Everything You Should Know About Asian Stock Markets

Although all stock markets work similarly, Asian stock exchanges have unique features you should know about. Our guide will provide all the valuable information on that.

What Is a Stock Market?

Before we start with Asian stock markets, let's clarify what a stock market is.

A stock market is a place where shares of publicly listed companies are traded. They can be bought and sold by traders, investors and hedge fund managers.

A stock market is where shares of publicly listed companies can be bought and sold by different kinds of investors.

The stock market serves as a barometer of the world's economic health. It comes as no surprise that stocks surge in times of positive sentiment and plunge in unstable times.

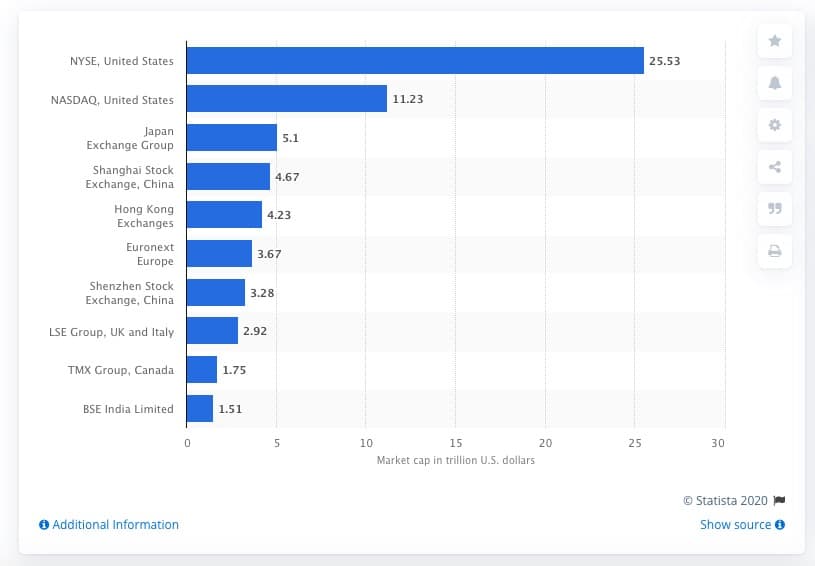

Here's a list of the largest stock exchanges by listed companies' market capitalisation as of March 2020.

As you can see, the Japan Exchange Group, Shanghai Stock Exchange and Hong Kong Exchanges are ranked third, fourth and fifth, respectively.

If you still need reasons to invest in Asian stock markets, continue reading.

Why You Should Invest in Asian Markets

Here are a few good reasons to invest in these markets:

- Strong economies. The Asian stock market encompasses many countries, most of which have strong, competitive economies. In general, Asia is a subject of steady, fast growth.

- Diversification. Consider this market as a way to diversify your portfolio. The Asian market is diversified, so it may work well to hedge your funds.

- Additional hours. It's not a secret that Asian stock markets work while other parts of the world sleep. Investing here could be an option if you're looking for additional opportunities.

- A considerable part of world stocks. Three Asian stock exchanges are among the top five world markets. It means that they include an enormous part of the world stocks that you can trade.

Asian Stock Markets Benefits and Drawbacks

Let's consider the pros and cons of Asian stock markets.

|

Benefits |

Drawbacks |

|

Giant companies. Asian stock exchanges are in the top 5 world stock exchanges by company capitalisation. |

Regulation. Asian regulation is stricter than in other regions. |

|

Additional opportunities. Asian stock markets operate at different hours compared to European and American ones. You have extra hours to trade. |

Different factors. Asian economies and companies may differ from well-known American or European ones. |

|

Leading economies. Strong world economies are represented in Asian markets. They provide excellent opportunities for successful trades. |

List of Asian Stock Markets

Let's look at the largest Asian stock exchanges.

Tokyo Stock Exchange

The TSE is the largest Japanese stock exchange created on 15 May 1878. It includes shares of 3,700 of the country's largest companies. If you want to trade shares of such Japanese giants as Honda, Mitsubishi and Toyota, this is the place for you.

Hong Kong Stock Exchange

The Hong Kong Stock Exchange was founded in 1891. As of October 2020, its market capitalisation was $43.3 trillion. It's represented by Chinese banks and insurance companies, including the Bank of China, Industrial and Commercial Bank of China and China Construction Bank.

The exchange has over 2,500 companies. To be listed on it, the minimum market capitalisation requirement is HK$500 million. At the same time, the minimum value of the public float is HK$125 million.

Shanghai Stock Exchange

This is one of the world's largest exchanges and one of China's three leading marketplaces. Surprisingly, the Shanghai Stock Exchange isn't fully open to foreign investors; it's subject to tight capital account controls.

The stock exchange is relatively young, having been established in 1990. All the listed stocks are divided into A and B types. A-stocks are traded in Chinese yuan. B-stocks are denominated in US dollars and were created only in the 1990s for non-residents.

The Top Asian Stock Market Indices to Trade or Invest In

There are several options to invest in the stock market. You can buy and sell real companies' shares, invest in indices or trade stock and index CFDs.

As a reminder of what indices are, an index is a combination of stocks representing one stock exchange and acts as a benchmark of economic health, such as the DJIA, DAX and FTSE 100 indices.

An index is a combination of stocks that represent one stock exchange.

The essential advantage of investing in a stock index is the ability to hedge your funds and get rid of choice. It can be challenging to choose the right stock that will be potentially profitable in the future. When you select an index, you don't need to waste your time researching multiple shares.

Let's choose an Asian stock index.

Nikkei 225

Nikkei 225 is the most popular, price-weighted market capitalisation index. It includes 225 companies listed on the Tokyo Stock Exchange. If you're interested in the situation on the Japanese stock market, this index is for you. It appeared in 1950 and was called TSE Adjusted Stock Price Average. The companies in the index are reviewed at least once a year in October.

Hang Seng Index

The Hang Seng Index includes 34 companies listed on the Hong Kong Stock Exchange, which is capitalisation weighted. The index's companies should represent 65% of the whole stock exchange's capitalisation. Four sub-indices represent the companies of the index. These are Commerce and Industry, Finance, Properties, and Utilities.

China A50

If you want to evaluate the Chinese economy's health, you can choose the China A50 index, one of the primary Chinese indices. It's also called the FTSE China A50 Index.

The index includes shares of the 50 largest companies that should be registered in the mainland of China. It combines shares of companies listed on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The shares are reviewed four times per year. Be ready for high volatility when trading this index.

Nifty 50

The Asian market is represented not only by Chinese and Japanese stocks. Another important economy is the Indian market. The Nifty 50 index represents the 50 largest enterprises listed on the National Stock Exchange, a leading Indian index.

Asian Stock Markets: Characteristics

We gathered the main points to build a successful trading strategy.

Asian Market Hours

There can't be standard hours for all Asian stock markets, but there are primary markets whose opening hours you should keep in mind.

|

Country |

Stock Exchange |

Trading Hours (UTC) |

|

Japan |

Tokyo Stock Exchange |

12 am to 6 am lunch: 2:30 am to 3:30 am |

|

Hong Kong |

Hong Kong Stock Exchange |

1:30 am to 8 am lunch: 4 am to 5 am |

|

Shanghai |

Shanghai Stock Exchange |

1:30 am to 7 am lunch: 3:30 am to 5 am |

|

India |

National Stock Exchange of India |

3:45 am to 10 am |

Influencing Factors

To predict price movements, combine fundamental and technical analysis.

As for fundamental factors, consider the figures of the companies you trade and the industry they belong to. A company's earnings report is a leading factor that defines its strength.

To predict price movements, combine fundamental and technical analysis.

When choosing a market, you must understand which economy provides the best opportunities for you. Check events in the economic calendar: GDP, retail sales and jobs are among the leading barometers of financial health.

It's vital to understand how the news affects the price of equities. For example, the trade war between the US and China negatively affected the Chinese economy and the stock market, particularly.

Apply technical analysis to define the price direction of indices and shares. If you trade CFDs, you can simply choose the standard MetaTrader indicators such as Volumes, MACD, RSI and Moving Averages.

Asian Markets and Other Markets: Differences

The main difference is regulation. Before entering the market, you must understand how it's regulated. For example, the Shanghai Stock Exchange is partially closed for foreign investors. Also, some operations can be forbidden.

Another factor you should consider is the stock exchange's requirements. Although giant companies represent the largest world exchanges, there can be different numerical features.

How to Trade Asian Stock Indices. A Beginners Guide

Now it's time to learn how to trade indices.

- Choose an index. Your choice may depend on the economy and its development. For that, you should do research and find a country that has the best economic forecast. Also, you can check previous price movements to evaluate the degree of price volatility. Use a Libertex demo account to see a list of the indices available.

- Open the list of instruments in the trading platform. A complete list is available on MarketWatch.

- An index CFD is traded like any other instrument on MetaTrader. You can place buy and sell orders and select Take-Profit and Stop-Loss levels.

Tips and Tricks for Traders

Asian stock markets are not complicated, but we still have some tips that can make trading there more straightforward.

- Remember the time difference. Asian trading hours differ from European and American ones. Asian countries also have different time zones.

- Check economic data. Stocks serve as a barometer of financial health. Not all Asian stock markets are affected by world economic health. Some of them are primarily influenced by the country's economy. Consider such vital figures as GDP, retail sales and jobs data.

- Know the companies you trade. If you trade stock indices, you should know the major companies included in the index and the industries they belong to. Otherwise, you'll lose the ability to forecast the price direction.

- Remember to check the country's regulations. However, if you trade CFDs with Libertex, you won't have problems. All the securities available for trading are listed on Libertex's website.

Conclusion

To conclude, Asian stock markets are among the top world stock exchanges. They provide exciting opportunities for traders and investors worldwide. But they have unique features you should know about before entering the market.

Asian equity markets allow traders to trade stocks and indices. When doing so, you should combine technical and fundamental analysis. One of the best ways to trade Asian stock markets is to use CFDs. You can trade CFDs by opening a Libertex demo account. If you're a newbie, open a demo account and try different securities, including stock and index CFDs.

FAQ

What Are Asian Stock Markets?

Asian stock markets are stock marketplaces represented by Asia's largest companies.

What Time Do Asian Stock Markets Open?

Every country has its own opening hours. Here are the trading hours of the largest Asian stock exchanges. The Tokyo Stock Exchange opens at midnight UTC. The Hong Kong Stock Exchange opens at 1:30 am UTC. The Shanghai Stock Exchange opens at 1:30 am UTC. The National Stock Exchange of India opens at 3:45 am UTC.

What Is the Biggest Stock Exchange in Asia?

Japan Exchange Group is the largest stock exchange in Asia.

Which Stock Market Opens First in the World?

New Zealand's stock market opens first, followed by Australia's, Japan's, Hong Kong's, Singapore's and India's.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.