Bitcoin’s Price Prediction

Its capitalization grew to over $1.3 billion at the end of 2021 and now stands at $2,188,795,322,124.27 in total.

However, being the so-called king of cryptocurrencies comes with its problems, and the volatility of the market makes it difficult to predict Bitcoin's viability.

In this article, our goal is to explore BTC's rise from the beginning and understand what it is, what influences its price, how it has performed in the past, how it is performing now, and how it is likely to perform in a few years. So, if you're interested in investing in the Bitcoin market, trading Bitcoin, and learning about Bitcoin predictions, you've come to the right place.

That said, let’s get started without further ado!

Key points

- Bitcoin forecast for 2025: Bitcoin is expected to start around $110,048 in May and rise to approximately $174,539 by December, showing about 36% growth. Volatility remains high, with a possible minimum price of $157,085 and a maximum above $191,993.

- Bitcoin forecast for 2026: Bitcoin could continue its upward trend, with average monthly prices ranging from $236,416 in January to $285,289 in December. Minimum levels are near $200,000, and maximums could reach $300,00, supporting annual growth between +114% and +159%.

- Long-term forecast: Bitcoin is projected to reach an average of $368,155 by 2027, $566,099 by 2030, and $2,320,693 by 2040, potentially rising to $3,107,788 by 2050, implying a more than 50-fold increase from 2025 levels.

BTC price for today

Price forecast for tomorrow and the next 30 days

The price outlook for tomorrow and the next 30 days is based on current market analysis and economic indicators. According to Gov. capital, the following changes are expected:

|

Date |

Regular Price |

Best Possible Price |

Least Possible Price |

|

2025-May-29 |

112,140.100 |

123,354.110 |

100,926.090 |

|

2025-May-30 |

113,950.525 |

125,345.578 |

102,555.473 |

|

2025-May-31 |

112,196.574 |

123,416.232 |

100,976.917 |

|

2025-Jun-01 |

114,007.911 |

125,408.702 |

102,607.120 |

|

2025-Jun-02 |

112,253.077 |

123,478.384 |

101,027.769 |

|

2025-Jun-03 |

113,690.644 |

125,059.708 |

102,321.580 |

|

2025-Jun-04 |

115,390.390 |

126,929.429 |

103,851.351 |

|

2025-Jun-05 |

113,797.205 |

125,176.925 |

102,417.484 |

|

2025-Jun-06 |

113,657.074 |

125,022.781 |

102,291.367 |

|

2025-Jun-07 |

114,917.627 |

126,409.389 |

103,425.864 |

|

2025-Jun-08 |

115,085.960 |

126,594.556 |

103,577.364 |

|

2025-Jun-09 |

115,318.614 |

126,850.476 |

103,786.753 |

|

2025-Jun-10 |

116,212.976 |

127,834.274 |

104,591.679 |

|

2025-Jun-11 |

114,424.201 |

125,866.621 |

102,981.781 |

|

2025-Jun-12 |

116,271.501 |

127,898.652 |

104,644.351 |

|

2025-Jun-13 |

116,232.481 |

127,855.729 |

104,609.233 |

|

2025-Jun-14 |

115,110.097 |

126,621.107 |

103,599.088 |

|

2025-Jun-15 |

115,946.882 |

127,541.571 |

104,352.194 |

|

2025-Jun-16 |

116,922.081 |

128,614.289 |

105,229.873 |

|

2025-Jun-17 |

116,281.697 |

127,909.866 |

104,653.527 |

|

2025-Jun-18 |

115,407.610 |

126,948.371 |

103,866.849 |

|

2025-Jun-19 |

113,944.100 |

125,338.510 |

102,549.690 |

|

2025-Jun-20 |

114,434.244 |

125,877.669 |

102,990.820 |

|

2025-Jun-21 |

114,066.190 |

125,472.809 |

102,659.571 |

|

2025-Jun-22 |

115,907.711 |

127,498.482 |

104,316.939 |

|

2025-Jun-23 |

115,764.373 |

127,340.810 |

104,187.936 |

|

2025-Jun-24 |

113,982.503 |

125,380.753 |

102,584.253 |

|

2025-Jun-25 |

113,332.296 |

124,665.526 |

101,999.067 |

|

2025-Jun-26 |

112,192.111 |

123,411.322 |

100,972.900 |

|

2025-Jun-27 |

110,731.390 |

121,804.529 |

99,658.251 |

|

2025-Jun-28 |

111,851.964 |

123,037.161 |

100,666.768 |

Source: Gov.capital (26.05.2025)

Short-term Bitcoin price prediction chart for 2025

Given the difficulty of articulating the countless ups and downs plaguing the cryptocurrency market, expert analysts are needed to lay the groundwork for understanding bitcoin price prediction, BTC price movements, and bitcoin dominance trends. Only by studying bitcoin cost projections, market sentiment, and bitcoin’s market capitalization can investors prepare for bitcoin's future. But remember: a bitcoin price prediction is not certain.

With high BTC dominance typically indicating increasing bullish momentum, even the bitcoin price today is highly volatile. Always conduct your own research before investing.

However, let's be clear: this forecast is an attempt to determine what Bitcoin might be worth in 2025. Market volatility should not be ignored.

Take this price development forecast chart with a grain of salt.

|

Month |

Open |

Low-High |

Close |

Total,% |

|

2025 May |

94,274 |

92,969-118,528 |

108,378 |

15% |

|

2025 Jun |

108,378 |

100,183-134,769 |

107,724 |

14% |

|

2025 Jul |

107,724 |

107,724-131,900 |

123,271 |

31% |

|

2025 Aug |

123,271 |

112,205-129,097 |

120,651 |

28% |

|

2025 Sep |

120,651 |

94,253-120,651 |

101,347 |

7.5% |

|

2025 Oct |

101,347 |

101,347-123,246 |

115,183 |

22% |

|

2025 Nov |

115,183 |

108,418-124,740 |

116,579 |

24% |

|

2025 Dec |

116,579 |

116,579-144,698 |

135,232 |

43% |

Source: Longforecast.com (26.05.2025)

Peter Brandt (Factor LLC)

Peter Brandt, CEO of Factor LLC, believes his views will confuse dogmatic investors. He considers himself a Bayesian and remains open to multiple narratives. His BTC price prediction is $135,000 +/- $15,000 in 2025, but also recognizes the risk of a decline of 50% or more. He hedges his bets based on Bayesian priors, aware of the risks inherent in his 50-year career as a trader.

Bloomberg

According to Bloomberg, Bitcoin’s historical tendency to “add a zero” about once per cycle forms the foundation of their base-case outlook. They estimate the token is on track to reach approximately $100,000 by the end of 2025, which is only about 5% above the current spot price of around $95,000.

Looking further ahead, and continuing to apply the same logarithmic growth curve, Bloomberg projects that by the early 2030s, Bitcoin could be trading near $1 million, representing a gain of approximately 950%.

If the supply-driven adoption curve continues to compound exponentially through the 2040s, another “order of magnitude” increase toward the $10 million range is considered conceptually realistic, implying a potential upside of about 10,400% from current levels.

While reaching such milestones could turn a $10,000 investment today into more than $1 million over the coming decades, McGlone cautions that tighter global liquidity, stricter regulation, or a collapse in the store-of-value narrative could result in significant interim drawdowns.

Robert Kiyosaki

Robert Kiyosaki, author of Rich Dad Poor Dad, remains one of the most well-known advocates of Bitcoin among traditional financial thinkers. He expresses confidence that Bitcoin will reach $500,000 by 2025, and in the longer term, even $1,000,000. In his view, this growth will occur against the backdrop of a large-scale economic crisis in the U.S. and the weakening of the dollar as the world's reserve currency.

Kiyosaki emphasizes that the coming collapse will be a turning point: he expects a "giant crash" of the financial markets and is preparing in advance by acquiring "hard assets" – gold, silver, and Bitcoin.

He warns that without financial education, investors may fall victim to what’s coming and urges people to take advantage of market crashes to make strategic purchases.

Morgan Stanley

At Morgan Stanley, we believe the cryptocurrency market is on the verge of transformation and expect a Bitcoin rally after the halving in early 2024. With approximately 137.1K BTC remaining, optimism is fueled by the recent US-Binance agreement. Analysts predict a rise above $ 100,000, driven by institutional interest and regulatory progress.

Fidelity Investments

Fidelity Investments predicts that 2025 will be the year of decentralization. This shift will be driven not only by increasing value and demand, but also by the explosion of new use cases for decentralized technologies. These innovations solve important global problems and increase the practical benefits of decentralization. Decentralization will therefore continue to evolve in 2025 because there are compelling reasons to adopt it.

JP Morgan

JPMorgan expects Bitcoin's dominance over Ethereum and other altcoins to remain strong in 2025, driven by its appeal as a digital hedge, significant institutional investment, and progress in Layer 2 networks. Nikolaos Panigirtzoglou, Managing Director at JPMorgan, explained that Bitcoin's positioning as a digital hedge, similar to gold, continues to attract inflows into Bitcoin ETFs, in contrast to the muted demand for Ethereum ETFs.

Plan B

PlanB, the creator of the stock-to-flow model, believes Bitcoin could reach $1 million by 2025. His model compares the total supply to newly minted coins, suggesting that scarcity drives prices. He recently shared bold month-by-month predictions stating that BTC could reach $1 million by mid-2025. Factors influencing these predictions include the US presidential election, regulatory changes, and geopolitical events.

Monthly price predictions for Bitcoin value

While current market sentiment toward Bitcoin (BTC) shows some bearish tendencies, technical analysis from leading platforms suggests 2025 could bring future price movements and volatility. Experts from DigitalCoinPrice, Longforecast, Wallet Investor, and Gov Capital offer varied bitcoin price prediction results, balancing optimism with caution about a potential bitcoin bubble.

To better grasp bitcoin cost trends and the BTC price outlook, we compiled a monthly price prediction overview from June to December 2025. Insights reflect high BTC dominance, typically, rising green histogram levels, Bitcoin's interest, and projections for BTC adoption.

Our forecast includes expected ranges, potential rate changes, and key support levels, considering spot bitcoin ETFs, bitcoin exchange traded funds, and institutional adoption. Understanding bitcoin's market capitalization, bitcoin protocol advances, and third-party participation helps reveal what lies ahead for investors aiming to buy bitcoin.

Price prediction for June 2025

Market figures released by DigitalCoinPrice outline a price range for June between 102,607.120 USD and 123,117.337 USD, with the monthly average settling at 111,924.851 USD. The observed change over the period was approximately 1.70%

Price prediction for July 2025

According to data provided by Longforecast, the price in July was recorded within a range of 101,670.245USD to 134,653.353USD, with an average monthly value of approximately 122,412.139 USD. The relative change for the period amounted to 11.23%, based on the observed market performance

Price prediction for August 2025

Figures reported by DigitalCoinPrice indicate that the price in August fluctuated between 111,949.560 USD and 143,915.084 USD, with the average value stabilizing around 130,831.894 USD. The price variation for the month was calculated at 18.88%, reflecting the extent of intra-month movement.

Price prediction for September 2025

Based on information from DigitalCoinPrice, September showed a trading range from 119,649.677 USD to 150,355.414 USD, with an average price level of 136,686.740 USD. The measured change across the month was approximately 24.20%, marking a continued evolution within the defined boundaries.

Coin price prediction for October 2025

Price data compiled by Longforecast shows that in October, the price moved between 121,124.545 USD and 176,049.785 USD, while the mean value across the period stood at 160,045.259 USD. The recorded rate of change was 45.43%, indicating the scale of price adjustment during the month.

Price forecast for November 2025

According to estimates from WalletInvestor, the November price corridor ranged from 143,581.231 USD to 194,995.099 USD, with a calculated average of 177,268.272 USD. The total monthly variation was approximately 61.08%, corresponding to market dynamics during that interval.

BTC to USD price prediction for December 2025

Data from DigitalCoinPrice indicates that during December, price levels fluctuate between 157,085.748 USD and 227,195.517 USD, while the average monthly price remained near 206,541.379 USD. The rate of change was assessed at 87.68%, in line with previous movement trends.

How high will Bitcoin go?

Some experts believe that Bitcoin will reach an unprecedented milestone of $1 million per coin by 2030, positioning itself among the world's most valuable assets.

Bitcoin price prediction 2026

As we can see in the table below, according to the Digitalcoinprice projections, the minimum price in 2026 will be $235,896.79. The expected maximum price will be $284,661.75. The average price in 2026 will be about $260,504.37.

|

Month |

Min Price |

Avg Price |

Max Price |

Avg. Change |

|

Jan 2026 |

233,678.70 |

233,777.53 |

260,273.78 |

112.90 % |

|

Feb 2026 |

234,447.35 |

249,435.90 |

262,689.52 |

127.16 % |

|

Mar 2026 |

234,337.54 |

253,421.87 |

259,032.97 |

130.79 % |

|

Apr 2026 |

232,536.72 |

245,625.62 |

284,661.75 |

123.69 % |

|

May 2026 |

235,896.79 |

246,361.33 |

278,095.34 |

124.36 % |

|

Jun 2026 |

233,590.86 |

244,911.88 |

250,874.36 |

123.04 % |

|

Jul 2026 |

231,350.81 |

240,816.11 |

261,558.51 |

119.31 % |

|

Aug 2026 |

235,819.93 |

241,694.56 |

246,668.78 |

120.11 % |

|

Sep 2026 |

234,502.25 |

260,504.37 |

270,705.37 |

137.24 % |

|

Oct 2026 |

233,272.42 |

236,336.02 |

255,947.41 |

115.23 % |

|

Nov 2026 |

234,513.23 |

237,115.64 |

242,836.55 |

115.94 % |

|

Dec 2026 |

232,273.18 |

244,253.05 |

259,977.30 |

122.44 % |

Source: DigitalCoinPrice (26.05.2025)

Bitcoin price forecast 2027

According to Digitalcoinprice, the price will reach the following values in 2027: Minimum price: $323,061; Maximum price: $395,917.45; Mean Bitcoin price: $367,345.86.

|

Month |

Min Price |

Avg Price |

Max Price |

Avg. Change |

|

Jan 2027 |

319,876.62 |

336,984.43 |

342,101.41 |

206.89 % |

|

Feb 2027 |

322,962.17 |

358,605.29 |

367,686.26 |

226.58 % |

|

Mar 2027 |

323,061 |

326,849.32 |

395,917.45 |

197.66 % |

|

Apr 2027 |

319,898.58 |

331,933.35 |

336,852.67 |

202.29 % |

|

May 2027 |

320,392.71 |

321,194.29 |

341,585.32 |

192.51 % |

|

Jun 2027 |

322,292.36 |

336,786.78 |

340,102.93 |

206.71 % |

|

Jul 2027 |

320,535.46 |

321,172.33 |

367,960.78 |

192.49 % |

|

Aug 2027 |

321,962.94 |

336,501.29 |

369,289.44 |

206.45 % |

|

Sep 2027 |

318,921.30 |

341,519.43 |

343,781.44 |

211.02 % |

|

Oct 2027 |

322,621.77 |

367,345.86 |

376,800.18 |

234.54 % |

|

Nov 2027 |

318,690.71 |

336,841.69 |

363,469.70 |

206.76 % |

|

Dec 2027 |

322,830.41 |

329,144.27 |

349,590.19 |

199.75 % |

Source: DigitalCoinPrice (26.05.2025)

Bitcoin price prediction 2028

According to Digitalcoinprice, Bitcoin's value in 2028 is expected to fluctuate between a minimum of $421,732.91 and a maximum of $500,727.53, with the average price hovering around $489,219.83 throughout the year

|

Month |

Min Price |

Avg Price |

Max Price |

Avg. Change |

|

Jan 2028 |

418,823.04 |

446,647.95 |

463,898.51 |

306.76 % |

|

Feb 2028 |

418,460.68 |

427,289.10 |

489,362.58 |

289.13 % |

|

Mar 2028 |

418,877.94 |

448,701.32 |

452,357.87 |

308.63 % |

|

Apr 2028 |

419,855.22 |

431,099.38 |

500,727.53 |

292.60 % |

|

May 2028 |

421,732.91 |

473,803.03 |

485,310.73 |

331.49 % |

|

Jun 2028 |

419,448.94 |

425,806.72 |

458,616.83 |

287.78 % |

|

Jul 2028 |

418,801.08 |

444,166.32 |

474,692.47 |

304.50 % |

|

Aug 2028 |

421,568.20 |

435,403.79 |

481,313.78 |

296.52 % |

|

Sep 2028 |

420,536.02 |

489,219.83 |

497,158.83 |

345.53 % |

|

Oct 2028 |

420,327.39 |

462,679.66 |

485,124.06 |

321.36 % |

|

Nov 2028 |

421,107.01 |

440,707.43 |

450,941.37 |

301.35 % |

|

Dec 2028 |

417,955.57 |

420,975.24 |

465,216.18 |

283.38 % |

Source: DigitalCoinPrice (26.05.2025)

Pantera Capital

Pantera Capital predicts that BTC could reach $740,000 by 2028, driven by regulatory changes, institutional adoption, and historical growth trends. The cryptocurrency, which has gained approximately 120% this year, recently traded around $93,000 after approaching the $100,000 mark. CEO Dan Morehead highlighted the resilience and growth potential of this currency, stressing that despite the skepticism, it is still far from its peak.

Bitcoin price forecast 2029

Based on the DigitalCoinPrice forecast. During 2029, the minimum price of Bitcoin is expected to be $421,732.91, while the maximum recorded price could reach $500,727.53. The average value of the cryptocurrency is projected to be around $489,219.83. The presented data provides a general overview of Bitcoin’s price range for 2029.

|

Month |

Min Price |

Avg Price |

Max Price |

Avg. Change |

|

Jan 2029 |

366,313.69 |

403,856.45 |

413,113.11 |

267.79 % |

|

Feb 2029 |

365,874.46 |

374,878.57 |

377,360.20 |

241.40 % |

|

Mar 2029 |

366,950.56 |

403,746.64 |

434,591.22 |

267.69 % |

|

Apr 2029 |

366,214.86 |

390,536.95 |

404,701.95 |

255.66 % |

|

May 2029 |

363,107.34 |

386,221.56 |

411,356.21 |

251.73 % |

|

Jun 2029 |

366,247.80 |

378,381.39 |

392,776.99 |

244.59 % |

|

Jul 2029 |

367,203.12 |

371,529.48 |

387,506.29 |

238.35 % |

|

Aug 2029 |

367,236.06 |

406,502.78 |

413,113.11 |

270.20 % |

|

Sep 2029 |

365,336.41 |

367,719.21 |

382,982.28 |

234.88 % |

|

Oct 2029 |

363,766.18 |

399,497.14 |

408,512.23 |

263.82 % |

|

Nov 2029 |

363,601.47 |

388,340.82 |

396,642.18 |

253.66 % |

|

Dec 2029 |

363,612.45 |

370,277.69 |

374,076.99 |

237.21 % |

Source: DigitalCoinPrice (26.05.2025)

Bitcoin price forecast 2030

Looking further ahead, DigitalCoinPrice analysts have shared their projections for Bitcoin’s potential price range. In 2030, they forecast a minimum price of $521,535.82, a mean price of around $598,224.51, and a maximum price reaching approximately $564,854.39.

|

Month |

Min Price |

Avg Price |

Max Price |

Avg. Change |

|

Jan 2030 |

520,690.31 |

531,275.63 |

598,224.51 |

383.83 % |

|

Feb 2030 |

519,559.30 |

524,643.33 |

538,039.70 |

377.79 % |

|

Mar 2030 |

520,844.04 |

558,990.73 |

579,315.87 |

409.07 % |

|

Apr 2030 |

516,254.13 |

538,665.59 |

553,445.52 |

390.56 % |

|

May 2030 |

520,316.97 |

535,239.64 |

566,095.20 |

387.44 % |

|

Jun 2030 |

517,451.02 |

534,943.16 |

541,377.81 |

387.17 % |

|

Jul 2030 |

521,316.20 |

531,352.50 |

589,396.09 |

383.90 % |

|

Aug 2030 |

516,232.17 |

521,568.76 |

534,350.21 |

374.99 % |

|

Sep 2030 |

521,502.87 |

564,854.39 |

584,301.07 |

414.41 % |

|

Oct 2030 |

521,535.82 |

533,076.45 |

535,755.73 |

385.47 % |

|

Nov 2030 |

517,407.10 |

526,444.16 |

566,062.25 |

379.43 % |

|

Dec 2030 |

518,988.31 |

521,074.63 |

538,775.40 |

374.54 % |

Source: DigitalCoinPrice (26.05.2025)

Bitcoin price prediction 2031

The following forecast was made by CoinGape. Their prognosis is slightly different. As we can see below, they expect a minimum price of $146,657.32, an average price of around $153,112.68, and a maximum price of approximately $150,143.22.

|

Month |

Min Price |

Avg Price |

Max Price |

Potential ROI |

|

January |

146,657.32 |

146,923.34 |

147,189.36 |

0.36% |

|

February |

147,207.09 |

147,446.51 |

147,685.92 |

0.33% |

|

March |

147,703.66 |

147,969.67 |

148,235.69 |

0.36% |

|

April |

148,253.43 |

148,510.58 |

148,767.73 |

0.35% |

|

May |

148,785.46 |

149,051.48 |

149,317.50 |

0.36% |

|

June |

149,335.23 |

149,592.38 |

149,849.53 |

0.34% |

|

July |

149,867.27 |

150,133.28 |

150,399.30 |

0.36% |

|

August |

150,417.04 |

150,683.05 |

150,949.07 |

0.35% |

|

September |

150,966.81 |

151,223.96 |

151,481.11 |

0.34% |

|

October |

151,498.84 |

151,764.86 |

152,030.88 |

0.35% |

|

November |

152,048.61 |

152,305.76 |

152,562.91 |

0.34% |

|

December |

152,580.65 |

152,846.66 |

153,112.68 |

0.35% |

Source: CoinGape (26.05.2025)

Bitcoin price forecast 2032

In CoinGape’s forecast for 2032, the minimum is expected to be around $153,130.42, the average near $156,496.43, and the upper bound exceeds $159,603.51. At this stage, these figures outline the anticipated amplitude of movement rather than indicating precise price targets, and they do not rule out the possibility of deviations from the baseline scenario.

|

Month |

Min Price |

Avg Price |

Max Price |

Potential ROI |

|

January |

153,130.42 |

153,396.43 |

153,662.45 |

0.35% |

|

February |

153,680.19 |

153,928.47 |

154,176.75 |

0.32% |

|

March |

154,194.49 |

154,460.51 |

154,726.52 |

0.35% |

|

April |

154,744.26 |

155,001.41 |

155,258.56 |

0.33% |

|

May |

155,276.29 |

155,542.31 |

155,808.33 |

0.34% |

|

June |

155,826.06 |

156,083.21 |

156,340.36 |

0.33% |

|

July |

156,358.10 |

156,624.12 |

156,890.13 |

0.34% |

|

August |

156,907.87 |

157,173.89 |

157,439.90 |

0.34% |

|

September |

157,457.64 |

157,714.79 |

157,971.94 |

0.33% |

|

October |

157,989.67 |

158,255.69 |

158,521.71 |

0.34% |

|

November |

158,539.44 |

158,796.59 |

159,053.74 |

0.32% |

|

December |

159,071.48 |

159,337.50 |

159,603.51 |

0.33% |

Source: CoinGape (26.05.2025)

Bitcoin price forecast 2033

According to CoinGape’s forecast for 2033, Bitcoin is expected to remain within a price range of $159,621.25 to $166,076.61, with an average price of around $163,171.70. These estimates outline the indicative boundaries of movement for the year, allowing for potential adjustments as market conditions evolve

|

Month |

Min Price |

Avg Price |

Max Price |

Potential ROI |

|

January |

159,621.25 |

159,887.27 |

160,153.28 |

0.33% |

|

February |

160,171.02 |

160,410.44 |

160,649.85 |

0.30% |

|

March |

160,667.59 |

160,933.60 |

161,199.62 |

0.33% |

|

April |

161,217.36 |

161,474.51 |

161,731.66 |

0.32% |

|

May |

161,749.39 |

162,015.41 |

162,281.43 |

0.33% |

|

June |

162,299.16 |

162,556.31 |

162,813.46 |

0.32% |

|

July |

162,831.20 |

163,097.21 |

163,363.23 |

0.33% |

|

August |

163,380.97 |

163,646.98 |

163,913.00 |

0.33% |

|

September |

163,930.74 |

164,187.89 |

164,445.04 |

0.31% |

|

October |

164,462.77 |

164,728.79 |

164,994.81 |

0.32% |

|

November |

165,012.54 |

165,269.69 |

165,526.84 |

0.31% |

|

December |

165,544.58 |

165,810.59 |

166,076.61 |

0.32% |

Source: CoinGape (26.05.2025)

Bitcoin price forecast 2034

CoinGape forecasts that in 2034, Bitcoin’s price will fluctuate within a range between a minimum of $166,094.35 and a maximum of $172,549.71, with an average price of around $169,192.92.

|

Month |

Min Price |

Avg Price |

Max Price |

Potential ROI |

|

January |

166,094.35 |

166,360.36 |

166,626.38 |

0.32% |

|

February |

166,644.12 |

166,883.53 |

167,122.95 |

0.29% |

|

March |

167,140.68 |

167,406.70 |

167,672.72 |

0.32% |

|

April |

167,690.45 |

167,947.60 |

168,204.75 |

0.31% |

|

May |

168,222.49 |

168,488.51 |

168,754.52 |

0.32% |

|

June |

168,772.26 |

169,029.41 |

169,286.56 |

0.30% |

|

July |

169,304.29 |

169,570.31 |

169,836.33 |

0.31% |

|

August |

169,854.06 |

170,120.08 |

170,386.10 |

0.31% |

|

September |

170,403.83 |

170,660.98 |

170,918.13 |

0.30% |

|

October |

170,935.87 |

171,201.89 |

171,467.90 |

0.31% |

|

November |

171,485.64 |

171,742.79 |

171,999.94 |

0.30% |

|

December |

172,017.67 |

172,283.69 |

172,549.71 |

0.31% |

Source: CoinGape (26.05.2025)

Bitcoin price prediction 2035

Using a combination of technical and fundamental analysis, Coingape has created a Bitcoin price prediction for 2035. According to their estimates, Bitcoin's price is expected to range between a minimum of $172,567.44 and a maximum of $179,022.81, with the average price hovering around $176,053.34.

|

Month |

Min Price |

Avg Price |

Max Price |

Potential ROI |

|

January |

172,567.44 |

172,833.46 |

173,099.48 |

0.31% |

|

February |

173,117.21 |

173,356.63 |

173,596.05 |

0.28% |

|

March |

173,613.78 |

173,879.80 |

174,145.82 |

0.31% |

|

April |

174,163.55 |

174,420.70 |

174,677.85 |

0.30% |

|

May |

174,695.59 |

174,961.60 |

175,227.62 |

0.30% |

|

June |

175,245.36 |

175,502.51 |

175,759.66 |

0.29% |

|

July |

175,777.39 |

176,043.41 |

176,309.43 |

0.30% |

|

August |

176,327.16 |

176,593.18 |

176,859.20 |

0.30% |

|

September |

176,876.93 |

177,134.08 |

177,391.23 |

0.29% |

|

October |

177,408.97 |

177,674.98 |

177,941.00 |

0.30% |

|

November |

177,958.74 |

178,215.89 |

178,473.04 |

0.29% |

|

December |

178,490.77 |

178,756.79 |

179,022.81 |

0.30% |

Source: Coingape (26.05.2025)

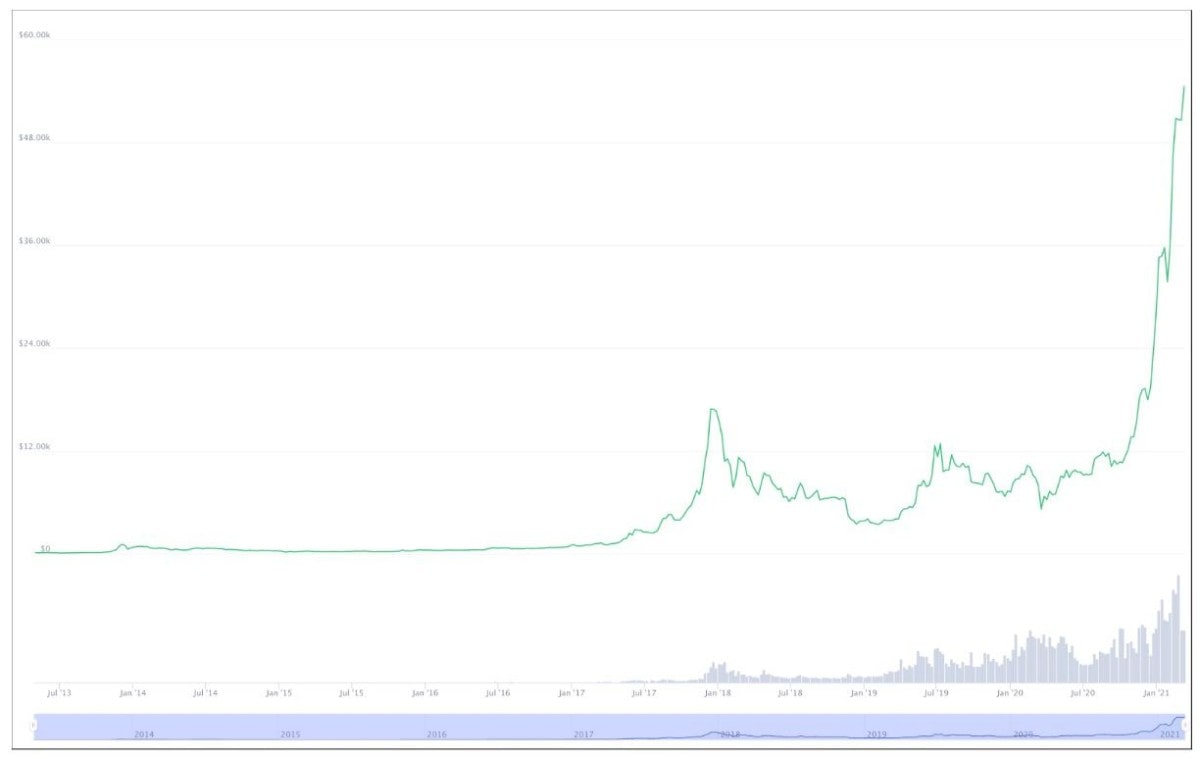

Bitcoin price history (2011-2024)

BTC is quite big now, but that wasn't always the case. Its history has been turbulent and complicated, to say the least. And so, in this section, we'll take a detailed look at the path BTC has taken to get here, all the supply and demand trends, factors influencing price changes, predictions, and bull runs. So buckle up. It's going to be quite a ride.

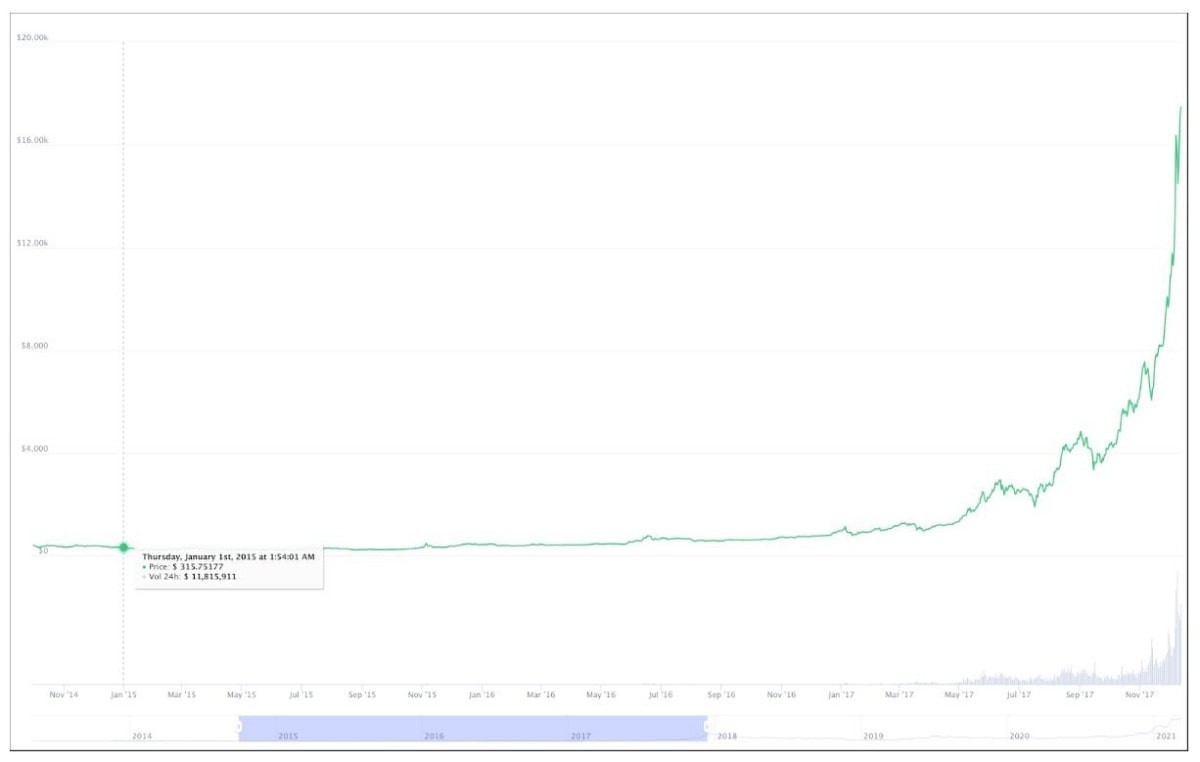

The first time this currency experienced a significant price increase was in 2011, when it surged from $1 to $32. Although this was a major jump, a recession in the BTC market soon followed, causing the price to fall to $2 per coin by November. This downward trend continued into the following year, with the price hovering around $4.80 in May before rising to $13.20 by August.

Starting at $13.40 in early 2013, the price rose sharply to $220 by early April. As expected, prices subsequently plummeted, falling to around $70 by mid-month. However, optimists were rewarded when another bubble formed, driving the price up by 1156.10% – from $123.20 in October to a peak in December. Just three days later, the price dropped back to $760.

A prolonged downturn followed, lasting several years, with the price reaching a low of $315 in early 2015. Then, in 2017, things started to pick up again. BTC spent the first two months in a downward trend, but then, in a rebound that no specialist making a Bitcoin price outlook could have predicted, the price rose from $975.70 in March to $20,089 in December.

This is the trend that brought BTC into the mainstream spotlight. It prompted numerous analysts to launch speculative predictions about dramatic price increases and the creation and proliferation of alternative cryptocurrencies. The boom had begun.

Or was it? Despite hopes for another bubble, BTC instead moved mostly sideways over the next few years. Of course, that didn't mean there was no supply and demand activity. In June 2019, the price exceeded the $10,000 mark again, but by December of that year, it had fallen back to $7,112.73.

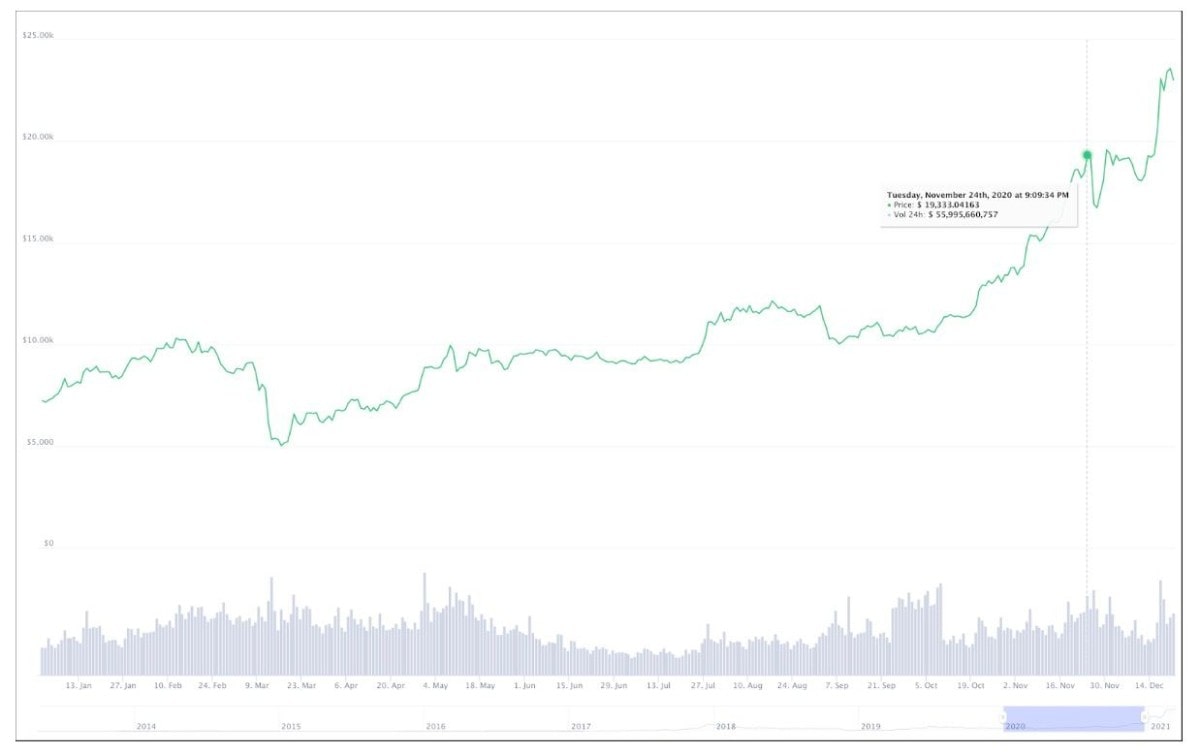

At this point, the COVID-19 situation had already begun to spread from one corner of the world to another. However, it was also a time of recovery. Although the price started the year at $7,200, it rose to over $19,000 by the end of November.

Whether it was government policies that struck fear into the hearts of investors around the world or the $1,200 stimulus checks that revitalized the stock market and other asset classes, it's no secret that the asset had a strong 2020. Not only did it emerge from a low point, but it also surpassed its previous all-time high, setting a new record.

Due to fears of inflation and the depreciation of the US dollar, many institutions also decided to buy BTC, driving it to unprecedented heights. In fact, its value was just under $24,000 in December 2020, representing a 224% increase since the beginning of the year.

In 2024, Bitcoin experienced volatile growth, influenced by regulatory shifts and evolving market trends. Early in the year, the bitcoin price prediction reached around $45,000, driven by a positive environment and rising institutional investors’ activity in a high market capitalization cryptocurrency. However, profit-taking and economic uncertainty caused a dip to $30,000, testing a neutral level near a key psychological level.

By year-end, BTC stabilized around $38,000. Analysts noted a bullish crossover, indicating strength, while the indicator showed signs of an additional rally. Growing total market capitalization and rising circulating supply have strengthened investors resort in Bitcoin without risking all your money.

News about major institutions' Bitcoin reserves played a crucial role in shaping market perception. Furthermore, the risks associated with buying BTC and the selection of trading pairs remained key concerns for many investors. Satoshi Nakamoto's vision of a decentralized network was brought back into focus by the developments of the year.

Long-term Bitcoin forecast 2027-2050

No one can say for sure what will happen when making long-term price predictions this far into the future. There are far too many potential factors to consider to provide any definitive answers. The global economy could collapse, the BTC market could crash completely, or the currency could disappear from the scene altogether. But who knows?

Long-term price prediction chart

In the following table, we can see how the value of BTC will change from 2027 to 2050 according to Telegaon's forecast.

|

Year |

Min Price |

Avg Price |

Max Price |

|

2027 |

$105,944 |

$201,247 |

$140,160 |

|

2028 |

$110,847 |

$301,053 |

$260,933 |

|

2029 |

$242,972 |

$420,066 |

$336,308 |

|

2030 |

$305,136 |

$660,471 |

$487,803 |

|

2035 |

$1,360,765 |

$1,934,579 |

$1,647,001 |

|

2040 |

$1,990,123 |

$2,651,674 |

$2,320,693 |

|

2050 |

$2,885,107 |

$3,454,010 |

$3,107,788 |

Source: Telegaon (26.05.2025)

Bitcoin forecast for 2040

The price of this currency could reach $2,343,429 by 2040, an increase of more than 2,008% from its current price of approximately $110,048. We base this on the average return of the last five years, which should be around 24,40% for projected price movements.

Although the above calculation is relatively simple and doesn't take complex factors into account, it provides a good starting point for further predictions. Ultimately, the state of the global economy and geopolitical conditions will be the key influences in Bitcoin's price formation, and they will also determine whether the coin will be a good investment in the future. In addition, risks related to market psychology and news surrounding the network also play an important role in determining whether the coin's price will rise in the future.

Bitcoin forecast for 2050

Telegaon's latest projections suggest that BTC could reach a peak value of $3,454,010 by 2050. The minimum and mean prices are expected to be around $2,885,107 and $3,107,788, respectively, pointing to a sustained upward movement over the coming decades rather than sharp speculative surges.

This outlook reflects the assumption that BTC will continue to gain traction as a digital store of value, driven by limited supply and wider market integration. Still, the trajectory toward these levels will likely be shaped by a complex mix of regulatory changes, shifts in global economic conditions, and the evolution of competing technological advancements, which could either reinforce or challenge Bitcoin’s long-term position.

MicroStrategy (Michael Saylor)

Michael Saylor, executive chairman and co-founder of MicroStrategy, offers the following view: Bitcoin proponents are optimistic about MicroStrategy's investment, believing it will yield significant returns, as BTC's value could rise to $13 million or even $52 million in the next few decades. Predictions suggest the price could increase by 12,900% to $13 million and 51,900% to $52 million. While this could turn a $10,000 MicroStrategy investment into millions, risks from impairment and debt could also lead to significant downside.

Max Keiser forecast

Max Keiser has made some pretty bold assumptions about Bitcoin's long-term price. Keiser expects game theory to play out 100%. Therefore, he says Bitcoin will likely reach $2,200,000 in the future, without specifying a timeframe for when this might happen.

Using "game theory," Keiser could imply further adoption by nation states in the future and more institutions and states accepting BTC as a reserve asset.

Trading vs. Investing in BTC

Ultimately, the question remains: What should you do with Bitcoin? Should you consider it an investment or trade it like a commodity or financial instrument?

Both options have strong arguments. After the next halving, the price of bitcoin could rise again, supported by a positive bitcoin price projection and growing bitcoin dominance. This dominance usually signals an opportunity for investors and traders. On the other hand, Bitcoin remains a favorite trading digital asset, often showing upward momentum on the daily chart, with moving average convergence divergence indicators suggesting strength.

Your choice depends on your goals: profit from quick price increases or hedge against currency devaluation?

Like everything in trading, this decision is a very personal one. Whatever you ultimately choose, you should never forget the risks associated with this decision, as well as the equally profitable alternatives to Bitcoin. In particular, you should consider Bitcoin CFDs.

These financial instruments allow you to enjoy the benefits of Bitcoin trading without having to physically own Bitcoin itself. Unlike more long-term investing, you can profit from short-term price fluctuations. To begin your journey and achieve your goals with the lowest possible losses, create a demo account on Libertex and practice with it!

What is Bitcoin?

Bitcoin is a virtual currency designed for financial transactions. Unlike traditional fiat currencies, it’s not a physical coin but a digital asset. The price of Bitcoin fluctuates daily based on market cap and trading volume. Each BTC is a file stored on a computer and moves during transactions across the Bitcoin network.

Every transaction is recorded on the blockchain through the Bitcoin protocol, ensuring supply regulated and transparency. If someone attempts fraud, the unique ID code lets users trace and reverse moves.

Growing bitcoin adoption, increasing its price and spot bitcoin ETFs reflect a bullish trend ahead. Its high dominance typically hints at investor confidence, while price prediction tools, relative strength index, and buy signal indicators guide investors seeking financial inclusion and widespread adoption.

Alt5: BTC transactions

Because it's more of a collaborative process, Bitcoin's economy is completely decentralized. There's no governing body, like a bank, that regulates it, and BTC was the first to start this trend. Soon, others picked up on it, and new crypto assets like Ethereum and Litecoin were created.

Because of its decentralized nature, it didn't take long for investors and traders to flock to Bitcoin. The freedom it offers is immense. However, due to its nature, trading in Bitcoin is not permitted in many countries; many have even banned it entirely.

FAQ

Is Bitcoin a good investment in 2025?

Anyone who invests in Bitcoin wants to succeed. But they should also be prepared for some downturns. Although Bitcoin has frequently rallied in the past, BTC could eventually reach zero if several relevant crypto platforms collapse and a significant sell-off occurs. As happened in 2022, for example, when prices collapsed.

What will Bitcoin be worth in 2026?

As predicted, Bitcoin will be worth approximately $260,504.37 by the end of 2026.

Can you predict Bitcoin’s price?

To a certain extent. Volatility makes it difficult, but there are ways to predict the price of Bitcoin. You have to study the Bitcoin market and use some elements of technical analysis, which requires practice, but yes, we can.

What will Bitcoin be worth in 2030?

Experts predict that the price of Bitcoin could reach up to $660,471 in 2030 if the trend continues as it is now.

Will Bitcoin ever die?

There's always a chance that BTC will crash and go under. It all depends on the regulations passed by governments and whether they decide to squeeze the life out of the cryptocurrency.

Can Bitcoin reach zero?

It can. As we've already said, it depends on the kind of policies governments decide to implement. If they decide to restrict it, BTC could go from hero to nothing in a matter of days.

How high can bitcoin go?

BTC’s future price depends on many factors – from institutional adoption and regulation to macro trends and market sentiment. Some forecasts point to six-figure targets, but outcomes hinge on demand, supply dynamics, and overall market momentum. Staying informed and tracking key trends is essential to understand where it might go next

How much will 1 Bitcoin be worth in 2050?

According to Telegaon's forecast, the average Bitcoin price in 2050 will be 3,454,010 US dollars. However, this is merely an estimate – actual developments may differ, and reaching this value is not guaranteed

Potential High & Low Bitcoin 5-Year Price Predictions

The potential highest 5-year price prediction for BTC is $564,854.39, and the lowest price is $521,535.82. These figures are based on projections and should not be interpreted as precise or guaranteed values.

Potential High & Low Bitcoin 10-Year Price Predictions

The potential highest 10-year price prediction for Bitcoin is $1,934,579, and the lowest price is $1,360,765. It’s important to keep in mind that such long-term predictions come with uncertainty and do not ensure the actual price development.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.