What Is a Market Maker?

If you want to do well in the trading world, you should learn who's running the financial markets and who stands in your way. In this guide, we'll cover everything from a broad definition to common myths and trading advice.

Market Maker Definition

Market makers are also referred to as liquidity providers, which vaguely explains what they do. Market makers are usually large banks or financial institutions that keep the market functional by infusing liquidity.

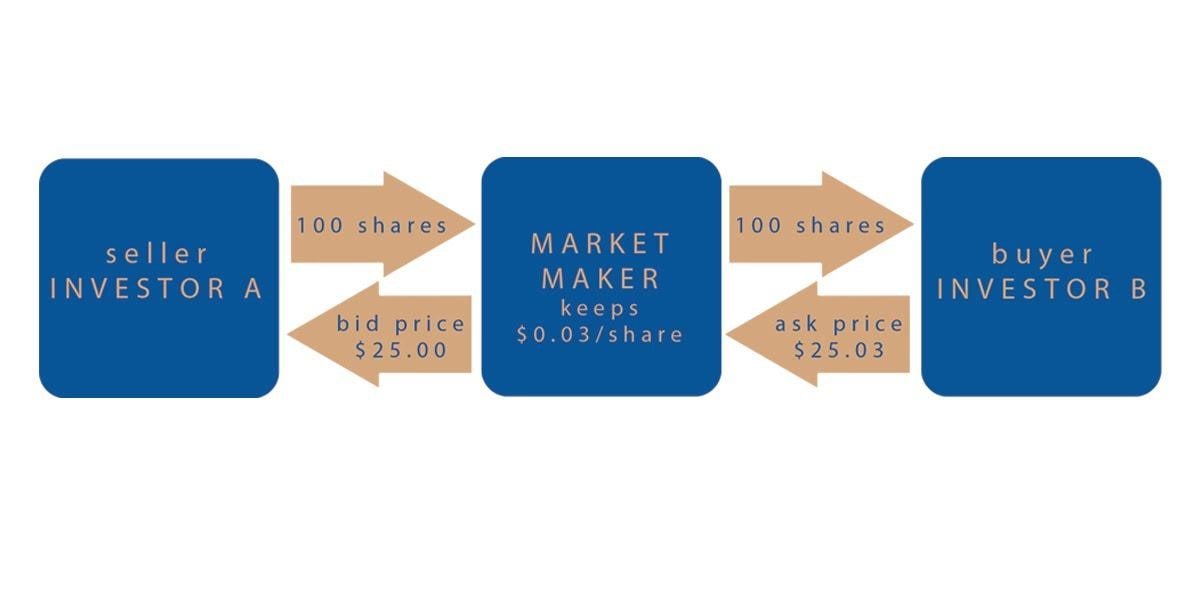

In simple terms, they ensure financial assets can easily become 'usable' money. If you want to sell an asset, they're there to buy it. If you're going to buy an asset, they can sell it. In turn, they take a commission in the form of the bid-ask spread.

Market making is prevalent in currency exchange, where the participants tend to be banks and foreign exchange trading firms. In theory, an individual can also 'make a market', but the size of the investments needed is a huge hindrance. It takes enormous funds to be able to always stand at the ready to buy or sell.

Example of a Market Maker

Say the current market price of EUR/USD is $1.05. Suddenly, there's news indicating that the EUR is going to rise. This should prompt individual traders to place market orders at $1.05. However, there will likely be an influx of buy orders at some point.

A market maker, anticipating this behaviour, sets the price at $1.10. Because of the high number of market orders, the market price may rise, let's say, to $1.15, and because of demand, fall back to $1.12. A market maker will then sell their EUR/USD inventory to meet peak demand at $1.15 and restock it when it drops to $1.12.

Types of Market Makers

We can distinguish three types of market makers by their specialisation: retail, institutional and wholesale.

Retail

This type of market maker arranges the retail order flow and services customer orders coming from retail broker companies. In other words, they answer the needs of individual traders.

Institutional

Institutional market makers operate with larger block orders. These can come from mutual funds, pension funds, insurance companies and asset management companies. This requires them to keep a substantial inventory on hand.

Wholesale

Wholesalers trade assets in large volume pools. Trading is often carried out through a high-frequency trading algorithm that optimises the bundling and spread arbitrage strategy. These firms are responsible for arranging order flows and compensating brokerages.

How Do Market Makers Work?

Market makers control how many asset units (stock, currency, etc.) are available for the market. Based on the current supply and demand of said asset, they adjust the price.

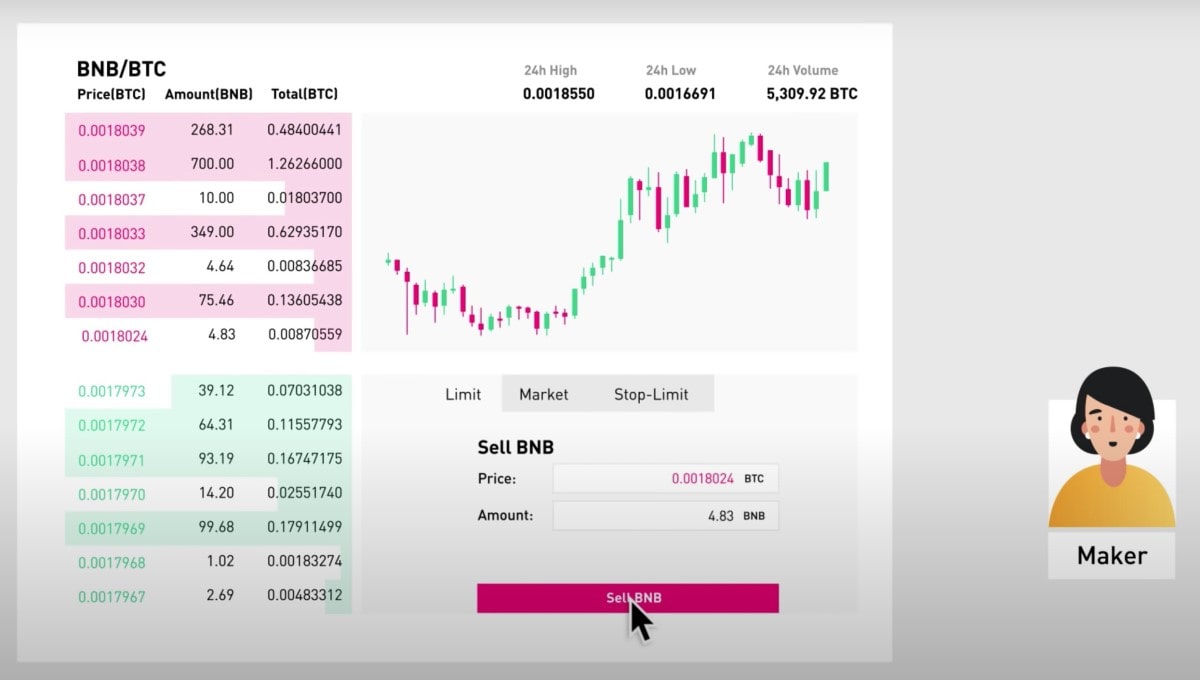

They provide liquidity for the order book by placing orders that can be matched in the future. Then, market takers (traders, for example) consume the inventory by taking the order from the order book.

Market makers are known to hold a disproportionately large number of assets. The reason why is they need to be ready for a high volume of orders in a short time at competitive pricing. If investors are buying, they're supposed to keep selling, and vice versa. They take the opposite side of trades being executed at any given time, i.e., acting as a counterparty.

Each market has its own market makers, which means that each broker uses a quote given by one or several market makers when offering prices to clients.

What Is the Role of a Market Maker?

To better understand what a market maker does, it's worth looking into the functions they perform in the market.

Price Continuity

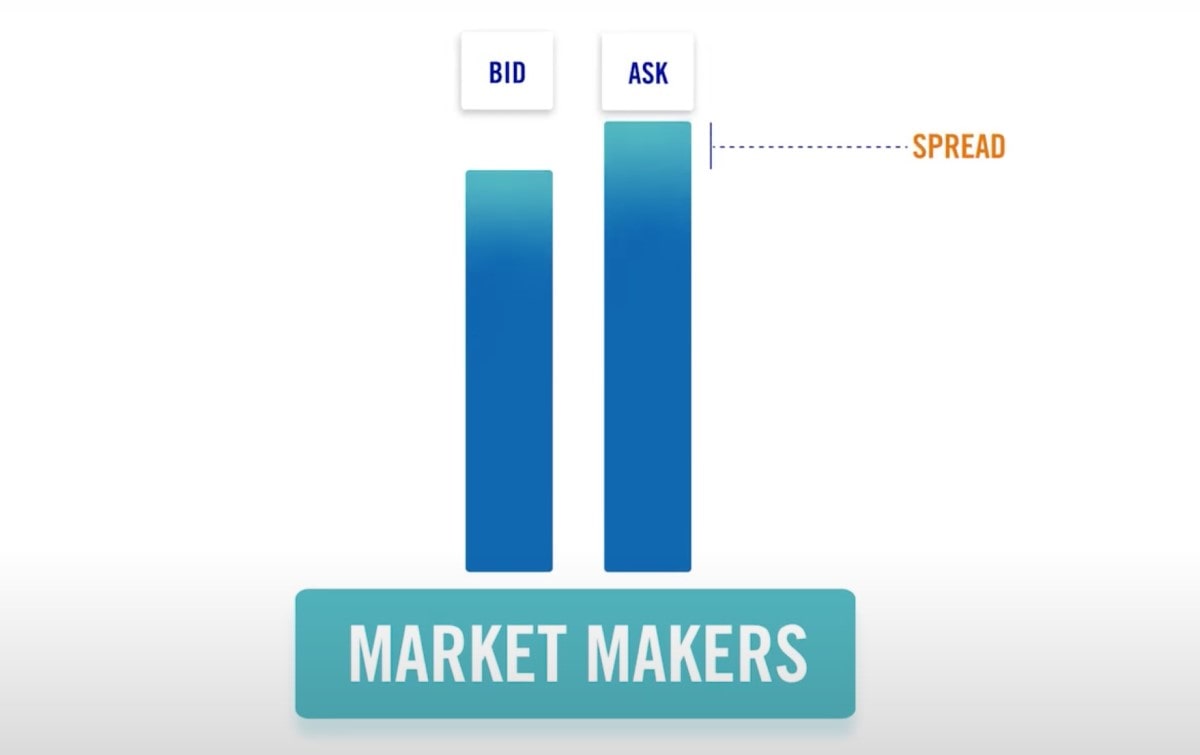

Price continuity characterises a liquid market with a relatively small bid-ask spread. Essentially, it's a cornerstone of reliable market making. A market maker should show the ability and willingness to make a price in a range of sizes, even despite significant volatility. Capital commitment and diverse distribution channels play an important role in doing that.

It should be noted that market makers don't provide price consistency for altruistic purposes. Even though it contributes to the market's health, they have their own stakes. Market makers tend to incur losses when the price continuity rule isn't adhered to.

Trade Continuity

Market makers need to have a continuous presence and provide the immediacy of dealing. Whenever an asset is bought or sold, there must be someone on the other end of the transaction.

If an institution offers real-time trading to its clients, a reputable market maker will facilitate this feature.

Flexibility and Coverage

Market makers enhance their service by providing flexibility in certain areas. In particular, they can offer non-standard settlement dates and the opportunity to settle in multiple currencies.

Moreover, instead of only picking a handful of assets, a market maker has to cover a broad range of instruments to its clients. This proves the market makers' commitment to client satisfaction.

Intermediation

By intermediary function, we mean several ways of intervening in the market:

- Serving as a link between sellers and buyers.

- Determining the opening price. At the start of a trading session, a market maker must define the optimal opening price.

- Actively quoting two-sided markets. According to market rules, a transaction can only be made with the participation of a market maker. That means that online quotes provided by market makers can be considered legitimate.

- Providing up-to-date information to all market participants. For example, on market prices.

- Maintaining market balance. There are times when sell orders exceed buy orders significantly. In these cases, market makers use their own funds to ensure the balance.

How Do Market Makers Make Money?

Market making is associated with risk brought over to trading books. To compensate for that risk, a market maker charges a fee in the form of commissions or the spread. Unlike traders, a market maker doesn't raise money by buying low or selling high.

Let's look closely at the two most important sources of market-making:

- Bid-Ask spread: Participants buy at the market makers' ask price and sell at their bid price. The market maker keeps the difference, so the more transactions are made, the bigger their profit is. Spreads tend to be tighter in more actively traded assets, though, since many market makers could compete for it.

- Commission: High-volume clients, such as brokerage houses, are charged a fee. Usually, it doesn't depend on performance and is charged for the services in general. Otherwise, it would create a conflict of interest between the client and the market makers.

How to Become a Market Maker

Anyone can become a market maker/liquidity provider if they meet the requirements. The catch is that it's practically impossible for a regular person to perform minimum trading functions. More commonly, only a large institution can sustain the required volume of trading.

But if you're interested in the process of becoming a dedicated market maker, here's how it goes:

- Verify eligibility and become familiar with exchange expectations.

- Complete all necessary paperwork to get a market maker permit.

- Apply to authorised exchange staff.

- Provide proof for Guaranteed Minimum Fill for eligible orders.

- Wait for the solicitation and approval process.

If we look at the topic more broadly, we can disregard the official "market maker" title. In essence, any participant with a significant share of operational volume makes the market in a way.

Advantages and Disadvantages of Market Making

The advantages of the market maker concept are exciting for smaller accounts and private investors. As for disadvantages, they're primarily applicable to advanced traders.

Advantages

- Continuous trading throughout trading hours. This provides a sufficient number of opportunities to enter and exit a trade.

- Competitive spreads guarantee. Spreads are kept fairly reasonable since there is stiff competition between numerous market makers.

- Investor confidence. Market makers have the expertise needed to analyse assets, and their activity can help indicate whether it's worth investing in.

Disadvantages

- Conflict of interest. Market makers are essentially traders' counterparties. This creates a divide that investors need to be cautious about.

- Impact market integrity. Their actions affect the price in the market. This behaviour comes with a risk of negatively affecting the health of the market and investing.

- Insider trading. Market makers have information that isn't disclosed to the general public that may lead to unfair profits.

Market Maker vs Broker

Let's avoid confusing market makers with brokers because they seem similar in many ways. The table below compares the two.

|

Market Maker |

Broker |

|

Acts as a source of liquidity for exchange-traded assets |

Facilitates selling an asset to a seller and purchasing for a buyer |

|

Large banks or financial institutions |

Individuals or firms |

|

Heavily influences the market |

Doesn't have a direct effect on the market |

|

Charges spreads between the price that traders receive and the one the market sets |

Charges fees and commissions |

|

Has deep market insight (an advance look at all incoming orders) |

Possesses the same information as the rest of the market |

|

Doesn't work for clients; instead, they create a market for investors |

Provides services for clients (consulting research, investment advice) |

List of the Largest Market Makers

Below is the list of market makers that are considered the largest in the world. Bear in mind that it's hard to compile their exact rating, but here are the companies that are worth traders' attention.

GTS

GTS, a leading electronic market maker across global financial instruments, has a total of over 10,000 different instruments globally. The list includes equities, ETFs, commodities, futures, foreign exchange and interest rate products. On the New York Stock Exchange alone, it accounts for $12.5 trillion of market capitalisation.

Citadel Securities

This financial institution manages over $30 billion in assets and is responsible for over 28% of US retail equity trading volume. In 2020, it was one of the few market makers that multiplied its revenue despite the crisis. Due to an increase in volatility and retail trading, the company doubled its profit, earning $4 billion.

J.P. Morgan

J.P. Morgan is a global leader in financial services that aims to resolve working capital and efficiency challenges. Technology powered by J.P. Morgan's leading market-making franchise does the heavy lifting to aggregate liquidity. In 2019, the company was deemed Best Market Maker (Major Currencies) and Best Market Maker in Emerging Markets by Profit & Loss Readers' Choice Awards.

Deutsche Bank

Deutsche Bank manages positions for its own account in the same products and handles clients' FX and PM products. This provides sufficient capacity to fulfil anticipated customer demand and react to market movements. Throughout 2020, the bank continued providing prices and making markets even on traditionally illiquid products (synthetic notes, long-dated cross-currency swaps or structured products).

Jump Trading

Jump Trading, the publicity-shy market maker, uses best-in-class technology and combines sophisticated quantitative research. Despite being in operation since 1999, the company remains highly secretive. Reportedly, Jump Trading and its sister company, Jump Capital, are currently diving deeper into crypto.

Myths About Market Makers

Most of us have heard the assumption that the market is manipulated by some power driving prices in whatever direction they need. If these claims come from newbies, it makes sense. However, blaming all losses on shadowy puppeteers can quickly become detrimental.

Below are several myths that we can clarify.

They Have All the Power

If a market maker were to manipulate prices, they would be charged with a criminal offence. At the very least, they would be stripped of their license. This has happened in the past. For example, many Russian banks lost their licences trying to manipulate the rouble exchange rate during the Russian-Ukrainian crisis.

Sure, markets can be controlled, but markets are global in nature and have hidden political or economic motives rather than intervening in trading activity.

Market Makers Can Collude and Conspire

Once again, there are regulations in place that prohibit such activity. Collusion and conspiracy with the aim to make speculative profits aren't tolerated. Different liquidity providers are mostly in competing positions.

Market Makers Initiate the Majority of Trades

Market makers open approximately 10-15% of total trade volume. That's not enough to fully form the market value of an asset.

Market Makers Arrange the Stop-Loss Trap

There's a myth that a market maker can hunt Stop-Losses. Stop-Losses are insignificant for market makers' activity because they're invisible until they become market orders. If they want to provoke the crowd to make trades in the right direction, they can do so in other, more effective ways.

Why Should Traders and Investors Be Aware of Market Making?

Market makers have a significant impact on the market and, hence, your trading success. Here's how you can use that to your advantage.

Include Market Makers in Fundamental Analysis

Don't get caught up with technical indicators. Instead, make sure to include fundamental analysis in your trading strategy and incorporate knowledge about market makers and how they keep the market balanced.

If you're trading in CFDs, apply intermarket analysis to the stock and commodity markets as they're closely related. It's quite possible to find assets ahead of your selected currency pairs' dynamics; these can be useful as additional indicators.

Trade with Market Makers, Not Against Them

You don't necessarily need to overcome market makers. You can sometimes win by working just like them. Market makers profit from impatient, uninformed traders. Try to get in the mind of an informed trader and enter the market before the market maker balances it out. Analyse data on real volumes using exchange platforms or special indicators for MetaTrader.

Know How to Avoid Market Makers

If you don't want to deal with market makers' direct influence, switch to a different time frame. Large players (except for HFT) aren't interested in scalpers, and the risk of being affected by a market maker is much smaller for medium-term trades.

Conclusion

It's undeniable that the market maker's role is technically difficult but has real value for the market and exchanges. These participants must commit to maintaining fair prices for different types of assets and covering demand at any time. You may not have known it before, but market makers have always been present in financial markets. Otherwise, large-volume orders would only be executed with long delays, making trading impossible.

To get started on the right note, sign up for a demo account at Libertex. You can use it to practice and master your strategy in a simulated market.

When you upgrade to a live account, you'll already be accustomed to how the market works and make sound decisions. And thanks to market makers and our platform, you can open positions within a matter of seconds.But please note that trading CFDs with a multiplier can be risky and lead to losing all of your invested capital.

Finally, here's a quick round-up for this topic.

FAQ

Who Are the Biggest Market Makers?

In addition to the large banks or financial institutions mentioned in the article, we can point to UBS, Citi, Barclays, Virtu Financial, Two Sigma Securities, Hudson River Trading and AlphaTheta.

Is Market Making Illegal?

No, managing the spread and liquidity pool isn't illegal in any market. As long as it keeps the secondary market as healthy as possible, it's perfectly acceptable. However, there's a line where it could get illegal, such as wash trading and other efforts to push the price up.

Can Market Makers Lose Money?

Yes, market makers face the risk of being stuck in the wrong positions. For example, when they purchase an asset from a seller, and a sharp decline occurs before it's sold to a buyer. Market makers are trading against market volatility and informed traders.

How Much Does a Market Maker Earn?

It depends on the different classes of market makers and where they're employed. According to Glassdoor, the average base pay is $98,000/year. But it can also go up to $150,000-$200,000/year.

Can Anyone Be a Market Maker?

Technically, yes. There's no rule stopping individuals from becoming a market maker, and whenever you have a bid and offer entered, you're making a market, albeit a small one. But to actually influence the market, you'd need billions of dollars.

Do Market Makers Trade Against Individual Traders?

Yes and no, but there's nothing to fear in the currency market. Market makers sometimes have an incentive to lose. Their ultimate goal isn't to use individual traders but rather to ensure balanced market conditions for all.

Are Banks Market Makers?

Not all of them. On the one hand, banks do benefit from making markets in conventional spot and forward foreign exchange contracts. There's also a degree of intermediation in volatility-related products. However, banks can't accurately forecast changes in exchange rates, and often enough, they barely earn anything from market making compared to other sources of revenue.

Who Is a Market Maker in Trading?

Market makers create a digital market for online traders. In the contexts of the CFDs instrument, market makers are funding banks, central banks, business banks and massive brokerage companies.

What Is Market Making?

Market making is when a company or an individual buys and sells large amounts of a particular asset. Their main role is to ensure a certain level of liquidity and, thus, keep the financial markets running efficiently. These participants need to meet capital requirements to facilitate transactions.

What Are a Market Maker and Taker?

As the name suggests, market makers make the price and contribute volume to an exchange's order book. A market maker places orders with prices that differ from the current market price. Market takers work with the price given to them and take volume off of the order book.

Can Market Makers See Your Stop-Loss?

Stop-Loss orders are sent to the market, but they aren't displayed on the public order book. Instead, they're displayed just like any other sell order without clarifying that it's a Stop-Loss order. As for Trailing Stops, your broker sits on them until they're triggered and sent to the open market later.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.