How can I use options CFDs for speculation and hedging?

Your ability to utilise the profit potential that options CFDs offer is only as good as your understanding of how to use them correctly. That’s why our next step will be to explore a variety of options CFD strategies and the appropriate scenarios for each of them.

Speculation

Speculation is a perfectly legitimate strategy of aiming for a significant gain quickly while willing to take a bigger risk. Typically, such an approach will differ from that of a long-term investor, and options CFDs could be a helpful tool in a speculator’s arsenal.

Speculative strategies with options CFDs

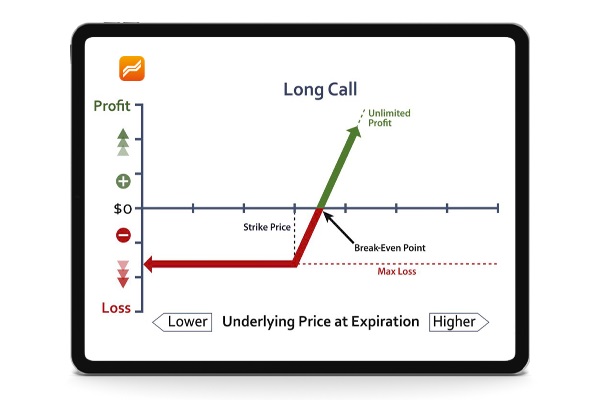

Long Call = Buying Call option CFDs

You can use this strategy if you’re bullish or think that a particular underlying index or commodity will go up. Furthermore, it allows you to increase your position’s volatility versus the that offered by the underlying instrument and lets you increase your potential profit if prices move in your favour.

Example

If the S&P 500 is currently trading at $3,000, and you believe it will trade at a higher price before the option’s expiry date, you can trade this view by purchasing a Call option CFD. (Note: You can replicate this strategy by selling/shorting a Put option CFD on the same instrument).

Risk/Reward: In this case, your potential gain from a long call would be unlimited and much higher than if you had invested in the S&P 500 index itself. However, your risk of loss is limited to what you paid for the option CFD since it can’t go below 0, even if the S&P 500 price is below the strike price of the Call option CFD at expiry.

Note: You can replicate this strategy by selling/shorting a Put option CFD on the same underlying asset. However, in that case, your gain would be limited since the value of the Put can’t go below 0 (if the price of the underlying goes up). Conversely, your risk of loss would be substantial because the Put option CFD can go up in price multiple times (if the price of the underlying asset drops significantly below the strike price). Thus, you would lose money on your short position.

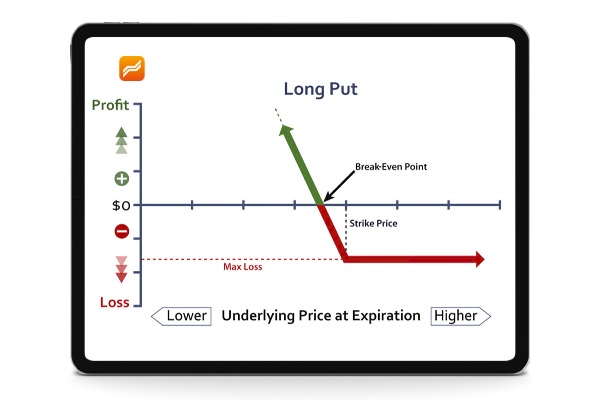

Long Put = Buying Put option CFDs

This strategy is used when you’re bearish or think an asset’s price will go down. Additionally, it enables you to effectively leverage your position since the change in the value of the option is usually greater than the change in the value of the underlying asset.

Example

Continuing our example, if the S&P 500 is currently trading at $3,000, and you think it will trade at a lower price before the option expires, you can trade this view by purchasing a Put option CFD. (Note: You can replicate this strategy by selling/shorting a Call option CFD on the same instrument).

Risk/Reward: When buying Put option CFDs, your potential gain is unlimited and much higher than if you were to short the S&P 500 index itself. However, again, your risk of loss is limited because the value of the Put option CFD can’t go below 0, even if the S&P 500 price is higher than the strike price of the Put option CFD at expiry.

Note: You can replicate this strategy by selling/shorting a Call option CFD on the same instrument. However, similar to selling a Put, your gain is limited because the value of the Call can’t go below 0 (if the price of the underlying goes down). On the other hand, your risk of loss would be substantial because the Call option CFD can go up in price multiple times (if the price of the underlying asset shoots up significantly above the strike price). Thus you will be losing money on your short position.

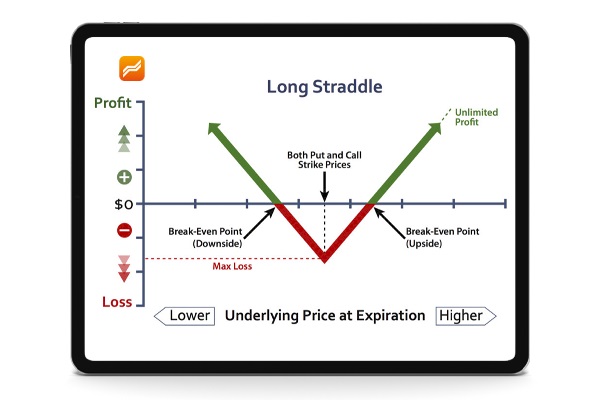

Straddle = Buying a Call and a Put option CFD with the same strike price and expiry

You can use this strategy if you’re expecting a sudden increase in the volatility of an asset but don’t know which way the prices will move. This strategy is often used around companies’ earnings releases, when a sudden and significant change in price may occur.

Example

Using the S&P 500 as an example once more, let’s say that a presidential election is coming up or the US Fed is announcing its interest rate decision. As a trader, you don’t know what the exact outcome will be, but you do expect it to cause the S&P 500’s price to increase or decrease substantially. In this case, you simultaneously buy a Call and a Put option CFD with the same strike price and expiry date on the S&P 500.

Risk/Reward: Let’s assume that after the actual announcement, the market reacts positively, and prices shoot up. You’ll incur a small loss on the Put option CFD equal to its price and make a huge gain on the increase in the value of the Call option CFD. Conversely, if prices drop, your gain will come from a significant increase in the value of the Put option CFD while incurring a small loss on what you paid for the Call option CFD. Finally, if markets don’t respond, and the price of the underlying assets doesn’t change, both options CFDs will slowly lose value as their expiry approaches.

Hedging

Hedging is an attempt to protect your portfolio or a specific investment from adverse price changes and thus avoid losses. One of the original purposes of options is to accomplish this goal reasonably, cheaply and effectively.

Hedging strategies with options CFDs

Let’s imagine that you’ve made a profit on an investment in the S&P 500 index. Say that you want to go on an extended holiday and don’t want to follow the markets or trade during this time but also don’t want to sell your investment either. In that case, you can keep your S&P 500 index holdings and additionally purchase some Put option CFDs on the same underlying asset.

If the S&P 500 goes up, you’ll make a profit on the index that you own and a loss on the Put option CFDs, thus maintaining the overall value of your holdings somewhat stable. Conversely, if the S&P 500 goes down, your losses on the index will be compensated by the gains in the price of the Put option CFD. Finally, if the S&P 500 remains flat, the value of the Put option CFD will also not change much, and your holdings will remain relatively stable.

A word on leverage

As you’ve certainly understood by now, options CFDs are more volatile than their underlying assets, which gives you more profit and loss potential. In fact, from one perspective, options CFDs can be seen as taking leveraged positions in the underlying assets. Consequently, you must be careful when using leverage with options CFDs. That’s why we’ve capped leverage for trading options on Libertex at 5 and recommend that you carefully consider the risk you’re willing to take before opening leveraged positions.

Now that you know the basics of options and options CFDs, why you may want to use them and the strategies you can utilise, you’re ready to place your first few practice trades.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.