Bullish and Bearish Divergence: How to Catch a Signal

Investors like divergence because it can be used both as a signal confirmation and a stand-alone signal. However, like any other technical concept, it has features that should be noticed before using it. In our tutorial, we'll uncover all the secrets of using divergence effectively and applying profitable strategies.

What Is Divergence in Trading: Definition

Divergence is one of the most effective and common market conditions that provide reliable trading signals on the price reversal and market retracement depending on the divergence type. The concept is simple, and that's why it's loved by traders worldwide.

Divergence is a market condition in which the price and the indicator diverge or go in different directions. The signal of the upcoming price movement appears from this divergence.

The indicator is usually an oscillator placed below the price chart, so you can easily see divergence without applying additional tools.

Divergence is a market condition in which the price and the indicator go in different directions. The signal of the upcoming price movement is read from this divergence.

Divergence should be used to define accurate entry/exit points. It only provides necessary information about the foreseen price direction that can be used to open or close a trade.

Because divergence provides signals on the price direction, there are different types of it you should know about.

Types of Divergences

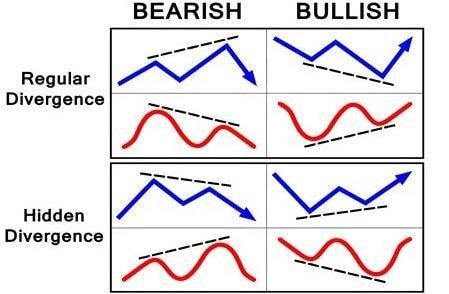

There are two main types of divergence: bearish and bullish. Both types have two forms: regular and hidden. Let's consider each type in detail.

With a bearish divergence, we consider the price's extremes. If bullish divergence occurs, we look at the price chart's lows.

Regular Divergence

Regular divergence is the easiest form of divergence that can be found on the chart, so we'll start with it. The idea of regular divergence is to predict a weakening trend and potential price reversal.

The idea of regular divergence is to predict a potential price reversal.

Bullish Divergence

A bullish divergence can also be called convergence. It's a market situation in which the price forms lower lows. At the same time, the indicator you chose has higher lows. It's the first signal that traders should bet on the upward rally. You know that indicators are used to predict the price direction. Thus, if the indicator moves upward, it means the price should rise, as well.

Bearish Divergence

A bearish divergence happens when the price forms higher highs, but the indicator creates lower highs. Usually, the price goes down after bearish divergence forms. The downward movement occurs because the indicator is more important in defining the coming price direction. If the indicator goes down, it signals the price will go down.

It may seem challenging to remember all these highs and lows, so here's a way to remember:

- With bearish divergence, we look at the price chart's highs.

- For a bullish divergence, we look at the price chart's lows.

Hidden Divergence

Hidden divergence is another form of bullish/bearish divergence. This type of divergence's name reflects the main problem a trader might face: hidden diverge is hard to identify. Hidden divergence is a tool that indicates a market correction and continuation of the previous price movement.

Hidden divergence predicts a market correction and continuation of the previous price movement.

Hidden Bearish Divergence

Hidden bearish divergence is when the price forms lower highs, but the indicator creates higher highs. The lack of higher highs on the price chart is an indication that bulls are not in force anymore.

We already mentioned that the indicator hints at the upcoming market direction. However, that's not the case with hidden divergence. Although the indicator forms higher highs and a trader may consider it a sign of upward movement, the market sees an opposite trend, and retracement will likely occur. Such a signal can be used to open a short position at higher levels.

Hidden Bullish Divergence

Hidden bullish divergence is a market situation in which the price has higher lows. Still, the indicator forms lower lows. Although the indicator moves down, a lack of lows on the price chart signals bears' weakness. We expect the price to retrace. It's a great chance to open a long position at lower levels.

It's not easy to keep all these signals in your head, so we created a table that will help you understand the differences. Use it to read signals correctly.

|

Type of Divergence |

Price |

Indicator |

Signal |

|

Regular: a sign of a price reversal |

|||

|

Bearish |

Higher High |

Lower High |

Potential reversal downward |

|

Bullish |

Lower Low |

Higher Low |

Potential reversal upward |

|

Hidden: a sign of a correction and continuation of price's direction |

|||

|

Bearish |

Lower High |

Higher High |

A downtrend is likely to resume |

|

Bullish |

Higher Low |

Lower Low |

An uptrend is likely to resume |

The Best Technical Indicators for Identifying Divergence in Trading

We've talked a lot about indicators but haven't mentioned what indicators are used to identify divergence. We're going to list the most common and reliable ones.

Keep in mind that not all technical tools provide divergence signals, and the ones that do provide more than just divergence signals. So, since this tutorial is about divergence signals, we'll focus on them.

Oscillators are the most reliable technical indicators that can be used to define divergence. MACD, RSI, Stochastic Oscillator and CCI are among them.

MACD

It doesn't matter if you're a newbie or a professional trader; it's still worth learning about the MACD indicator. It's one of the easiest technical tools that provide good signals.

The MACD indicator is a lagging indicator, which means that its signals occur late. Still, it offers an advantage when talking about divergence. The signal that divergence provides will be even stronger.

The idea is similar: all you need to do is wait until the indicator forms highs/lows that will be different from the price's highs/lows.

We always say that it's vital to use other technical indicators or patterns to confirm any signal you get. However, the MACD indicator can be used on its own. A crossover signal of the indicator can be used as confirmation if you want to enter a trade based on a divergence signal. If a crossover occurs, it's a sign that divergence is occurring.

RSI

RSI (Relative Strength Index) is an oscillator commonly used to depict overbought/oversold market conditions. At the same time, it forms highs and lows and can be used for the divergence concept.

The RSI indicator is represented by a solid line that moves up and down. This line's highs and lows are used to find divergence.

Look at the chart below. As you can see, there's a bearish divergence between the price chart and the RSI oscillator.

Any of the divergence types can be found when applying the RSI indicator.

Stochastic Oscillator

The Stochastic Oscillator is similar to the RSI and reflects overbought and oversold market conditions.

The oscillator consists of two lines that form tops and bottoms, and divergence is based on them. All you need to do is check whether the oscillator formed a high or low that doesn't correlate with the price's high/low.

When using RSI and Stochastic Oscillator, you should be careful as their signals are more frequent, leading to many fake alerts. That's why you should never forget about confirmations.

How to Identify Divergence

The concept of divergence is simple. All you need to do is:

- Apply a technical indicator that's placed below the price chart. We've mentioned the most popular indicators used to identify divergence above.

- Draw the line between the recent highs/lows on the price chart and the indicator. For that, you can use the line tool of the trading platform you use.

- Define whether the price and indicator are moving in different directions.

- If they are, check whether the divergence is based on highs or lows. That will determine the signal.

- Both regular and hidden divergence need confirmation. We never suggest using any market signal on its own when other market tools don't confirm the same conclusion.

How to Use Divergence in Trading: The Best Strategies

Divergence is one of the more straightforward concepts you can apply while trading. To increase the number of trades you make based on divergence, learn our trading strategies.

Strategy 1: Take Profit with Divergence

As we mentioned above, divergence doesn't provide clear entry/exit points. You should look for conformations while trading. At the same time, regular divergence predicts a price reversal. It can still be used to close a trade and take profit.

Divergence doesn't provide clear entry/exit points, but you can still use it as a likelihood to close the trade and take profit.

Imagine you're holding a short position. The price forms a bullish divergence with any indicator we mentioned above.

Bullish divergence is the first sign of a possible price reversal. However, you always need additional confirmation, whether it's the MACD indicator, RSI or a Stochastic Oscillator.

You can use candlestick and reversal chart patterns or support levels as confirmation. If patterns forecast a price reversal, the divergence signal is confirmed. If the price has reached a strong support level, that's also a sign of a price reversal. So, if you're holding a short position, you should close your trade.

The same concept applies to bearish divergence.

Strategy 2: MACD and Divergence

Let's consider a real example. On the EUR/USD pair's daily chart, we see bullish divergence.

We'll use MACD histogram signals. We already noted that the MACD indicator can confirm a divergence signal on its own. So, as the price and the indicator form bullish divergence, there's a sign the price will soon rise. Moreover, there's a bullish crossover, which means we can open a long position.

As we use confirmation from only one indicator, we should think about placing a Stop Loss order below the price's last low.

A Take Profit order can be placed at different levels. As we look at the daily chart, we can expect the price to move up for days. We can close the trade as soon as there's a bearish MACD crossover (1). Another option is to place a Take Profit order at the previous resistance level (2).

Key Points About Divergence

Divergence is an easy tool. That said, it has the features you should never forget to use correctly:

- Divergence can be found on any timeframe.

- Divergence can be used for any asset.

- The indicators that form divergence on a price chart are usually oscillators.

- Divergence provides both bullish and bearish signals.

- Both regular and hidden bearish forms of divergence are formed with highs. It's vice-versa when looking for regular and hidden bullish divergence. In that case, you'd look at lows.

- Regular divergence signals a high probability of a market reversal. Hidden divergence indicates a correction and continuation of the previous price movement.

- Divergence isn't used to identify a perfect entry/exit point. However, it can provide the necessary information about the way the price direction might go.

Conclusion: Should You Use Divergence in Trading?

To sum up, divergence is a market condition when the price and indicator move in different directions. The signal of the upcoming market movement forms based on divergence regarding the location of highs and lows. The leading indicators are the MACD, RSI and Stochastic Oscillator.

In general, divergence is an easy tool that can be used both by newbies and professional traders. However, hidden divergence can be challenging for you if you've never worked with it.

If you lack experience, consider opening a Libertex demo account. You can try live trading without any risk and gain enough experience in a safe environment. Try our divergence strategies on any trading instrument, including CFDs. As soon as you gain the necessary skills, it'll be time to open a real account.

We've talked a lot about divergence. Now, let's sum up everything we've learned.

FAQ

What Is Bullish Divergence?

Bullish divergence is a market condition in which the price forms lower lows. At the same time, the indicator you chose has higher lows. It's the first signal that the price may rise soon

What Is Bearish Divergence?

Bearish divergence happens in which the price forms higher highs, but the indicators create lower highs. Usually, the price goes down after the formation of bearish divergence.

How Can You Identify Bullish Divergence?

You can locate bullish divergence when you see that the price is forming lower lows on the chart, while the indicator has higher lows.

What Does Hidden Bullish Divergence Mean?

Hidden bullish divergence is a market situation in which the price has higher lows, and the indicator forms lower lows. This kind of divergence predicts a possible price retracement. It's a great chance to open a long position at lower levels.

How Do You Detect Divergence?

Divergence is one of the easiest technical tools. All you need to do is apply an indicator (the list of the most reliable ones is given above) and check whether the price and the indicator are moving in different directions.

Which Indicator Is Best for Divergence?

We would highlight such indicators as the MACD, RSI and Stochastic Oscillator. Still, you can apply other indicators but be sure you do that in a demo account, not a real one.

What Is Bullish Divergence on MACD?

The MACD indicator forms highs and lows. If the indicator's highs/lows don't match the price's highs /lows, divergence is occurring.

How Do You Confirm RSI Divergence?

To confirm the RSI divergence, check whether the price forms different highs/lows than the RSI oscillator. Also, any signal needs confirmation. It's best to apply support/resistance levels, other technical indicators predicting the market reversal, candlestick and chart patterns.

What Causes Divergence?

Divergence is caused by the difference in price and indicator directions. It can happen when the indicator predicts the market direction that isn't yet visible on the price chart. One of the reasons for divergence is a change in the market sentiment.

How Do You Trade with Divergence?

To trade divergence signals, you need to remember divergence types. Check whether divergence is caused by highs or lows, and check the table we created for you. The key indicators are RSI, Stochastic Oscillator and MACD.

How Reliable Is Divergence?

Divergence is a highly reliable tool. Classic divergence is easier to detect and more effective. It's also important to know about hidden divergence.

How Do You Spot Bearish Divergence?

During bearish divergence, the price forms higher highs, but the indicators create lower highs. Usually, the price goes down after the formation of bearish divergence.

What Does Divergence Mean in Trading?

Divergence is a market condition when the price and the indicator go in different directions. It helps read the signal of the upcoming price movement.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.