Becoming a CFD Trader: A Comprehensive Guide

Who a Trader Is: Definition

Before we teach you how to become a trader, you should understand that there are two terms often used simultaneously: investor and trader. Where does the difference lie?

An investor puts their money in an asset for an extended period and waits for the price to increase. Usually, investors open positions in one direction. If they own the security, they sell it. If not, they buy it and wait until the asset goes up to sell at its peak price.

A trader is a person who speculates on the asset's price.

A trader speculates on the asset's price. It's possible to both buy and sell an asset at once without owning it. The idea is to catch the market direction and trade according to it. The trader can open as many positions as their funds allow.

Trader Types

There are many classifications of traders. We'll start with independence.

Level of Independence

Independence shows whether the trader operates on behalf of others or for a personal result.

Trading on behalf of others. Some traders work on behalf of a client. They trade with the client's funds and take a commission for their service. Although they don't risk their money, they risk their reputation.

Such traders should have solid experience and a high rate of well-executed trades. Usually, they work for an institution or company that owns enough money to enter the real market. Let us remind you that one standard lot equals €100,000.

Trading on behalf of others is the second step in your trading career that requires professional education, long-term experience and confirmed skills.

Independent trader. Some people trade on their own, only using the services of a broker that provides an online platform. In such a case, traders risk their own money, while anything their positions generate belongs to them. It can be your first step in a trading journey, where you gain enough experience before working for an institution. Still, many traders don't work for others - instead, they want to be in charge of their own funds and positions. In this article, we'll talk about them.

Trading Style

The next classification is the trading style. Traders use various timeframes, open and close trades differently. Their approaches to trading vary according to their purpose.

- An intraday trader is the one that opens and closes positions within one trading day. It works well if you don't want to handle a swap.

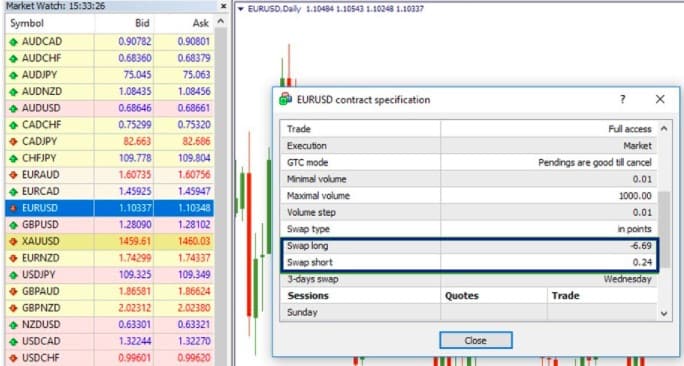

A swap is a small sum that is either charged or paid for keeping the trade overnight. If you use a MetaTrader platform, you can view the swap values there. Open the 'Market Watch' panel, click the currency pair you want to trade, choose 'Specification'. The window with the information about the instrument will appear. There you can find the size of the swaps for long and short trades.

- A swing trader is one who waits for the market to change its direction. Swing traders use technical analysis to predict the price reversal and trade within a trend. Usually, they hold a trade for longer than a day as the strong trend forms for several days.

- Scalperare traders who open many trades within a single day. The number of positions may amount to hundreds. Such a trader uses small timeframes. The risk is hidden in the spread, a commission paid to a broker for opening a position.

- A momentum trader is the one that determines the strong trend and trades within it. The asset should have a significant volume. The trade is kept for at least several days regarding the chosen timeframe.

Analysis

Traders use various types of market analysis to predict the price direction.

- Technical analysis. Such traders rely on past market movements. They use technical tools such as charts, candlestick patterns, indicators that reveal the market direction.

- Fundamental analysis. Fundamental traders believe that market sentiment affects the price direction. The market mood is based on current events. To predict the asset's direction, they read the news and check the economic calendar. Positive events will lead to the rise of the asset; negative events will cause the drop.

- Mix. Nevertheless, some traders prefer combining both methods. Technical analysis can't measure the current market sentiment properly, and fundamental analysis doesn't include indicators predicting certain price levels. So, they perform both kinds of analysis to get the most information.

Tools to Become a Trader in Financial Markets

Many beginners ask how to become a trader. Fortunately, you don't need specific certifications, qualifications or equipment. But the situation might be different if you aren't going to work for a financial institution and present other people's interests.

Generally, all you need is:

- PC or smartphone. Most CFD brokers provide a user-friendly mobile version of the trading platform. Thus, you can trade whenever and wherever you want, just by having an Internet connection.

- Basic knowledge about the financial markets. Although you don't need to provide certificates to a CFD broker, knowing how the market works is vital. Without it, you'll lose immediately.

- A reliable broker. Unless you have enough funds to trade without a broker, you should find a reliable brokerage firm to present your interests and open trades on the market. A regulated broker provides clear conditions, has proper authorisations and many satisfied clients.

- Some funds. Although brokers provide multiplier options, you should have at least €100 to enter the market. Remember that the funds you have determine the size of trades, the amount of possible profit and the ability to handle unpleasant market situations when it moves against you.

A multiplier is the kind of fund support the broker offers to a trader to open more significant trades. It's not a loan, so the trader doesn't have to return the money.

What to Know About Becoming a Trader

Becoming a trader is just one step - the actual trading journey is much harder. Let’s go through the steps you’ll need to take.

Step 1. Decide who you are

First of all, you need to have a solid strategy to define when you should enter and exit the market. It won't work if you don't know what approach to use.

Your trading approach will depend on the amount of time you are prepared to spend on trading.

It's vital to understand whether you consider trading a hobby, part-time or full-time job. How can you scalp if you are busy with your main job? What will you be occupied with if you use a momentum method that allows you to leave the computer for several days?

If you still doubt what approach suits you more, practice on a demo account. A Libertex demo account provides a wide range of trading instruments so that you can decide whether you're a scalper or trend trader.

Step 2. Required skills

Specific skills also define what a trader is. It's essential to understand how to deal with market volatility, enter the market at the perfect time, determine the best market conditions, etc. Also, you should know how to analyse the market using fundamental and technical methods.

Step 3. Choose the market

Although you can trade any asset, many people choose to trade securities that they have experience with and knowledge about. Do you know the difference between the USD/TRY and USD/JPY pairs?

The Turkish lira is an exotic currency, so it's risky. Thus, it's highly volatile; economic events are unlikely to affect its direction as much as they impact the Japanese yen. The main factor that will determine the strength of its movements is the news. Geopolitical events and conflicts affect its direction.Beginners typically avoid exotic currencies, as they aren't skilled enough to deal with enormous fluctuations.

Unlike the Turkish lira, the Japanese yen is considered a less risky asset - but don’t be mistaken, there are still risks. Historically, JPY has been rising during adverse events and falling when the market is calm. The USD/JPY is one of the major pairs that is often used by beginners.

Choose major currencies and avoid exotic ones if you're a newbie.

Step 4. Learn daily

Trading isn't just opening and closing positions - in fact, it requires specific knowledge. That's why you should practice different strategies, learn how to analyse the market and know all the basics of trading such as spread, swap, indicators, etc.

Step 5. Count risks and rewards

It's essential to understand how much you can earn and lose. For this, learn about risk management, multiplication, and position size. These factors determine the risk level you can bear and define your possible results in the future. Learn about Take-Profit and Stop-Loss orders to manage your trades more precisely.

Step 6. Trading strategies

It's time to create your own strategy or choose an existing one. The trading strategy is the set of specific conditions that determine entry and exit points. These can be based on particular actions of trading indicators, breakouts of distinct levels or the creation of chart/candle patterns.

Step 7. Practice on a demo account

Some traders prefer to practice on a demo account before entering the real market. Such accounts have the same assets and instruments and allow traders to see how their strategies may behave in market conditions.

The downside of a demo account is that it doesn’t create real emotions. But, you can put the strategies you learn into play once you enter the real market.

Trader Psychology: Tips

Another crucial point we should talk about is trader psychology. You won't learn how to become a trader if you don't figure out the psychological factors that may affect your trades. It seems unnecessary, but many traders make mistakes because of the wrong psychological approach. There are many resources available that give tips on mastering your emotions while trading: for instance, “Trading Psychology: The Bible for Traders.” We’ve compiled some tips from trading psychology authors on which characteristics you should avoid when trading:

- Too confident. It doesn't matter how long you've been trading; you can never be 100% sure of the market direction. You should always use Stop-Loss orders, never trade against the prevailing trend and avoid opening trades that exceed your funds. Markets are tricky, and you may lose all your money in a matter of seconds.

- Lack of attention. When you're a newbie, you pay attention to each small detail. As you get a little experience, you'll start to believe you know everything about the market and can predict its direction without mistakes. You ignore significant factors that can affect the market movements. Never lose control. Never leave trades unattended for a long time.

- Game. Some traders believe trading is just a game. It's not - especially when real money is on the line.

- Concentration on losses. Some traders can't deal with failures and focus on them instead of thinking about new options Every trade may end up at a loss or a profit. If you lose once, review your mistakes, mind them and move on.

- Fight with the market. It's a dangerous mistake when traders concentrate on their losses and invest more money in the losing trade, trying to persuade the market that they're right. If the market moves against you, set a Stop-Loss order and don't let the trade exceed it.

Only professional traders can use trailing Stop-Loss and Take-Profit orders. If you're a beginner, you may be too confident in your forecast and miss the moment when the market passes the return point.

What Is the Potential Return for a Trader?

No one can answer this question as trading isn't a job with a fixed salary. Your potential income depends on many factors. These include deposits, the asset you trade, the trading approach and the moment you enter and exit the market.

However, your deposit affects the final results. For calculation purposes, we'll consider 0.01 lot size as the standard lot is €100,000, and this sum is too big for newbies.

- €100. Imagine you deposit €100. Regarding the risk-reward ratio, you should remember that the risk shouldn't be higher than 5%. We'll use 3%. Trading 0.01 lots, the Stop-Loss order can be placed 30 pips from your entry point. So, you risk €3. The Take-Profit is three times bigger than the Stop-Loss as the perfect risk-reward ratio is 1/3. So, the Take-Profit is 90 pips or €9.

- €500. The risk is the same: 3% or €15. With the same position size, each pip costs €1.5. If you need faster results, you can increase the position size. A higher reward should be accompanied by a broader Stop-Loss order. For example, 0.1 lot. Thus, each pip will cost €1. The risk can be increased as well. Let's imagine it's 5%. In this case, the Stop-Loss costs you €25, but the profit will increase to €75.

If you want to start small, it's totally up to you - assess how much you can afford to lose and what your goals are.

Being a Trader: Benefits and Limitations

Knowing what a trader is isn't enough to understand what pitfalls this role hides. If you're still unsure whether you're ready to be a trader, check the limitations and benefits first.

|

Benefits |

Limitations |

|

Win-win strategy. You can place sell and buy orders without owning the asset. It gives you much more flexibility. |

Time. Markets fluctuate significantly. If you don't monitor the price for a long time, you could lose most of your funds. |

|

Small funds. If we compare investing with trading, the latter requires smaller funds. No matter whether you trade currencies, cryptocurrencies, stocks (CFDs) or metals (CFDs), you can enter the market having only several dollars as online brokers provide multiplication. |

Smaller gains. If you trade daily, you have a chance to earn the amount that will satisfy your expectations. However, profits may be followed by losses due to market volatility. Investing may provide higher rewards, but risks still exist. |

|

Knowledge. If you want to be a trader, you need to constantly acquire new knowledge and analyze the market. Please remember that if you want to place your trades efficiently, you should continually work on your skills. |

Losses.Although market direction can be seen on the chart without special tools, many traders fail because of several factors. First, the market is highly volatile. If you trade within a short period, there are risks the market turns against you. Second, many traders undervalue the importance of knowledge. Only by practising and learning daily can you achieve the desired results. Some traders choose to do so by practicing in a demo account. |

|

Rapid rewards.Unlike investing, trading doesn’t take years. You can trade on minute timeframes and even see results within a day. |

Conclusion

So, you've learned what a trader is. To become a trader, you don't need specific skills or equipment. Everyone who wants to trade can do so. However, it's not a game; it's a job that requires knowledge and a willingness to improve daily.

Many good traders spend plenty of time reading educational materials and practicing in a demo account to gain knowledge and skills in a controlled environment.

Please note that trading CFDs with the multiplier can be risky and can lead to losing all of your invested capital. A Libertex demo account is the most comfortable way to begin your trading path. As soon as you feel confident enough, you can move to the real account. Libertex provides a wide range of assets, trading indicators, tight spreads.

Let's answer the most common questions about traders and trading.

FAQ

What It Means to Be a Trader?

Being a trader, you speculate on the price changes. The main idea is to predict the market direction and open positions at the right time.

What Is a Trader's Role?

There's no specific role as a trader. A trader is a part of the financial world that participates in money movements.

Is Becoming a Trader Worth It?

It depends on your goals. Some people are looking for fast results and want flexibility, while others are fine with slower results and choose to invest instead.

What Skills Does a Trader Need?

To become a trader, you should know the basics of financial markets, understand the trading process and be ready for losses.

How Many Hours Do Traders Work?

It depends on the goal. If you consider it a full-time job, you may spend the whole day trading and exploring new strategies. However, if it's just a hobby, you don’t have to spend a lot of time on it.

Is Being a Trader Hard?

Traders often do the hard work of studying the market, making analyses, and practicing their strategies. The hard work may pay off - but you should be aware that there are no guarantees.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.