Crude Oil Price Forecast: Short-Term and Long-Term Predictions

What Is Crude Oil?

Crude oil is a fuel source in liquid form that can be found underground and extracted by drilling. Oil has many uses, including plastic and petroleum production, transportation, heat and electricity generation.

Because of oil's origins, it's considered a "fossil fuel". Simply put, crude oil was created hundreds of millions of years ago when plankton and prehistoric algae settled at the bottom of the ocean. The organic matter was covered with mud and layers upon layers of sediment; the resulting pressure heated the remains. For millions of years, the matter formed kerogen (a waxy substance), and after even more heat and pressure, it transformed into liquid oil.

Crude oil is a nonrenewable resource. When the world's current oil supply is used up, it'll take millions of years to create more oil.

A Closer Look at Crude Oil Usage

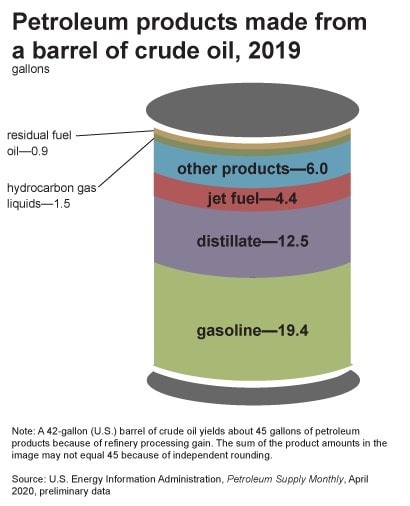

Crude oil has many uses. It's the base for gasoline, jet and diesel fuels. Furthermore, crude oil is the base for petroleum products, including paraffin wax, tar, asphalt and lubricating oils. Oil's use can even stretch as far as perfume, fertiliser, soap, vitamin capsules and insecticides.

While pretty much every country depends on oil, only a handful produce it. The top 5 countries that have the most oil are the US (17.9%), Saudi Arabia (12.4%), Russia (12.1)%, Canada (5.9%) and Iraq (5%).

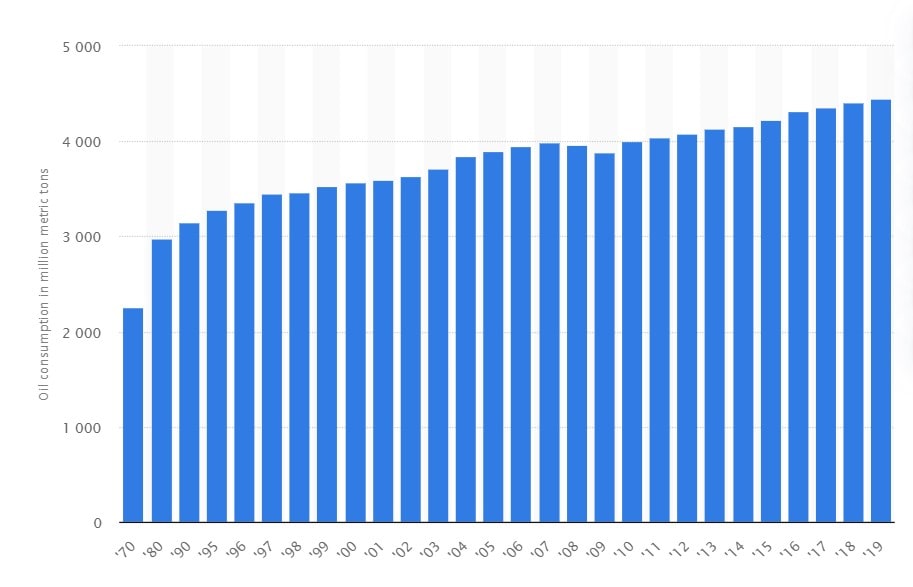

Global oil consumption has risen steadily year to year over the last three decades. The only decline was during the financial crisis of 2008 and the COVID-19 crisis of 2020.

Crude Oil Types

There are two main types of crude oil: Brent and West Texas Intermediate (WTI).

WTI

West Texas Intermediate (WTI) crude oil is lightweight and has little sulphur. As such, it's high-quality and is often called "light, sweet" oil. Its properties make WTI ideal for producing gasoline, which is why it's the US's standard for crude oil.

Brent

Brent combines crude oil from over a dozen various oil fields in the North Sea. While it isn't as "light" or "sweet" as WTI, it's still good for making gasoline. It's the standard for Europe's and Africa's crude oils.

4 Factors Influencing Oil Price

Due to unexpected changes to the factors that affect oil prices, this commodity has become highly volatile. Later, we'll take a look at how exactly crude oil's price performed in 2020, but first, we'll introduce four key factors that have had a significant impact on this black gold.

Diminishing Global Demand

The EIA estimated that the global demand for oil and liquid fuels was 92.2 million barrels per day. This was 9 million fewer barrels per day than in 2019. However, the EIA anticipates that the barrel per day rate will rise by 3.35 million in 2022.

Rising Production in the US

US producers of alternative fuels and shale oil have increased their supply. It has been gradual, with supply increasing slowly since 2015. Shale oil producers have found ways to extract oil more efficiently, mainly by keeping wells open and reducing the cost of capping.

In August of 2018, the US became the largest oil producer in the world. The next year, US crude oil production exported more oil than it imported for the first time since 1973.

Decreasing OPEC's Clout

While US shale producers have increased their market influence, they don't operate in OPEC's cartel-like manner. OPEC hasn't cut their output enough to support prices. The leader of OPEC, Saudi Arabia, desires higher oil prices, as that is where its government gets revenue from. However, this is offset by losing its market share to Russian and US companies. Furthermore, Saudi Arabia doesn't want to lose its market share to its archrival Iran.

Increasing Dollar Value

The value of the dollar has been driven up by FX traders ever since 2014. In times of economic distress, many traders consider the US dollar to be a safe haven. For instance, from 2013 to 2016, the dollar's value increased as a response to Brexit and the Greek debt crisis. And the coronavirus pandemic caused the dollar to increase in value from 3 to 23 March 2020.

So, how does this affect oil? All oil transactions are made in USD, and most oil-exporting countries maintain their currency's value at a fixed exchange rate to USD. As such, a 25% rise in the dollar's value comes along with a 25% decline in oil prices.

Crude Oil Price Performance in the Past

Over the last decade, the price of crude oil has been especially volatile. Crude oil is one of the most scrutinised commodity prices; its cost influences all stages of production and, therefore, alters the price of end-products, as well.

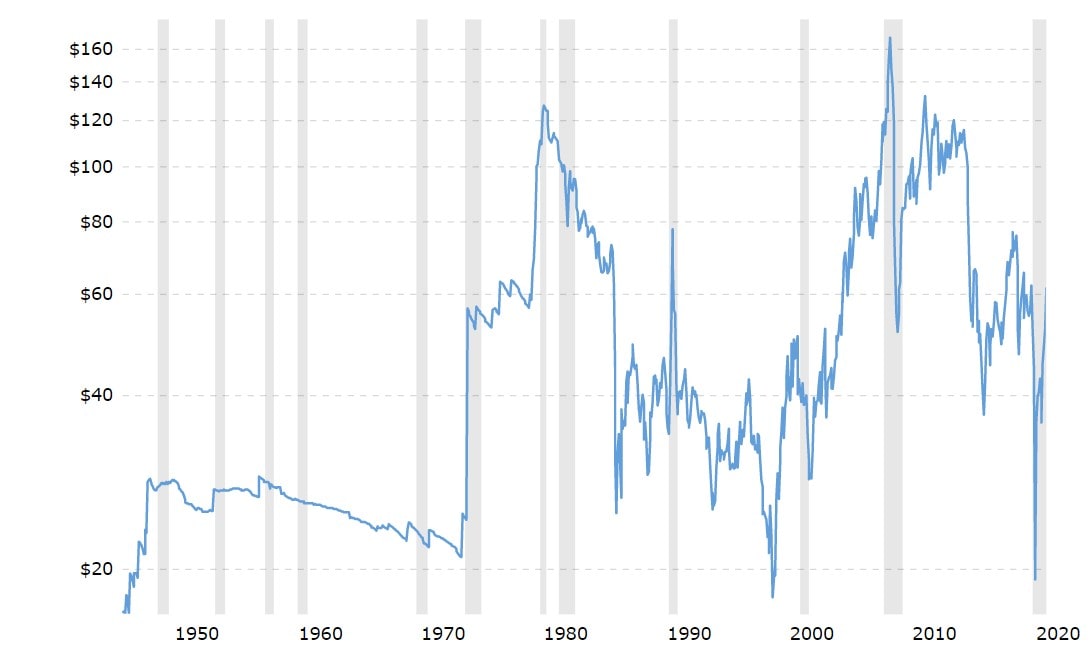

Why has crude oil been so volatile? Oil's inherent inelasticity in regards to short-term changes in supply and demand means that its prices are naturally erratic. What's more, the economic growth in BRIC countries (like India and China) and the use of horizontal drilling and hydraulic fracturing in the US have caused further changes to supply and demand, thus contributing to the heightened price volatility since 2009. The chart below shows the historical fluctuations in oil's price:

Some historical world market oil events reflected in the chart include:

- 3 May 1970: The delivery of Saudi Arabian's Trans-Arabian Pipeline was disrupted in Syria, which drove oil tanker rates to all-time highs in June-December.

- 1981: Saudis flooded the market with cheap oil in 1981, causing OPEC members to make unprecedented price cuts. In October, all OPEC members compromised on a benchmark of $32 per barrel.

- August 1990: Iraq invaded Kuwait, thus causing oil prices to soar.

- 1998: Crude oil reached its lowest price since the 1980s as a result of the Asian economic crisis.

- 2008: The globaleconomic collapse brought the price of WTI oil to an all-time high of $125.21 per barrel.

- 2020: The globalpandemic reduced oil demand. This and other factors brought the price of oil to negative territory.

How Was Oil Doing in 2020-2021? What's Happened to Oil Prices in 2022 (So Far)?

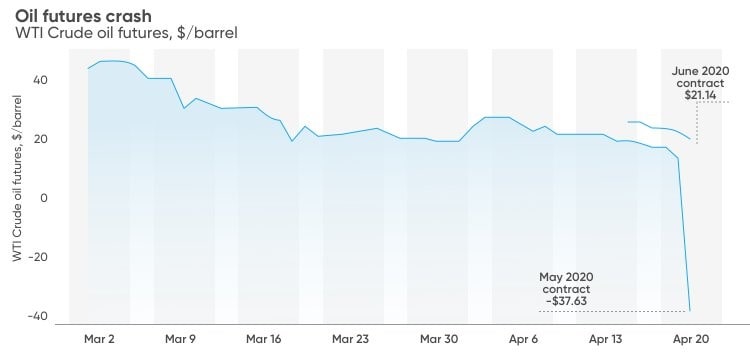

Crude oil had a terrible year in 2020, and we don't say that lightly. The US's assassination of Iran's most powerful military commander, Qasem Soleimani, on 3 January 2020 led to heightened global tensions. Add COVID-19 to the mix, as well as the Saudi-Russia oil price war, and it's not surprising that oil's price shot down.

What nobody was expecting, however, was for the price to reach -$37.63. This occurred on 20 April 2020, plunging crude oil's price to negative prices for the first time in history.

As the commodity plummeted amidst immense oversupply and a drop in demand, investors fled. Since then, however, crude oil has managed to recover its losses and reach price levels of late 2019.

So far, in 2022, the price of oil has been on a wild ride. Russia's invasion of Ukraine has had a ripple effect across the globe. The new financial sanctions and exodus of western companies from Russia, which used to meet 5% of global crude demand and 10% of the refined products export market, deepened fears over oil supplies.

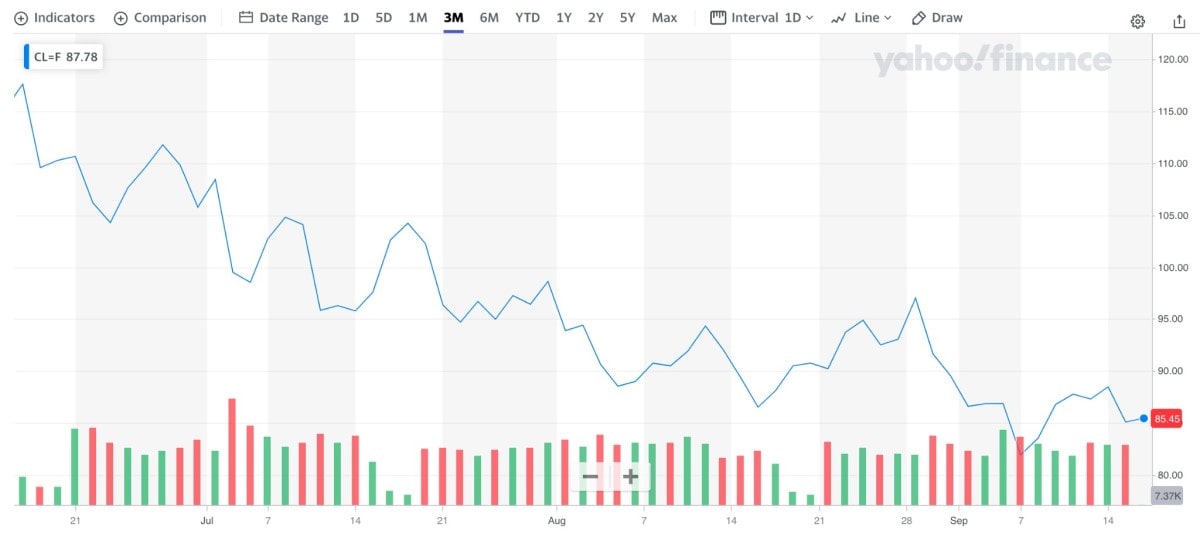

Between 25 February and 3 March, oil prices rose from $97.93 to $127.98 a barrel. Another big swing happened between 16 and 23 March, when prices went from $98.02 to $121.60. Up until the beginning of August, the price was moving in an uptrend, albeit a rocky one. Starting from 6 August ($122.11), oil has been in a steep downtrend.

The closing price on 16 September was $85.29.

Crude Oil Price Forecast for 2022-2024

Wallet Investor has published Brent crude oil predictions for 2022-2024. After 2024, however, month-to-month predictions are too speculative to provide, so we'll give more general insights for later years.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

October 2022 |

87.91 |

86.60 |

86.60 |

88.17 |

-1.51% |

|

November 2022 |

86.57 |

84.89 |

84.89 |

86.65 |

-1.98% |

|

December 2022 |

84.91 |

85.81 |

84.19 |

85.87 |

1.06% |

Summary: Brent crude oil is anticipated to enter October between $86.60 and $88.17. It may end 2022 between $84.19 and $85.87. Source: WalletInvestor

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2023 |

86.06 |

87.25 |

86.06 |

87.37 |

1.36% |

|

February 2023 |

87.31 |

92.13 |

87.31 |

92.13 |

5.23% |

|

March 2023 |

92.40 |

93.58 |

92.40 |

93.62 |

1.25% |

|

April 2023 |

93.96 |

95.42 |

93.96 |

95.85 |

1.54% |

|

May 2023 |

95.35 |

99.78 |

95.35 |

99.78 |

4.44% |

|

June 2023 |

99.98 |

101.23 |

99.89 |

101.36 |

1.24% |

|

July 2023 |

101.26 |

99.72 |

99.72 |

101.45 |

-1.54% |

|

August 2023 |

99.64 |

99.06 |

98.33 |

99.64 |

-0.58% |

|

September 2023 |

98.95 |

98.57 |

98.51 |

99.27 |

-0.39% |

|

October 2023 |

98.60 |

97.36 |

97.36 |

98.91 |

-1.27% |

|

November 2023 |

97.35 |

95.76 |

95.75 |

97.42 |

-1.66% |

|

December 2023 |

95.49 |

96.41 |

94.89 |

96.46 |

0.95% |

Summary: Brent crude oil is anticipated to enter 2023 between $86.06 and $187.37. It may end 2023 between $94.89 and $96.46. Source: WalletInvestor

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2024 |

96.67 |

98.01 |

96.67 |

98.08 |

1.38% |

|

February 2024 |

98.15 |

103.19 |

98.02 |

103.19 |

4.88% |

|

March 2024 |

103.25 |

104.16 |

103.25 |

104.31 |

0.87% |

|

April 2024 |

104.49 |

106.09 |

104.49 |

106.57 |

1.5% |

|

May 2024 |

106.15 |

110.52 |

106.15 |

110.60 |

3.96% |

|

June 2024 |

110.68 |

111.91 |

110.68 |

112.03 |

1.1% |

|

July 2024 |

111.96 |

110.43 |

110.43 |

112.18 |

-1.38% |

|

August 2024 |

110.44 |

109.61 |

109.03 |

110.44 |

-0.76% |

|

September 2024 |

109.72 |

109.29 |

109.25 |

109.99 |

-0.39% |

|

October 2024 |

109.33 |

108.21 |

108.15 |

109.65 |

-1.04% |

|

November 2024 |

108.00 |

106.35 |

106.35 |

108.00 |

-1.55% |

|

December 2024 |

106.01 |

107.39 |

105.62 |

107.39 |

1.28% |

Summary: Brent crude oil is anticipated to enter 2024 between $96.67 and $98.08. It may end 2024 between $105.62 and $107.39. Source: WalletInvestor

Looking to the Future: Oil Price Forecasts for 2025-2050

Developing an oil price forecast is so much more complicated than forecasting currency pairs or crypto because it depends so heavily upon environmental changes in addition to the global economy. Oil is a limited resource, so we'll eventually hit a plateau in production, and, afterwards, this commodity will become scarcer and scarcer. This implies that the price will skyrocket.

|

Month |

Opening price ($) |

Closing price ($) |

Minimum price ($) |

Maximum price ($) |

Change |

|

January 2025 |

107.52 |

108.71 |

107.52 |

108.85 |

1.09% |

|

February 2025 |

108.76 |

113.70 |

108.76 |

113.70 |

4.35% |

|

March 2025 |

114.26 |

115.05 |

114.26 |

115.07 |

0.68% |

|

April 2025 |

115.20 |

116.86 |

115.20 |

117.28 |

1.42% |

|

May 2025 |

116.99 |

121.14 |

116.85 |

121.21 |

3.43% |

|

June 2025 |

121.33 |

122.65 |

121.33 |

122.70 |

1.08% |

|

July 2025 |

122.70 |

121.30 |

121.29 |

122.90 |

-1.15% |

|

August 2025 |

121.03 |

120.26 |

119.74 |

121.03 |

-0.65% |

|

September 2025 |

120.38 |

120.02 |

119.98 |

120.68 |

-0.3% |

|

October 2025 |

120.10 |

118.79 |

118.79 |

120.37 |

-1.1% |

|

November 2025 |

118.61 |

117.21 |

117.21 |

118.71 |

-1.19% |

|

December 2025 |

116.85 |

118.13 |

116.36 |

118.13 |

1.08% |

Summary: Brent crude oil is anticipated to enter 2025 between $107.52 and $108.85. It may end 2025 between $116.36 and $118.13. Source: WalletInvestor

However, we must not ignore the push for renewable resources. If solar energy becomes the new normal, global oil markets will instead plummet. This is why it's futile to provide a price prediction for crude oil set decades in the future.

Wars, climate change and government policies will all influence oil's price, for better or worse.

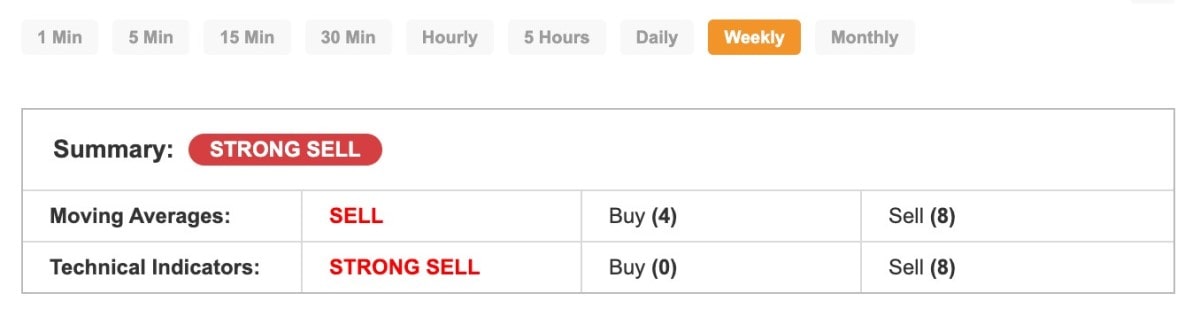

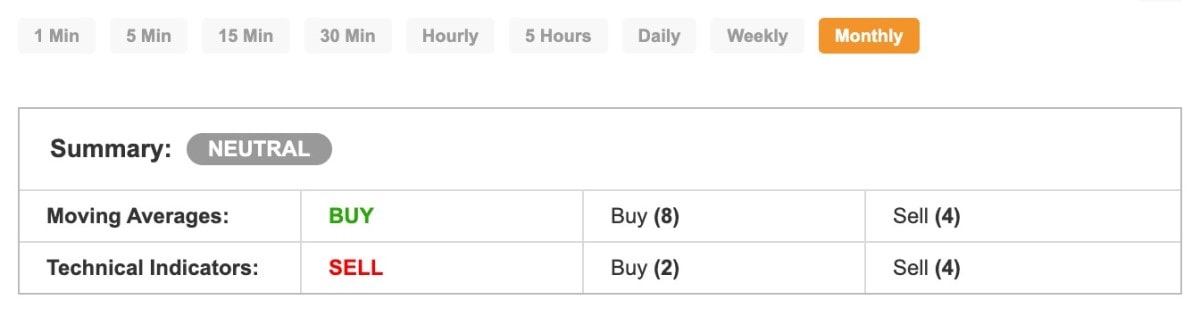

Technical Analysis of Oil Price

When determining whether to buy or sell oil, it's crucial to create a technical analysis. We'll show you the top technical indicators to include in crude oil analysis, presented alongside an example.

First, you need to determine whether you want to trade Brent, WTI or both. They trade differently, so they each have their own technical analysis.

Next, choose the timeline that you want to look at. While it's possible to set up technical analysis for timelines as short as 30 minutes, it can also be useful to look at the bigger picture, such as in weekly increments.

You'll also want to decide which technical indicators to use. Some useful ones include:

- Simple Moving Average (adds recent prices and divides it by the number of days in the time period)

- Bollinger Bands (shows two price channels (or bands) above and below a centerline)

- Relative Strength Index (measures the change and speed of recent price movements)

Based on the weekly trend, the moving average and technical indicators indicate a strong buy.

Long-Term Oil Price Predictions by Experts

We've gathered several long-term price predictions from experts in the field.

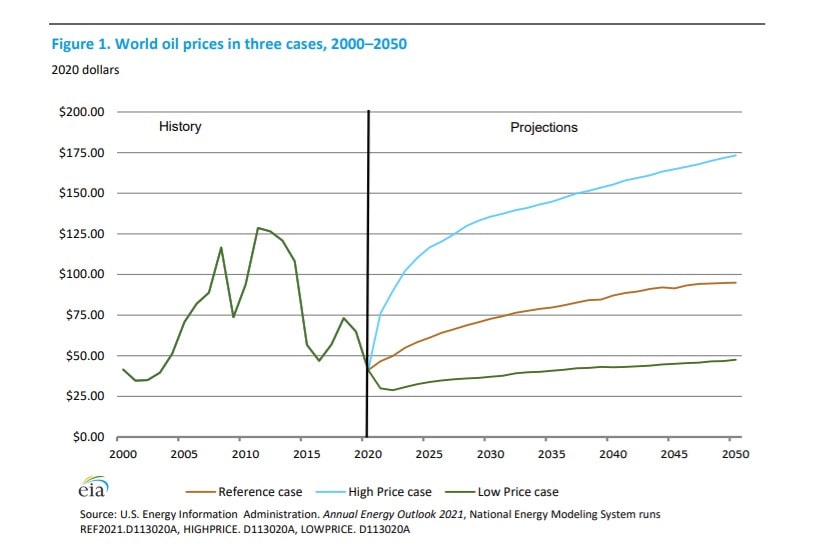

EIA

The US Energy Information Administration (EIA) is one of the most reputable sources of oil price predictions. According to their short-term energy outlook, crude oil prices will hold steady.

As for their long-term opinion, the EIA predicts that the price of crude oil may follow three paths: the reference path, the high price path and the low price path. In a best-case scenario, crude oil's price could soar to $175+ by 2050. In a worst-case scenario, it could stay under $50 for the next several decades.

Kimberly Amadeo - The Balance

Amadeo is the President of World Money Watch; she has over 20 years of experience producing economic analysis. Amadeo predicts that Brent's price will rise to $89 per barrel by 2030 and then $132 per barrel in 2040. Her reasoning? By then, all the cheap oil sources will have been used up, making oil extraction more expensive.

McKinsey

In 2021, McKinsey released their Global Oil Supply and Demand Outlook, in which it predicted three paths for oil's future prices. While their recession path was not as drastically negative as what really happened in 2020, oil prices now match up with McKinsey's Base Case. McKinsey foresaw the stagnation, oversupply and OPEC issues that have plagued oil prices in 2020 and 2021. So, what do they see for crude oil's price in the long term?

They have several different long-term predictions, in fact, depending on which short-term scenarios are not remedied. In the best-case scenario, in 2040, there will be strong demand growth, and barrels will be worth over $100. If stagnation and oversupply remain, prices will be around $80-90 per barrel. If OPEC remains in control of the market balance, the price per barrel should be between $65 and $75. If there is long-term oversupply, the price per barrel would instead be $50-$60.

What to Do With Crude Oil: Trade or Invest?

Just as with any other market, there is no guarantee of profit when you invest in oil. Because of its often-fluctuating prices, crude oil is a very risky asset. Therefore, before making an investment decision, be sure to check out the latest expert opinions, market trends, and technical analysis. To build any trading strategy, it's crucial to inform yourself about economic goings-on as deeply as possible.

But what if you aren't ready to make a long-term investment commitment? With CFDs, you can make trades on the crude oil market in a shorter timeframe without waiting for years. With the Libertex Trading Platform, you can get started trading WTI and Brent Crude Oil CFDs.

Let's finalise this article with commonly asked questions.

FAQ

Are Oil Prices Expected to Rise in 2022?

According to Wallet Investor, oil prices may go down by the end of the year.

Will Oil Prices Ever Recover?

Not only will oil prices recover, but they may also reach a new all-time high by 2050, depending on which global market scenarios play out.

Will Oil Go Up to $100 a Barrel?

Yes, this is certainly possible. In fact, the EIA forecasts that Brent oil could reach as high as $175 per barrel by 2050, and economic conditions might drive the price even higher. $100 per barrel is not unprecedented; in July of 2018, prices reached $133 per barrel. In December 2018, prices dropped down to $40 per barrel (lower than the current price) and then rose to $124 per barrel in 2011.

So, large fluctuations in price are possible, and we may even see prices upwards of $200 per barrel over the next couple of decades. However, you must keep in mind that extended high prices will cause people to change their buying habits, resulting in demand destruction.

Can Oil Go Up?

Political unrest, as well as growing scarcity, could cause the price of oil to go up.

How Can I Buy a Barrel of Oil?

While you can buy a barrel of oil, you'd need to go to the spot market, which is for physical goods that are bought, sold and traded in real-time.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.