How to receive dividends

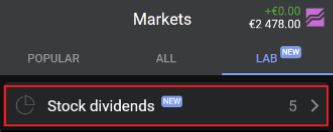

One of the key ways in investment accounts is to take potential advantage of when dividends are paid out. Dividends are a company's profits that are distributed to shareholders. This usually happens after the company's quarterly report is released. Dividends are paid out according to dedicated calendars that indicate dividend payment dates.

To take a potential advantage on dividends, find an asset in the calendar and open a buy position no later than a day before the ex-dividend payment.

By buying an asset, you become an investor in the company's shares and become eligible to receive a dividend payment on the payment date when you are "recorded" as being a shareholder. You must keep the position open through the record date to receive the dividend payment.