What is the IBEX 35 Index?

IBEX 35 definition

The IBEX 35 (Índice Bursátil Español Index) is a free-float market capitalisation weighted index of the most liquid stocks listed on the Madrid Stock Exchange. It's rebalanced twice a year to ensure that the 35 most-liquid stocks on the exchange remain in the index.

History of the IBEX 35

The IBEX 35 index was launched in 1992 and recorded its lowest-ever level later the same year. The index then strengthened through the rest of the 1990s, trading as high as 12,968 in early 2000. Like many indices, the IBEX declined substantially in 2001 and 2002, after the Dotcom bubble burst.

The index had its strongest rally from 2003 to 2007, when the construction and real estate sectors were booming. This was followed by a period of record volatility while the global financial crisis played out between 2007 and 2009. The recovery was short-lived, as Europe's debt crisis followed in 2011, with Spain amongst the worst-affected countries.

Since then, the IBEX 35 has lagged behind other Spanish indices due to its low exposure to technology and growth stocks. The index has remained in a sideways trading range between 6000 and 12,000 since 2009.

How the IBEX 35 is calculated

The IBEX 35 is based on free-float market capitalisations, which are not capped. A company's free float is the number of outstanding shares that are not restricted or held by related parties. The free float is expressed as a percentage that is multiplied by the market capitalisation to arrive at the free-float market capitalisation.

To calculate the weight of each company, the sum of the free-float market capitalisations of all 35 companies is calculated first. Each company's weighting is then calculated by dividing its free-float market capitalisation by the total value of all 35 companies.

To calculate the index level, the total free-float market cap of all 35 companies is divided by the same value for a base period and then multiplied by the index level for that base period.

Some market capitalisation weighted indices have a cap on the weight of each company. However, this is not the case for the IBEX index.

How the IBEX 35 Works

The IBEX 35 index is maintained by Bolsas y Mercados Españoles, which also manages financial markets in Spain. The index is reviewed twice a year, in June and December, by a technical advisory committee.

Any changes to the index are based on the six-month period prior to the review. Liquidity, not market value, is the primary criterion for inclusion.

The stocks that are included are the 35 companies with the highest traded value over the review period, provided that they account for at least 0.3% of the total index value and trade on more than 33% of trading days or fall into the 20 most-valuable companies.

Any changes that are made come into effect on the first trading day following the third Friday of the review month.

IBEX 35 Companies

The following are the largest 10 companies in the index and account for 71% of the total weight of the index.

|

Company |

Symbol |

Sector |

Industry |

Weight |

|

Iberdrola SA |

IBE.BC |

Utilities |

Utilities |

18.21% |

|

Industria De Diseno Textil SA |

ITX.BC |

Consumer Cyclical |

Apparel Retail |

11.97% |

|

Banco Santander SA |

SAN.BC |

Financial Services |

Banks |

8.41% |

|

Cellnex Telecom SA |

CLNX.BC |

Communication Services |

Telecom Services |

7.10% |

|

Amadeus IT Group SA A |

AMS.BC |

Technology |

IT Services |

5.74% |

|

Telefonica SA |

TEF.BC |

Communication Services |

Telecom Services |

4.80% |

|

Ferrovial SA |

FER.BC |

Industrials |

Infrastructure |

4.51% |

|

Banco Bilbao Vizcaya Argentaria SA |

BBVA.BC |

Financial Services |

Banks |

4.45% |

|

Aena SME SA |

AENA.BC |

Industrials |

Airports and Air Services |

3.06% |

|

CaixaBank SA |

CABK.BC |

Financial Services |

Banks |

2.99% |

Prominent companies

The following three companies account for nearly a third of the index's market capitalisation.

Iberdrola SA

Iberdrola is a power utility company that generates and distributes electricity in Spain, the United Kingdom, the United States and Brazil. The company employs 34,000 people and has a market value of €69 billion, making it the second-most-valuable company in Spain.

Industria De Diseno Textil SA

ITX is an apparel and household product retailer. The company's brands include Zara, Pull & Bear, Massimo Dutti, Bershka, Stradivarius, Oysho and Zara Home.

With a market value of €75 billion, ITX is the most valuable company in Spain. However, its low free float reduces its weight in the index.

Banco Santander SA

Banco Santander is the largest financial services group in Spain. The company also operates globally and has a total of 11,950 branches. The company has a market value of €27 billion.

IBEX 35 Sector breakdown

The sectors that dominate the IBEX 35 are an important aspect of the index. The top 5 sectors in the index are as follows:

|

Sector |

Weight |

|

Utilities |

28% |

|

Financials |

17% |

|

Industrials |

14% |

|

Consumer Discretionary |

13% |

|

Communication Services |

12% |

The IT, Healthcare, Energy and Real Estate sectors together account for just 16% of the index.

Pros and Cons of IBEX 35

Pros

- The IBEX 35 is not highly correlated with other prominent indices. This makes it a useful tool for hedging and pair trades.

- The index has relatively high short-term volatility, which makes it attractive for short term traders.

- The IBEX index is more defensive than other benchmark indices under certain market conditions. This is due to its high exposure to utilities and low exposure to technology companies.

Cons

- The IBEX 35 has underperformed most other benchmark indices over the last decade.

- The index has high exposure to the utilities sector and low exposure to growth sectors like IT.

- The index is less liquid than indices like the S&P 500 and FTSE 100, which makes it slightly more expensive to trade due to a wider spread.

IBEX 35 vs other indices

IBEX 35 vs Dow Jones

The IBEX 35 outperformed the Dow Jones 30 index during the bull markets of the 1990s and mid-2000s. However, it has underperformed substantially since then. The IBEX has low exposure to the tech and healthcare sectors that have led the Dow over the last decade. If these sectors were to underperform, the IBEX might outperform. The IBEX is slightly more volatile than the Dow.

IBEX 35 vs Nikkei 225

Japan's benchmark index, the Nikkei 225, has more exposure to the IT and Healthcare sectors than the IBEX. During the 1990s, the IBEX outperformed the Nikkei. Between 2000 and 2018, their overall performance was similar, though the IBEX has significantly underperformed the Nikkei 225 since 2018. The IBEX is a lot more volatile than the Nikkei, making it attractive for active traders.

IBEX 35 vs CAC 40

The CAC 40 index and the IBEX 35 have tracked one another fairly closely over the past 30 years and generated similar returns over the full period. While the IBEX outperformed during the 1990s and the mid-2000s, the CAC 40 has outperformed substantially since 2009.

IBEX 35 vs Russell 2000

The IBEX 35 and the Russell 2000 tracked one another closely between 1991 and 2009, but they have uncoupled since then. While the IBEX index remains at March 2009's level, the Russell 2000 has gained more than 200%. The Russell index has high exposure to healthcare and IT, which has led the index's performance. The IBEX is slightly more volatile and better suited to short term trades.

Why trade the IBEX 35 Index

The IBEX index has not performed well over the last decade and has been disappointing for investors. However, the index is perfectly suitable for trading for several reasons:

- The index is quite volatile over short periods.

- It can be shorted using CFDs.

- It often trades in clearly defined trading ranges.

- Periods of low volatility often lead to larger moves.

How to trade IBEX 35

IBEX 35 trading hours

The Spanish stock market trades from 9:00 am to 5:35 pm CET each day. These are the normal hours during which the index is updated. However, the futures contracts on which CFDs are based have a longer trading day. The hours that CFDs can be traded vary from one broker to the next.

Fundamental analysis of IBEX 35

This index is affected by several factors. Firstly, the index reacts to movements in global markets, in particular, European and US equity markets. Although the correlation with other indices is relatively low, global markets still influence the index.

The second factor that affects the index is economic data in Europe and Spain. GDP growth, interest rates, consumer spending and employment data for Europe and Spain can all affect the index.

Like any index, corporate earnings for the member companies influence the index over time, particularly for the companies with the largest weights.

The index has low exposure to healthcare and technology companies. This means it may outperform other European indices if these sectors are under pressure.

The index also has low exposure to growth stocks. This means it may underperform other indices when global equity markets appreciate.

Technical analysis of IBEX 35

When analysing charts of the index, it's important to consider several different indicators and methods. Over the last decade, the index has traded in a range without persistent trends. This means long-term moving averages have been of limited value.

However, trendlines and support and resistance lines have been particularly useful.

The index often remains within a trading range for extended periods. Bollinger bands can also be used to define the trading range.

To keep an eye on volatility, setting the ATR indicator to 14 days is useful. Oscillators like the RSI and Stochastic indicator are useful for confirming overbought and oversold conditions.

Tips and tricks for IBEX 35 trading

- The IBEX 35 index follows different patterns compared to other indices and should be treated differently.

- Periods of low volatility are often followed by larger than normal moves. You'll need to adjust your strategy to anticipate the rising and falling volatility.

- It's a good idea to combine several timeframes when trading this market.

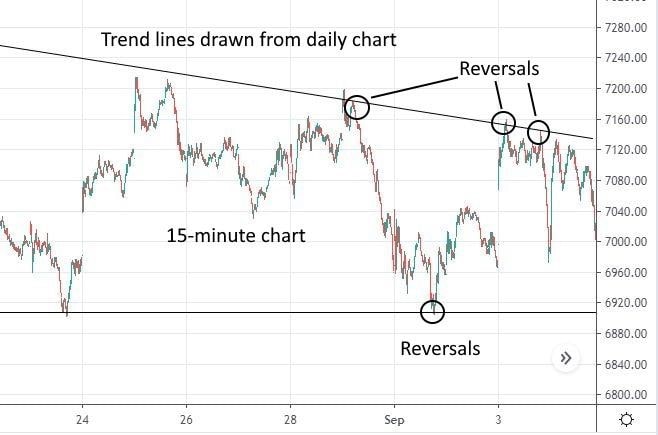

- Short timeframes such as 5 minutes and 15 minutes can be used to identify potential reversals on charts with longer timeframes like 1-hour, 4-hour and daily charts.

- The IBEX Index has been flat over the last decade, unlike most other indices, which have trended upward. While the index continues to move sideways, active traders should look to long and short positions.

What is CFD trading of the IBEX 35

CFDs are a type of derivative instrument that is similar to futures contracts. They allow traders to easily open both long and short positions using leverage. CFDs can be traded on any liquid assets, including indices, stocks, currencies, cryptocurrencies and commodities.

They offer more flexibility than other types of derivatives. You can start trading CFDs with any account size and can trade several asset classes using a single trading platform, such as the Libertex platform. But please note that trading CFDs with leverage can be risky and can lead to losing all of your invested capital.

Because CFDs are traded using margin, only a small percentage of the value of a position needs to be deposited before making a trade.

The best strategies for IBEX 35 trading

The IBEX 35 index is best suited to intraday trades and trades that last one to five days. The following are some of the strategies you can consider. In time, you may be able to develop your own approach to trading this market.

Pair Trading

The IBEX 35 often moves independently from other European and US indices. This is due to the fact that the index doesn't have much exposure to high growth stocks. This makes it a useful tool for pair trades.

A pair trade consists of a long and short position in different instruments. You open a long position for the instrument you expect to appreciate and a short position for the instrument you expect to decline. This could be based on the primary trend for each instrument or on trading ranges.

One approach to using the IBEX is to wait for a negative catalyst in another European market, short sell that market index using CFDs and open a long position using CFDs on the IBEX 35.

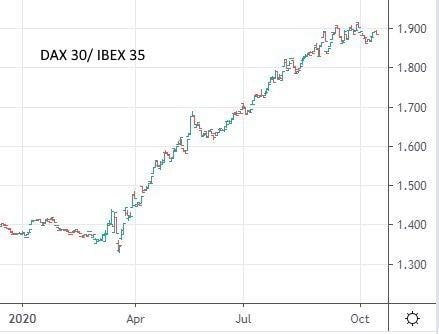

Alternatively, you can use a short IBEX 35 position to hedge a long position on another index. The chart below shows the net performance of a long DAX 30/short IBEX 35 position.

Intraday Reversals

The IBEX 35 index frequently trades in a clearly defined channel, with sharp reversals occurring when the index level reaches support or resistance levels.

The reversals can be anticipated using daily and 4-hour charts and then executed on shorter timeframes like 5- or 15-minute charts. The chart below is a 15-minute chart with support and resistance lines from the daily chart.

Positions can be held until momentum slows or until the index reaches a major support or resistance level. You'll need to use a tight Stop-Loss if a false reversal takes place.

Breakouts

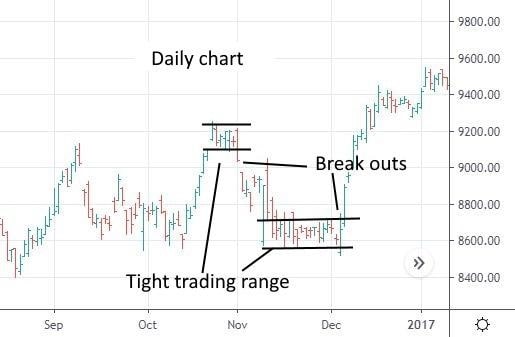

When the index trades in a very narrow range, a breakout in one direction or another is inevitable. Breakout trades can be traded on intraday timeframes or held for longer if there is sufficient volume.

To find a potential breakout trade, wait for a period when at least three consecutive days have a range that is noticeably lower than the average. Ideally, the price action should be confined to a clearly defined range, too. Wait for the index to break out of the range on sufficient volume before entering a trade in the direction of the breakout. Hold the position until momentum or volume fade. The following chart illustrates two trades like this.

Swing trading

Swing trading can be combined with the intraday reversal strategy outlined above. The IBEX index often moves up and down in a clearly defined channel.

The chart below illustrates such a channel on the 4-hour chart. Positions can be opened when the index reverses from one side of the channel and held until they reach the other edge of the channel. You can begin scaling out of a position when it reaches the middle of the channel if the price reverses before reaching the target. You will need to use a tight stop loss in case of a false reversal.

Interesting Facts about IBEX 35 index

- When reviewing the stocks in the index, the advisory committee does not consider the sectors that are represented in the index.

- The individual weight of each stock in the index is not capped like it is in other indices.

- The primary criteria used to include stocks is the trading volume rather than market value. This ensures that the index represents the most liquid stocks.

- The IBEX 35 index is part of a family of indices. The other IBEX indices include medium- and small-cap indices, a dividend index and two growth indices.

Conclusion

The IBEX 35 index hasn't performed well over the last decade. However, it's relatively volatile and often trades in a clearly defined range. These characteristics make it ideal for trading with instruments like CFDs.

You can trade CFDs on the index with Libertex. If you want to get started, you can open a risk-free demo account today. This will allow you to get used to the trading platform and learn more about trading the IBEX 35 index at no risk or cost.

Libertexis a broker and trading platform that offers CFDs, stocks, commodities, indices, ETFs and cryptocurrencies with a multiplier of up to 30x. The platform offers free trading tutorials and state-of-the-art trading tools.

IBEX 35 FAQ

What does IBEX 35 stand for?

IBEX stands for Índice Bursátil Español Index (Spanish Stock Exchange Index). The 35 represents the number of stocks in the index.

How is the IBEX 35 calculated?

The IBEX 35 index is calculated by adding up the free-float market values of the 35 companies in the index and then dividing the total by 35. The divisor is calculated by dividing the total market value from a previous date by the index level from that date.

The weight of each stock is calculated by dividing its free-float market value by the total value of all 35 companies.

Should I invest in the IBEX 35?

The IBEX 35 has not performed well since 2009. It may be worth investing in when it's trading at the lower edge of its ten-year trading level. The index is a better vehicle for trading with CFDs or similar instruments.

Can IBEX 35 go to zero?

Theoretically, yes, but that would imply investors attribute no value whatsoever to any companies in the index. The likelihood of that happening is virtually zero.

What are the major indices related to the IBEX 35 index?

The IBEX index is correlated with other European indices, though it is less correlated than most.

What is the best way to trade the IBEX 35?

CFDs and futures contracts are best for trading the index. They allow you to use leverage and trade long and short positions. This gives you maximum flexibility when trading the index.

Disclaimer: The information in this article is not intended to be and does not constitute investment advice or any other form of advice or recommendation of any sort offered or endorsed by Libertex. Past performance does not guarantee future results.

Why trade with Libertex?

- Get access to a free demo account free of charge.

- Enjoy technical support from an operator 5 days a week, from 9 a.m. to 9 p.m. (Central European Standard Time).

- Use a multiplier of up to 1:30 (for retail clients).

- Operate on a platform for any device: Libertex and MetaTrader.