OCO Order: a Chance or a Trap?

OCO Order: The Core Concept

In general, an order is a command to a trading platform to perform specific actions when certain conditions are met. There are different types of orders, some of which you may already know: pending orders, market orders, as well as stop-loss and take-profit orders.

An OCO order is a pair of pending orders, one of which is cancelled as soon as the other is executed. Usually, an OCO order is a combination of stop and limit orders. It's executed automatically when the price reaches the levels set by the trader.

A One-Cancels-the-Other order is a pair of pending orders, one of which is cancelled as soon as the other is executed.

OCO orders are used to minimise risk while trading in a highly volatile market. When a trader can't predict the upcoming market direction, it's worth placing two opposite orders, one of which will be triggered and one which will be deleted when the other is executed.

There is also the Order-Sends-Order command, but it works the opposite way. It triggers but does not cancel the second order, which is very important to note.

Pending Orders

Although we are talking about the OCO order, we should remind you what the pending orders are. Look at the picture below.

Pending orders are the basics of the OCO order.

Stop orders are presented by buy stop and sell stop orders. By placing them, a trader expects the price to break at a predetermined level to open the trade.

Limit orders consist of buy and sell limit orders. A trader anticipates the price to rebound from a certain level.

OCO Order: the Process

As we mentioned above, the OCO order helps investors reduce risks. Imagine you have shares of a company. As the stock market is highly volatile, especially in times of meaningful news or economic releases, the investor can place an OCO order.

Assume the shares have a price of $100. Due to the volatility, you anticipate the price can decline, but you don't want to lose more than $15. You place a sell stop order at $85. This means that if the price slips to $85, the stock will be sold at this level. However, if the price surges to $115, the sell limit order will be triggered. It means your stock will be sold at $115.

You should remember two significant points. The first one is that if one order is executed, the other one is cancelled. The second is that if one of the orders is cancelled, the second one is deleted as well.

The OCO order is usually set when the market is highly volatile. Otherwise, a trader will have to wait for a long time before any of the orders work. At the same time, it's a huge pitfall of this type of order. Some brokers had to block OCO orders as they increased the loss size because of the lack of a specific stop-loss.

The OCO order usually occurs when the market is highly volatile. However, high volatility is also a pitfall of this instrument.

Here's an example. Imagine the market is highly volatile. You placed a buy stop order, expecting the market to rise, and a sell stop order, considering a change of a downtrend or even a buy limit order considering a rebound strategy.

However, after the buy stop order was triggered, the market reversion occurred. You know that pending orders allow you to open positions without monitoring the market. It means you could miss that moment when the market moves in the opposite direction. As there's no stop-loss with either of them, or it's too far from the entry point, you'll lose your funds.

High volatility may be a reason for the following situation: the market may reach the stop-loss but later move in the same direction again. It means you'll suffer losses even though your market prediction was correct.

It doesn't mean you shouldn't use the OCO order; you just need to be pretty sure the market will form a trend and won't turn around until it reaches a specific point.

The Best OCO Strategies

An OCO order isn't only a way to limit risks, but a tool for famous trading strategies. The OCO order can be used both for retracement and breakout strategies.

Breakout Strategy

If you're unsure whether the market will move up or down, you can use a breakout strategy. It's based on the break of either support or resistance levels. That's why the OCO order consists of a buy stop and sell stop orders. It means that the order is executed if the price breaks above the set level.

Retracement Strategy

A retracement strategy supposes that you either buy at support or sell at resistance. Thus, an OCO order is represented by buy limit and sell limit orders. It means that you expect the price to reach a defined level and turn around.

OCO Order: Forex Trading Example

To make it simpler, let's consider an example of Forex trading with the OCO order. Imagine you trade the EUR/USD pair. It has been consolidating, but you believe the trend forms in case of the breakout of the specific level.

If the price breaks above 1.18, a bullish trend occurs. In case the price falls below 1.17, the bearish trend happens. Thus, you place a buy stop at 1.18; the sell stop is at 1.17. As soon as the price breaks either one or another level, one of the orders will be executed. The second order will be cancelled.

OCO Order: Benefits and Limitations

It's worth using the OCO order if you're unsure about the following market trend. It limits the risks of the wrong trade and saves time for investors. If the market has high liquidity, the OCO order can be successful.

Although it seems the order is simple, it can be tricky. That's why only experienced traders use it to lower risks and enter the market. Let's consider the pitfalls a newbie trader may face.

|

Benefits |

Limitations |

|

Win-to-win strategy. It's always complicated to define the upcoming market direction. An OCO order allows investors to place opposite orders. A trigger of any of them will lead to a successful trade. |

Not standard. It's a significant disadvantage that an OCO order isn't a standard tool in the MetaTrader platform. It's not easy to find a reliable program that will execute trades correctly. |

|

Limit risks. The primary function of the OCO order is to shorten market risks. The risk of a wrong trade reduces by 50%. |

Not for all. The order is tricky and doesn't suit beginner traders. To understand how to place an order, you should properly understand the idea of pending orders. |

|

Limit time efforts. The OCO order consists of pending orders; it means you don't have to monitor the market all the time. You can place an order and forget about it until it's executed. |

Blocked. Some companies block OCO orders as they may lead to high margins and losses. |

OCO Order in MetaTrader 4

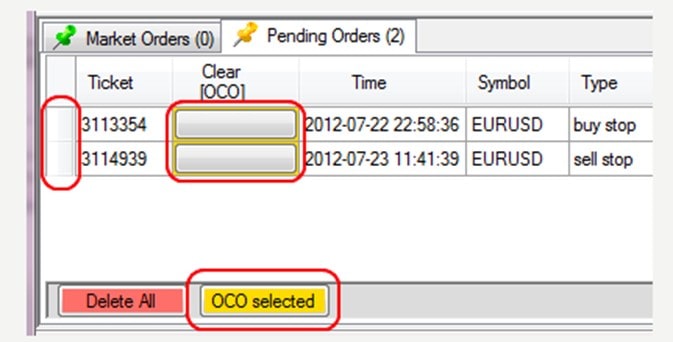

The OCO order isn't a standard tool in the MetaTrader platform. To set this type of order in MT4, you should download it from the Internet. You can find plenty of Expert Advisor programs that help place OCO orders. An Expert Advisor is a process to set a position based on specific rules. To choose the perfect one, you need to try several or simply read reviews.

The OCO order isn't a standard tool in the MetaTrader platform. You need an Expert Advisor to implement it in the MT4.

Each of the programs will have specific steps for installation. If you have doubts about setting an Expert Advisor program, you can contact the support team of your broker.

The OCO order program can look as follows.

You should be careful when choosing an EA. You should understand that it's not just an indicator that you download from the Internet. Even if it doesn't work correctly, you won't lose your money. However, if the OCO order doesn't work properly, there's a risk of money loss.

Tip for Traders: Avoid Mistakes When Placing OCO Orders

The OCO order isn't set by default in the MetaTrader platform. It means the order isn't for all traders. However, if you're skilled enough, you can try this tool to limit the risks of losing trades significantly. Before you use the order, read about the most common mistakes traders make.

- No confirmation. Although the order is used when you are unsure about the market direction, you must be sure the market won't turn around after the trade is triggered.

- Place stop-loss orders. You should define the level at which you will close the trade if the market moves against you. You can either place a stop-loss order or close the position yourself. If you do it yourself, you should trade on small timeframes to not waste the whole day monitoring the market.

- Reliable assets. It may sound strange how we can define reliable and unreliable assets, but this qualification is based on an asset's risk. Previously, we said that the OCO order is used in a highly volatile market. But it's an additional risk for traders. That's why you should choose less risky assets, such as major currency pairs. Even if you want to trade stocks, you should select blue-chip companies.

- Low liquid. You should avoid low liquid markets as there are risks the orders won't be executed, and the market conditions will change until the price reaches the level you determined.

Conclusion

To conclude, the OCO order is a tricky trading instrument. A beginner trader should avoid using this type of order as the risks of loss are high. Some brokers don't allow you to use this order, that's why it's not a standard tool of the MetaTrader platform.

If you still want to trade using the OCO order, you should practice a lot to have enough skills for tricky trades.Please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital. That's why you should try different strategies using a Libertex demo account. The demo account fully copies the real one and provides securities such as currencies and CFD and all the necessary instruments to help you in trading.

Read the answers to the frequently asked questions.

FAQ

What Does OCO Mean in Trading?

OCO or one-cancels-the-other order consists of two opposite pending orders, either of which triggers when the chosen asset touches a certain level. The second order is automatically cancelled.

How Do You Use OCO?

The OCO order is used to place two opposite orders if you're unsure about the market direction and want to limit risks.

What Is OCO Stop Limit?

The stop limit is a pending order that triggers a position when the price rebounds from a certain level.

Why Are OCO Orders Blocked?

OCO orders can increase the size of margin and loss in highly volatile markets, especially if a trader is a beginner.

What Is the OCO Trigger?

The OCO order is triggered when the price touches a predefined level.

What Are CO and OCO?

CO is a cover order that is placed together with a stop-loss order. OCO is a set of two pending orders, one of which is automatically cancelled as soon as the first one is executed.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.