverage, especially when it comes to currency trading, is that it has the effect of mitigating low volatility. And since volatile markets move in wider cycles than stable instruments, it can be beneficial for speculators.

- -Involves more fees

You will be subject to borrowing fees and the margin rate, which can eat away your profits (assuming you get any, which is also not guaranteed).

Bulls and bears: Long positions vs short positions

The terms "bull" and "bear" are used to identify the two types of traders we encounter in the exchange market.

Bulls are unsurprisingly found most commonly in bull markets. They are optimistic and expect the price to rise, which is why they open long positions. A long position in forex or forex CFD markets refers to buying a pair of currencies in the hopes that it will rise.

Bears, on the other hand, usually reside in bear markets, where traders are pessimistic and expect prices to fall, thus electing to open short positions. With respect to forex and forex CFDs, short positions are opened when the trader sells a pair of currencies or a contract for the pair hoping for the value to fall.

How to learn to trade forex and CFDs

Any type of trading requires ongoing learning. Even if you already have some experience, there are always areas where you can improve your skills.

You can start out with a demo account (which you can do for free with Libertex), and as you practice more, new markets will become less challenging. Some of the most important lessons you'll learn will have to do with the way you react when you make money and when you lose money. So, it's a good idea to move to a live account after you experience the ups and downs in a demo account and face your first losses, albeit in a practice environment.

To improve your trading, you can read books on technical analysis and technical analysis, strategies, and more. It's also worth learning about economics and monetary policies, as both affect the values of currencies. There are also lots of educational videos and articles on these topics available online.

Finally, you should keep a journal, set goals, and track your progress. The more systematic you are about the learning process, the more efficient it will be.

Main differences between forex and CFDs

Now, let's finally highlight the most notable differences between the instruments in question. Check out the table below.

|

Forex vs CFD |

||

|

Forex |

CFD |

|

|

Selection of instruments |

Limited to just currencies |

A broad range of underlying assets |

|

Contract sizes |

Uniform across different currencies |

Variations depending on the underlying asset (lots, shares, ounces, etc.) |

|

Contract denomination |

In the quote currency |

In the contract's currency |

|

How trades are settled |

Through the delivery of a set amount of base currency |

Cash-settled, based on the opening/closing price difference |

|

Market influences |

Fundamental factors, such as global macroeconomic events and economic factors |

Factors affecting the instrument being traded, often the supply and demand |

|

Cost of trading |

Depends on the spread |

Depends on the spread + trading conditions for a particular trade |

Pros and cons of forex trading

- +High liquidity

Forex is the most liquid market in the world, with a trading volume in excess of $5 trillion. This means you can open and close more positions than in other, less liquid markets.

- +Low volatility

There are fewer variables affecting the price difference between two currencies.

- +24-hour availability

Forex is open 24 hours a day, 5 days a week, so you don't have to time your trades as diligently as with stocks.

- +Hard to manipulate

The FX market is large enough that no single entity can control the market price for an extended period of time.

- -Market risks

All trading instruments are subject to numerous market risks. Political, economic, and geopolitical factors can contribute to increased volatility, which can make trading challenging and unprofitable.

- -Weekend gaps

Because currency markets trade 24 hours a day, forex traders do not have to worry about the overnight gaps that occur in other markets. However, forex markets are closed over weekends, which can result in price gaps. Forex traders should be cautious when holding positions over weekends.

- -Counterparty risks

Forex is not traded on centralised exchanges like equities and other instruments. This means there is less oversight placed on trading, and traders may not be protected if a broker becomes insolvent.

- -Regulatory risks

Forex brokers are regulated by several regulatory bodies, which depend on the country the broker is based in. Traders should always ensure their broker is certified by a reputable regulator.

Pros and cons of CFD trading

- +Wide range of markets

CFDs offer the ability to work in different financial markets from one account. Many brokers dealing with these instruments offer CFDs based on currencies, shares from different markets around the world, as well as other types of financial instruments such as gold, silver, oil, stock indexes, sectors, commodities, government bonds, currencies, etc. This allows traders to diversify and hedge.

- +Access to assets unavailable in your region

CFDs allow for global exposure to various markets, even if trading them directly is not allowed in your region. Worldwide exposure and diversity are not loopholes but rather fortunate characteristics.

- +Extended trading hours

Many brokers offer their clients extended hours, which means they can work with certain instruments or markets, such as the FTSE and Dow, even after the underlying market has closed for the day.

- +Flexibility

Traders can work for as long as they like: CFDs do not have a fixed maturity date. There is also no set contract size, which means traders can work with volumes of any size.

- -Varying liquidity

CFD prices are a direct reflection of what is happening in the underlying market. So, if you choose an asset with low liquidity, the instrument will not change that.

- -Lack of ownership

Traders can own the contract but not the asset, which may mean missing out on the perks of ownership. It's less relevant for currencies but highly relevant for assets like stocks and indices.

- -Risk of overtrading

Because CFDs have lower barriers of entry (i.e., lower capital commitment) compared to some underlying assets, traders can slip into the tendency to overtrade. This can lead to reckless decisions and magnified losses.

Which trading instrument should you choose?

When it comes to forex vs CFD trading, there is no definitive answer as to which instrument is better. They have many differences on a technical level as well as many similarities. Before you're swayed either way, it's important to research and practice with both to gain as close to real-life trading experience as possible. You may understand how certain instruments work on paper but have a completely different view of them once you actually see them in action.

Trading highly liquid markets and instruments is usually a good introduction to trading. So, if you're a beginner, you might have a better time trading FX pairs or CFDs on liquid instruments. But other than that, there are no clear guidelines to follow. You will have to try and find the type of instrument that suits your personality, level of skill, capital, risk tolerance, and goals the most.

It's not uncommon for traders to work with multiple instruments at once. So, you might not need to choose between forex and CFDs at all. You might find your way of using their strengths and minimising their weaknesses. But remember that you can't escape the risk of losses, no matter what instruments you go for.

How do I start trading forex or forex CFDs?

Regardless of which where you fall on the CFD vs forex debate, make sure to follow these core principles:

- Traders with limited or no forex or forex CFDs experience should choose currency pairs with high trading volumes. Generally, these will typically include the currencies of the world's biggest economies, such as the United States, European Union, United Kingdom, Japan, and Switzerland.

- Follow all economic events that are likely to affect your assets/underlying assets. Currencies can be influenced by things like releases of macroeconomic data on major global economies and economic decisions made by their issuing Central Banks. Knowing about these kinds of developments can tell you a lot about the strength or weakness of your currencies.

- Set yourself a trading schedule. The optimal hours for trading are when volumes are at their highest. These typically coincide with the opening and closing trade times on the biggest foreign currency exchanges, e.g., New York, London and Tokyo.

- Make use of technical analysis. This type of analysis involves using charts to study current price trends and anticipate future ones.

- If you are going to use leverage, do it properly. For instance, you need to set a stop-loss, which is a level of manageable loss for each trade. That way, you can avoid some of the losses by closing a position that did not go as expected.

The next step is to create your own free demo account. Once you have an account, you can practice by choosing currency pairs or CFDs on any assets you want and opening virtual trades. As you gradually learn new strategies, you will become more prepared to start trading with real money. However, when you enter the live trading stage, remember that even experienced traders have losses, and you should always apply appropriate risk and money management strategies.

Frequently Asked Questions

What does forex mean?

Forex is short for "foreign exchange" and involves the trading of any currency for another currency.

What is forex, and how does it work?

The terms forex, forex trading and currency trading refer to the trading of currencies. Forex is not traded on an exchange like shares but on 'over the counter' (OTC) markets. This means currency transactions take place directly between banks and other institutions. Forex traders can access the forex market via platforms provided by brokers.

What does CFD mean?

CFD means a contract for differences.

What are CFDs, and how do they work?

CFDs are derivative financial instruments, which means you don't own the underlying asset you're trading but can speculate on its value. In this arrangement, the trader pays the difference in the settlement price between the open and closing trades, which can move either in their favour or against them.

What is the difference between forex and CFDs?

Forex includes currencies only, while CFDs (contracts for difference) include other asset classes like shares and commodities, as well as currencies. So, you can trade forex directly, or you can trade CFDs on forex pairs.

How can I learn more about forex or CFD trading?

There are lots of free tutorials and videos online. A good place to start is by reading the Libertex blog with educational content and practising in the demo account.

Is trading difficult?

It depends on how much time and effort you devote to learning. It will definitely be challenging at times, but the process should be more smooth as you find the style of trading that works for you and develop your own approach to trading.

Why do traders fail?

Most traders fail when they try to be an overnight success, and they don't manage their risk exposure properly.

Is Forex trading a scam?

No, the currency market is legitimate and is, in fact, the largest financial market in the world. There are, however, fraudulent forex brokers and trading platforms, so make sure your chosen platform is reputable and licenced.

Is forex or forex CFD trading illegal?

Each country has different regulations regarding broker regulation and the amount of leverage available to retail clients. Some, however, ban one form of trading but not the other. For example, CFD trading is illegal in the US, which means CFDs on forex are not available to US citizens. However, forex trading itself is legal in the US.

Is trading safe?

Any type of trading entails risk. The amount you can lose depends on your own risk management and discipline. That said, trading with unregulated brokers is not safe regardless of your risk management.

How is forex taxed?

The way forex trading is taxed varies from country to country. In most cases, forex traders have to pay capital gains tax on anything they make.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.