Realistic Tezos Price Predictions: XTZ's Price in 2023-2025 and 2030

Which coin is the most lucrative investment? It's hard to tell. However, if you're thinking about purchasing some altcoins, Tezos is worth adding to your shortlist. The token hasn't only secured a stable position in the market; it's also gained the community's trust.

In this article, we have decided to examine its performance and share Tezos price predictions for 2023, 2024-2027 and 2030. Our forecast is based on the most recent data from different market analysts for a complete picture.

What Is Tezos (XTZ)?

XTZ is a crypto coin that was launched back in 2017. Its Initial Coin Offering (ICO) remains one of the most memorable to date: the scope of investment exceeded $232 million. Ever since then, the coin has maintained a leading position in the market. For example, it's considered one of the largest cryptos by market cap, with around $950 million as of the end of February 2023.

Tezos was designed by Arthur Breitman, who criticised Bitcoin for the lack of a governance process involving the community and its participants. Some say that XTZ is rather similar to Ethereum because both blockchain networks feature smart contracts. Nevertheless, there are differences. For example, Tezos boasts a far more advanced infrastructure. It doesn't require a hard fork or a change to the network's protocol that makes previously invalid blocks and transactions valid. Neither Bitcoin nor Ethereum can offer the same to their users.

This is among the key reasons why the Tezos networkcan be described as secure, upgradeable and built-to-last. XTZ is an open-source platform that is said to ensure outstanding accuracy due to its smart contracts. Moreover, its staking process involves the community, with people participating in governing the network by 'baking'.

Perhaps for all these reasons, XTZ was welcomed into the world of high-profile business. For example, the French bank Société Générale announced wholesale central bank digital currency trials in which Tezos outperformed other cryptocurrencies.

Those who want to find the coin don't need to search long. It's available on all major exchanges like Coinbase or Binance. A trader can experiment with cryptocurrency pairs, opting either for XTZ to crypto or XTZ to fiat.

What Factors Influence XTZ's Token Price?

Before you start trading Tezos, it's vital to understand what can affect its price. You'll need this data to predict XTZ token price fluctuations and make reasonable investment decisions. Of course, there are factors relevant to any crypto, like investor sentiment or overall economic situation.

Bitcoin

As the main cryptocurrency, Bitcoin shapes the price of altcoins, and Tezos is no exception. When Bitcoin is in a bull trend (i.e., its value increases), XTZ may follow the same path. While it may lose in the XTZ/Bitcoin ratio, the altcoin can generally still strengthen its position.

The best time to wait for a spike is after Bitcoin's rise. Typically, the main crypto enters a cool-off phase, and that's the exact moment to anticipate growth for Tezos.

The Overall Crypto Market

Any coin is tied to the general crypto market's state. When it's blooming, investors can anticipate price growth for all tokens. Similarly, when the market sees a recession, traders must be on guard to prevent significant losses.

Let's take a closer look at positive trends. When the market is prospering, typically accompanied by a rise in Bitcoin's price, the most lucrative pairs are crypto to USD or EUR. If you manage to buy XTZ cheap, you can later sell it for fiat and potentially gain profit.

The best scenario is to wait until the market stabilises and everyone starts looking for top-performing altcoins. Luckily, Tezos is likely to be among those.

Staking Mechanism

Although many other cryptos involve staking, Tezos has managed to secure a strong position. With a lot of exchanges introducing staking-as-a-service, its importance is likely to increase. Consequently, this drives growth for XTZ. In fact, it's already among the leaders: Binance and Coinbase consider the token to be the leading staking crypto.

Tezos' Past Price Performance

Making an XTZ price prediction may be difficult without assessing the token's past performance. It helps to identify price fluctuation patterns and analyse which factors have the biggest influence.

The Tezos coin started its path with a scandal. The coin launched in 2017 when its ICO took place in July, one of the largest in terms of accumulated investments. Its price at the time was average, bouncing between $1.70 and slightly more than $2. Instead of stabilising its position, the company had to deal with a lawsuit over the ICO. Several, in fact. All of them accused XTZ's founders of selling unregistered assets.

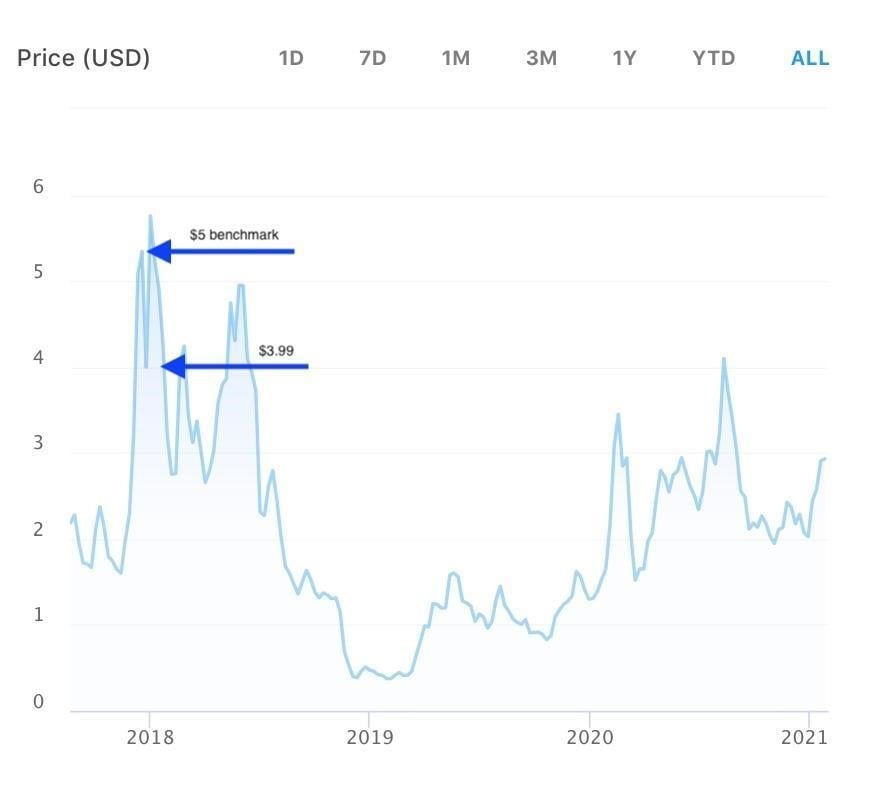

This, of course, affected the token's price. It had just begun to increase, reaching the $5 benchmark in December 2017, when another complaint was filed. As a result, it dropped to $3.90 in a couple of days.

However, the collapse wasn't disastrous. In fact, Tezos regained its position pretty fast and exceeded its previous high in early January 2018, hitting $5.75. No matter how promising it may have been, 2018 happened to be a complicated year for all cryptocurrencies, with constant ups and downs. As a result, XTZ ended the year at only $0.50.

What affected Tezos significantly at the time was a set of regulations. Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements were introduced in the summer of 2018, which posed a problem for XTZ since no user data was collected during the ICO.

After a long bearish period, the token finally started to regain its value in 2019. From March to December of that year, the coin did rather well. Although all cryptocurrencies saw their prices increase during that time, Tezos performed better than the rest, moving up an estimated 1,000% during the year. It climbed from 22nd position up to 10th in the cryptocurrency ranking by market capitalisation.

The blooming phase began approximately in the middle of the year. Some analysts believe that a massive boost in liquidity and accessibility were the key growth drivers.

Did Tezos Keep Growing in 2020-2022?

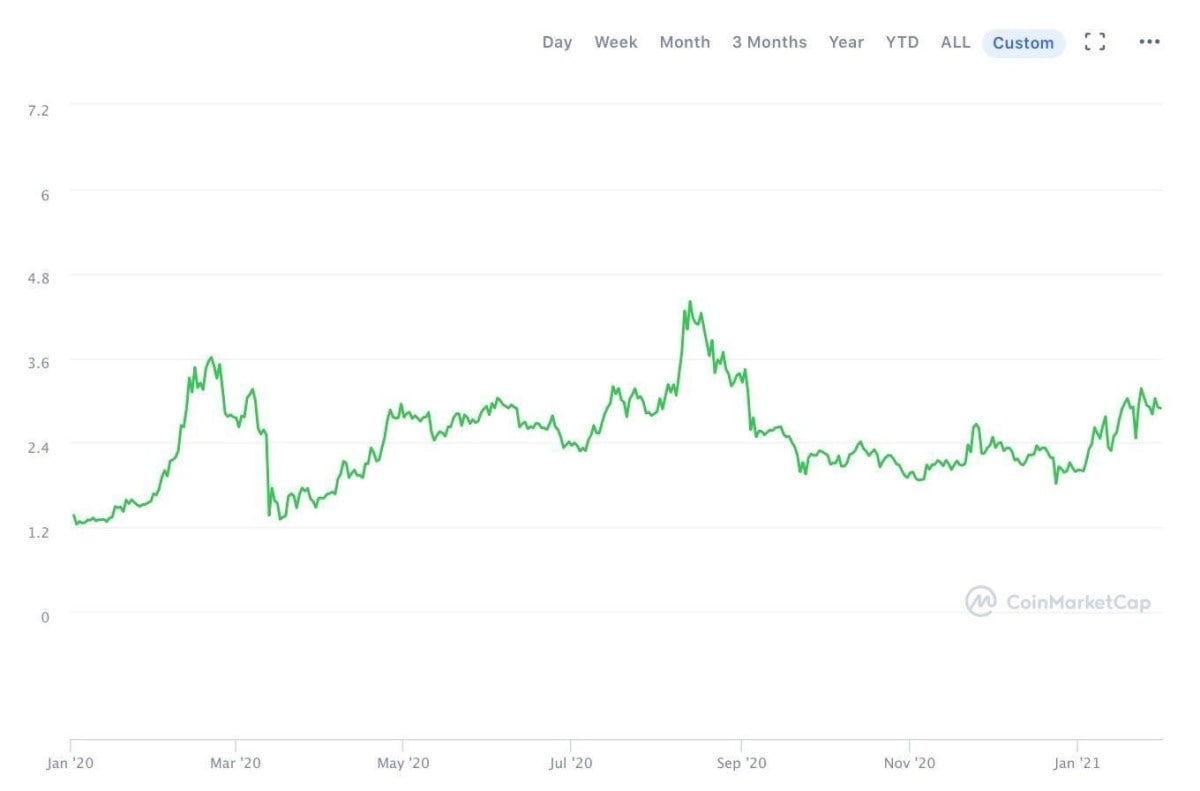

Despite quite an outstanding performance in 2019, the token lost value at the end of the year. Therefore, 2020 started on a pessimistic note. Some analysts, however, believed that Tezos was doing better than other altcoins and that the drop didn't indicate a loss of interest among investors.

On the whole, 2020 was a hard year for every industry, including the crypto market. So, it's hardly surprising the XTZ was constantly switching between bearish and bullish movements. If we look at its price action, we can notice several spikes.

The value suddenly increased due to the extensive measures taken to promote the token. In particular, Tezos improved its ecosystem by adopting two new protocols. In addition to that, Tezos introduced other changes. For example, it:

- Was chosen as a CBDC by the French bank Société Générale

- Gained two new bakers: EDF Group and Sword France

- Became a key token for a €100-million tokenised fund created by Logical Pictures

XTZ almost reached its all-time high in August 2020, when its price exceeded $4.40. This may have been because the three-year-long lawsuit finally ended. It ended in a $25 million settlement.

The year ended with positive news. XTZ gained an even more massive adoption when Sylo began supporting Tezos. The Sylo Smart Wallet boasts a community of 250,000 users, which provided the project with a boost.

In early 2021, the token experienced constant price movements. The best trend performance-wise started in mid-October, although the spikes were somewhat drastic.

The value went through ups and downs in short-lived cycles:

- From $2.00 (1 January 2021) to $5.32 (13 February 2021);

- From $3.46 (26 February 2021) to $7.23 (16 April 2021);

- From $4.44 (25 April 2021) to $7.53 (5 May 2021);

- From $2.15 (20 July 2021) to $8.70 (3 October 2021) and then down to $3.87 in December.

- After climbing back to almost $6.00 (6 December 2021), XTZ dropped even lower to $2.61 (24 January 2022).

Tezos made it to the green zone after Manchester United confirmed that Tezos would soon become its official training kit and technology partner. At the time, the coin rose to $4.55 on 9 February. However, this was muddled by the controversial lawsuit from two Tezos stakers, which the US Internal Revenue Service filed to dismiss. This brought the coin down to $2.62 by 24 February. In March, XTZ rose slightly by around 5% before entering a downtrend again. At the time of this update (February 2023), the trading price was $1.02.

Tezos Price Prediction for 2023: Will It Find Steady Ground?

In 2023, according to the short term price forecast, some think Tezos will continue to move in drastic spikes and drops. Still, it could reach the $2.22 mark in March and will continue floating at approximately the same level until the end of 2023, according to Digital Coin Price.

|

Month |

Minimum Price ($) |

Average Price ($) |

Maximum Price ($) |

|

March 2023 |

$0.85 |

$1.07 |

$2.22 |

|

April 2023 |

$0.90 |

$1.02 |

$2.18 |

|

May 2023 |

$0.89 |

$1.95 |

$2.24 |

|

June 2023 |

$0.89 |

$1.18 |

$2.18 |

|

July 2023 |

$0.86 |

$1.49 |

$2.18 |

|

August 2023 |

$0.88 |

$1.57 |

$2.22 |

|

September 2023 |

$0.84 |

$1.11 |

$2.23 |

|

October 2023 |

$0.86 |

$1.59 |

$2.19 |

|

November 2023 |

$0.85 |

$1.70 |

$2.18 |

|

December 2023 |

$0.89 |

$2.08 |

$2.15 |

However, there are less-positive forecasts. TradingBeasts, in particular, believes that the XTZ average forecast pricewon't jump higher than $1.67 at any time during the year.

|

Month |

Minimum Price ($) |

Maximum Price ($) |

Average Price ($) |

Change |

|

March 2023 |

1.14079 |

1.67763 |

1.34211 |

23.92 % |

|

April 2023 |

1.12215 |

1.65021 |

1.32017 |

21.90 % |

|

May 2023 |

1.10551 |

1.62575 |

1.30060 |

20.09 % |

|

June 2023 |

1.09022 |

1.60327 |

1.28261 |

18.43 % |

|

July 2023 |

1.07771 |

1.58487 |

1.26790 |

17.07 % |

|

August 2023 |

1.06762 |

1.57003 |

1.25603 |

15.98 % |

|

September 2023 |

1.06088 |

1.56011 |

1.24809 |

15.24 % |

|

October 2023 |

1.05791 |

1.55575 |

1.24460 |

14.92 % |

What Do Forecasts Say About Tezos' Price in the Long Term: 2030-2040

The next decadeis likely to be prosperous for the XTZ token. Once again, if we are to rely on the current trends of increasing crypto adoption, as a strong altcoin, Tezos is going to bloom. We have decided to break up the long-term Tezos coin price prediction by year.

For the sake of convenience, we'll be looking at one forecast for each year. But keep in mind that each Tezos XTZ price prediction can be different depending on the source.

XTZ in 2024

Digital Coin Price believes that 2024 might be a fairly steady year for Tezos. Here is the rundown of its Tezos XTZ price prediction with average, minimum and maximum prices.

|

Month |

Minimum Value |

Average Value |

Maximum Value |

|

January |

$2.23 |

$2.30 |

$2.57 |

|

February |

$2.21 |

$2.26 |

$2.33 |

|

March |

$2.23 |

$2.33 |

$2.62 |

|

April |

$2.21 |

$2.30 |

$2.62 |

|

May |

$2.25 |

$2.54 |

$2.70 |

|

June |

$2.20 |

$2.37 |

$2.58 |

|

July |

$2.22 |

$2.54 |

$2.65 |

|

August |

$2.23 |

$2.43 |

$2.59 |

|

September |

$2.22 |

$2.38 |

$2.46 |

|

October |

$2.21 |

$2.30 |

$2.33 |

|

November |

$2.21 |

$2.24 |

$2.66 |

|

December |

$2.22 |

$2.40 |

$2.49 |

XTZ in 2025

The forecasted Tezos price performance is expected to be a relatively uneventful year in 2025. That's the year when the token is supposed to grow slightly in value but still without some sharp movements, according to Digital Coin Price. See its price prediction in the table below.

|

Month |

Minimum Price |

Maximum Price |

Average Price |

|

January |

$3.06 |

$3.36 |

$3.21 |

|

February |

$3.08 |

$3.70 |

$3.39 |

|

March |

$3.07 |

$3.68 |

$3.38 |

|

April |

$3.05 |

$3.50 |

$3.28 |

|

May |

$3.08 |

$3.79 |

$3.44 |

|

June |

$3.05 |

$3.55 |

$3.30 |

|

July |

$3.07 |

$3.54 |

$3.30 |

|

August |

$3.07 |

$3.53 |

$3.30 |

|

September |

$3.05 |

$3.71 |

$3.38 |

|

October |

$3.05 |

$3.65 |

$3.35 |

|

November |

$3.09 |

$3.25 |

$3.17 |

|

December |

$3.07 |

$3.74 |

$3.40 |

XTZ in 2026

2026 is expected to be more optimistic for Tezos. The Tezos cost is predicted to surpass the average trading price level of $4.62, according to Digital Coin Price. See more detailed predictions in the table below.

|

Month |

Minimum Price level |

Maximum Price level |

Average Price level |

|

January |

$4.03 |

$4.11 |

$4.27 |

|

February |

$3.99 |

$4.12 |

$4.63 |

|

March |

$4.03 |

$4.23 |

$4.33 |

|

April |

$4.01 |

$4.10 |

$4.49 |

|

May |

$3.99 |

$4.19 |

$4.69 |

|

June |

$4.01 |

$4.45 |

$4.50 |

|

July |

$4.01 |

$4.18 |

$4.26 |

|

August |

$4.00 |

$4.04 |

$4.33 |

|

September |

$4.02 |

$4.16 |

$4.50 |

|

October |

$4.01 |

$4.08 |

$4.45 |

|

November |

$4.02 |

$4.53 |

$4.79 |

|

December |

$4.01 |

$4.62 |

$4.80 |

XTZ in 2027

In 2027, XTZ's price is expected to fluctuate in almost the same range, with the possibility of reaching the maximum price value of $4.04 by the end of the year. The price predictions according to Digital Coin Price are below.

|

Month |

Minimum Price level |

Average Price level |

Maximum Price level |

|

January |

$3.48 |

$3.68 |

$3.91 |

|

February |

$3.51 |

$3.71 |

$3.74 |

|

March |

$3.51 |

$3.55 |

$3.65 |

|

April |

$3.50 |

$3.60 |

$4.07 |

|

May |

$3.48 |

$3.88 |

$3.92 |

|

June |

$3.48 |

$3.76 |

$3.95 |

|

July |

$3.48 |

$3.51 |

$3.74 |

|

August |

$3.47 |

$3.66 |

$4.13 |

|

September |

$3.46 |

$3.53 |

$4.14 |

|

October |

$3.51 |

$3.75 |

$4.00 |

|

November |

$3.51 |

$3.55 |

$3.79 |

|

December |

$3.48 |

$3.65 |

$4.04 |

What Is the Tezos Price Prediction for 2030?

It's still hard to estimate what Tezos' worth will be 7 years from now. However, one thing is clear: if the token is still on the market in 2030, it will have passed the test and managed to mature. That means that it will have a reliable time-honoured infrastructure and a pool of devoted users.

This isn't far-fetched, especially when considering that XTZ's developers are constantly improving the technical backup, as well as promoting the token on the market.

Let's look at what could happen to Tezos from 2025 to 2030, according to Coin Price Forecast.

|

Year |

Mid-Year ($) |

Year-End ($) |

Tod/End |

|

2025 |

$1.68 |

$1.80 |

+72% |

|

2026 |

$1.89 |

$2.03 |

+94% |

|

2027 |

$2.23 |

$2.43 |

+132% |

|

2028 |

$2.63 |

$2.83 |

+170% |

|

2029 |

$3.03 |

$3.10 |

+196% |

|

2030 |

$3.29 |

$3.48 |

+232% |

Tezos Technical Analysis

If you want to be a professional trader, mastering technical analysis is a must. Technical analysis is the process of examining and forecasting price fluctuations based on historical data and market statistics. In other words, you'll be able to make your own Tezos price prediction relying on the available data.

You'll need to analyse the historical price chart and apply some analysis to technical indicators like MACD, RSI (relative strength index), or OHLC. To interpret the chart, you'll first need to learn some basic terms:

These indicators are necessary to describe past price performance and identify price movement patterns. Afterwards, they can be applied to predict XTZ's future prices.

What Do the Experts Say About Tezos' Price in the Long Term?

Predictions for Tezos' price in the long term vary among experts and analysts. Some believe that Tezos has the potential to become one of the major players in the crypto world, while others are more cautious in their outlook.

Although Tezos has already gained a significant position in the crypto market, it has already been criticised, primarily because of the lawsuits brought against it. Some community experts also don't approve of its governance philosophy. In particular, Vitalik Buterin, the founder of Ethereum, has often disagreed with the policies Tezos' team has implemented.

Nonetheless, experts can't deny the benefits of the token and the technology behind it. Even Buterin admitted that it was "well-thought-out" tech and hoped it would do well. Such positive market sentiment is a reason to believe in an optimistic Tezos price prediction.

What to Do with Tezos: Do I Trade or Invest?

Generally, Tezos is a rather stable altcoin that may be suitable for investors in the long term. That scenario may take place if the market keeps doing well. However, one shouldn't dismiss possibilities that can undermine their investment strategy and lead to financial collapse.

With this in mind, trading presents more options at the moment because you don't have to rely solely on price growth. Since the overall XTZ price forecast is positive and the coin is likely to gain in value, trading can be profitable as long as you manage to navigate the bullish and bearish trends. But please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital. If you want to be extra secure and confident, open a risk-free Libertex demo account. This will help you learn about the market in a safe, risk-free environment.

FAQ

Is Tezos a Good Investment in 2023?

Yes, the coin is considered to be a good investment in 2023. The coin is likely to increase in value in the long run, with the majority of analysts forecasting a bullish trend for XTZ. However, as with any investment, before you decide to buy Tezos, it's important to do your own research and consider a range of opinions before making any decisions.

Is Tezos Worth Buying?

Yes, the token is worth buying. According to XTZ price predictions, it will likely increase in the coming years. Some experts say that Tezos has a bright future ahead. At the moment of writing, Tezos' current price is $1.04.

Does Tezos Have a Future?

Yes, Tezos has a future. No market analysts currently predict the crypto's collapse. On the contrary, it is currently strengthening its position.

What Will Tezos Be Worth in 2030?

Currently, there are no precise estimates about Tezos' price in 2030. However, if it manages to survive until then, according to some experts, its price may even hit $10.

Is Tezos Volatile?

Crypto is a volatile market, which means price fluctuations are normal for Tezos. Last year alone showed that this coin could experience sharp movements, doubling and tripling in price before dropping. Based on these facts, we can expect the same level of volatility in the future as well.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.